Times are tough, and many are not doing well financially. But are loan sharks really the savior and your last resort?

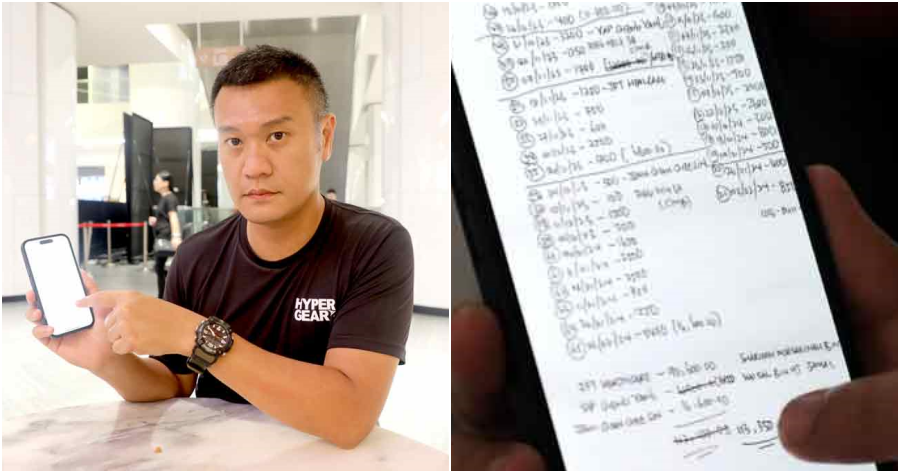

A Malaysian man borrowed RM50,000 from loan sharks and eventually received only RM27,000 after the “processing fee.” However, the man ended up owing RM4 million after borrowing from 16 loan sharks to cover debts after debts.

Don’t forget about the charged interests.

In a press conference, Kuala Lumpur Chinese Assembly Hall Secretary General See Foo Hoong said the man who borrowed from loan sharks had issues with business investment and added that the loan sharks used the logo of local banks to appear legitimate.

“He only get 40% to 60% of the borrowed amount. When he couldn’t pay the amount due to high interests, he kept on borrowing from different loan sharks to cover the previous debts.”

See added,

“The victim’s family has repaid more than RM4 million, but the loan shark said they still owed RM4 million. However, they were unable to repay and therefore came to me for help.”

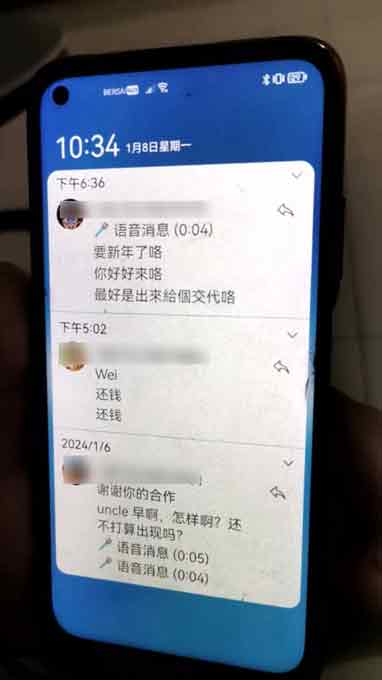

As a condition for loan sharks to lend money, they require the victims to take photos of the exterior of their homes, presumably in preparation for debt collection in the future!

After the victim provided pictures of his house, water and electricity bills, and a copy of his identity card, the online loan shark immediately issued him RM20,000. However, that was not enough.

The victim sent the loan shark copies of his parents, siblings, and wife’s identity cards.

On See’s advice, the victim has lodged a police report and provided necessary evidence to the authorities.

Borrowing money from loan sharks is never an option. It only leads to more issues, not solutions.