Well, millennials, it looks like our financial situation isn’t looking good. In this age where everything is displayed online, it looks like we are making really bad decisions when it comes to our financial status. Yup, looking at our bank account proves that!

Source: nst

According to The Star, Malaysian youths are living the high life and being a baller but to keep themselves to the lifestyles they’ve become accustomed to, they’re maxing out their credit cards. And you know that’s not good!

When the cash runs out, we turn to personal loans to finance our purchases of designer goods, latest expensive gadgets, luxurious overseas trips and organising lavish weddings we cannot afford. This has caused many youths to become bankrupt before they even turn 30 and currently, those aged between 25 and 44 are the biggest group classified as bankrupt in Malaysia.

Source: imoney

There have been 94,408 bankrupt cases reported from 2013 to August and a worrying 60 per cent of this is from the ages of 25 to 44 years old. Director-general Datuk Abdul Rahman Putra Taha of the Insolvency Department said that the main reason for this was because many wanted to “start their own life.”

“When they start their own lives, they are not financially stable. Some want to get married, but if the in-laws ask for hantaran gifts such as cars or a house, they need the money. Their pay can be considered low but they need expensive gifts. Where else can they go other than applying for personal loans?”

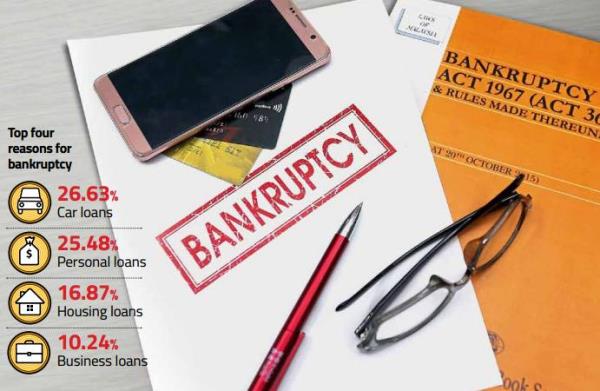

Here are the top four reasons an individual was declared bankrupt:

Source: the star

In another article by The Star, a 29-year-old explained that she was declared a bankrupt when she gave in to peer pressure.

“I needed something to match my lifestyle. I am staying in the Klang Valley and most of my friends drive expensive cars. I wanted to fit in. I was struggling to pay for my previous education loan and credit cards. After two years, I could not afford it any more. The banks repossessed the car and I was declared a bankrupt. I hope I can clear my name. It has been very difficult for me financially due to my previous debts.”

Source: canoe

Due to this worrying issue, Bank Negara Malaysia (BNM) is on their way to make sure that it will not be so easy for Malaysian youths to sign up for credit cards. Abdul Rahman said that the Insolvency Department is working together with the bank and government to reduce bankruptcy cases, especially with the Voluntary Arrangement under the Insolvency Act 1967.

Close to 58,000 bankrupts have been released by the courts in the last five years, but the government said that they want to reduce this number to about 4,000 to 5,000 cases per year.

Source: shutterstock

“The enforcement of the newly amended bankruptcy law began this year. If they meet our criteria, qualified borrowers will be automatically discharged as bankrupts three years from the date of filing of the Statement of Affairs (Penyata Hal Ehwal),” said Abdul Rahman.

If you are at risk of being declared a bankrupt, then take advantage of the amended laws. You can also ask to settle your debt without bankruptcy proceedings with a voluntary agreement. Pay your debts! Debtors must pay the agreed sum to creditors and file their pay and expenses slip statement every six months throughout the three-year period.

Spend wisely, people! That shiny new car is not worth going bankrupt for!

Also read: Malaysian Guy Considers Going Bankrupt Just to Fulfill Fiancee’s Expensive Wedding Requests