Chinese online shopping platform Taobao has begun imposing a 10% sales tax for purchases by users in Malaysia as required by the Malaysian government.

In case you missed it, Malaysia introduced a 10% sales tax on imported low-value goods (LVG) valued at RM500 and below starting 1 January 2024.

Naturally, this affects Taobao users in Malaysia as the shopping platform only lists items from China, though no official announcements regarding the imposition of the sales tax were made by Taobao.

However, recently, Taobao users in Malaysia have started getting notifications regarding the 10% sales tax on the Taobao app, with the LVG sales tax also appearing when making payments for purchases under RM500.

One notification on the Taobao app received by Malaysian users asserted,

“Taobao imports low-value goods according to Malaysia (“Imported Low-Value Goods” or “LVG”) requires that the relevant sales tax calculation, calculation and payment responsibilities be fulfilled from the effective date. The relevant regulations came into effect on 1 January 2024.”

shared to world of buzz

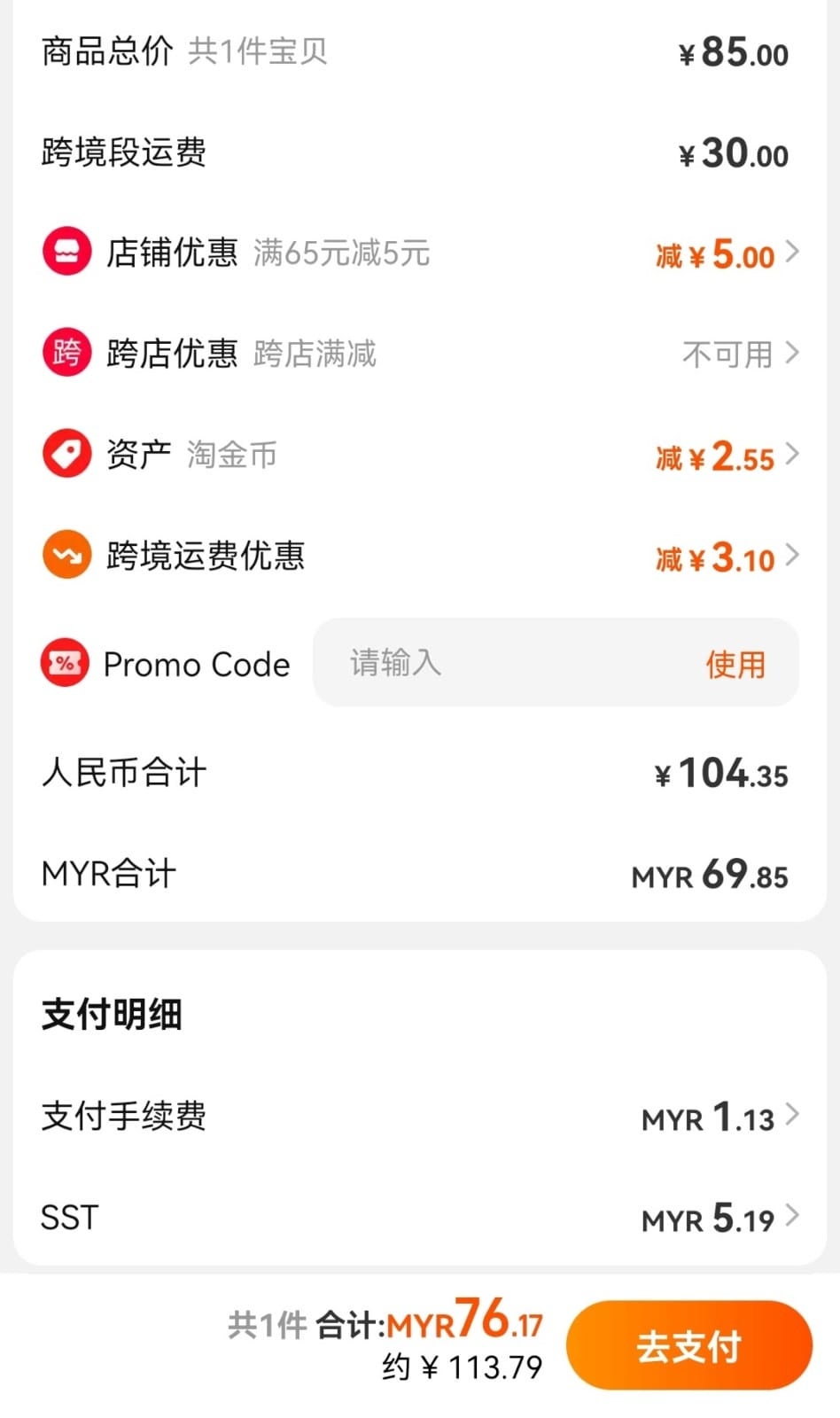

Furthermore, the Taobao app also now has a special section on the very bottom of the payment page which lists the applicable sales tax price for your purchases.

Do note that Taobao also charges a 3% fee if users use an international card (instead of from China) for payment. This coupled with any exchange fee from Malaysian Ringgit (MYR) to Chinese Yuan (CNY) and the new 10% sales tax does add quite a bit to the original price of the items you’re buying on Taobao.

shared to world of buzz

So, what do you guys think of the new LVG 10% sales tax? Share your thoughts with us in the comments.

Also read: Fahmi: 10% Sales Tax on Online Purchases Only For Imported Goods, Meant to Benefit Local Products