All taxpayers who have yet to declare their income tax, you may want to do so before 1 July 2019! After all, if you only declare it after the deadline, you may face a penalty ranging from 80 to 300 per cent, Astro Awani reported.

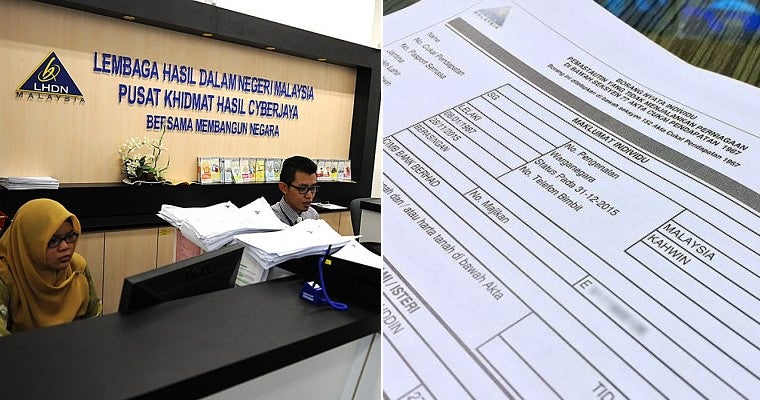

According to director of the Communications Division LHDNM’s Chief Executive Officer Syarein Abu Samah, taxpayers should use the opportunity to declare their income tax within the given period.

By doing so, taxpayers can enjoy a lower penalty rate (10 to 15 per cent) from the taxable amount and make the payment in installments.

Source: astro awani

He added that LHDNM can track taxpayers who fail to declare their income by using a data analysis with the help of various agencies including international agencies. This is achieved through exchanging information with the agencies.

Speaking to Awani Agenda, Syarein was quoted as saying,

“If taxpayers contact us, we will try to find a middle ground and reach a mutual agreement. But, the penalties imposed are still subjected to the PKPS Voluntary Declaration Special Program.

That being said, Syarein explained that if taxpayers make a voluntary declaration of their income, their family members and/or business partners will be spared from being audited.

Source: ringgitplus

Prior to this, the PKPS programme was announced during the presentation of Budget 2019. It was a part of the government’s initiative to encourage taxpayers to voluntarily declare their revenue. This move is in efforts to overcome leakage of state revenue.

Therefore, if you haven’t declared your income tax, it’s best if you do it ASAP to avoid facing a large penalty.

Also read: Never Filed Income Tax Before? Here’s a Simple Guide on How to Do It Online!