Taking to Twitter, @AimanIAbdullah shares reasons behind why Malaysians are going bankrupt on automobile debt, stating that when it comes to cars, we tend to overspend.

Sharing his opinion from the perspective of a motoring journalist, he writes, “One of the things I notice most about Malaysians is that with our cars, we overspend.”

“Take this example. If your salary is RM2k, you will spend RM603 a month with 10% downpayment.”

“That is 30% of your salary.”

As a motoring journalist, one of the things I notice most about Malaysians is that with our cars, we overspend.

Take this for example. Salary RM2k, RM603 monthly with 10% DP. That's 30% of your salary, on a car.

This is why many Malaysians go bankrupt on automobile debt. https://t.co/aQh0Zz7ZLV

— Aiman I. Abdullah (@AimanIAbdullah) March 13, 2020

His tweet which was aimed at a car salesperson who was advertising her car aimed at those with an income of RM1,900 – RM2,000 a month, @AimanIAbdullah said that it is because of this Malaysians risk bankruptcy.

In his thread, he advised Malaysians to strive to not spend more than 10% of their salary on a car.

“A friend of mine could have easily afforded a Mercedes-Benz, based on credit and income, but bought an X70 instead.”

Source: twitter

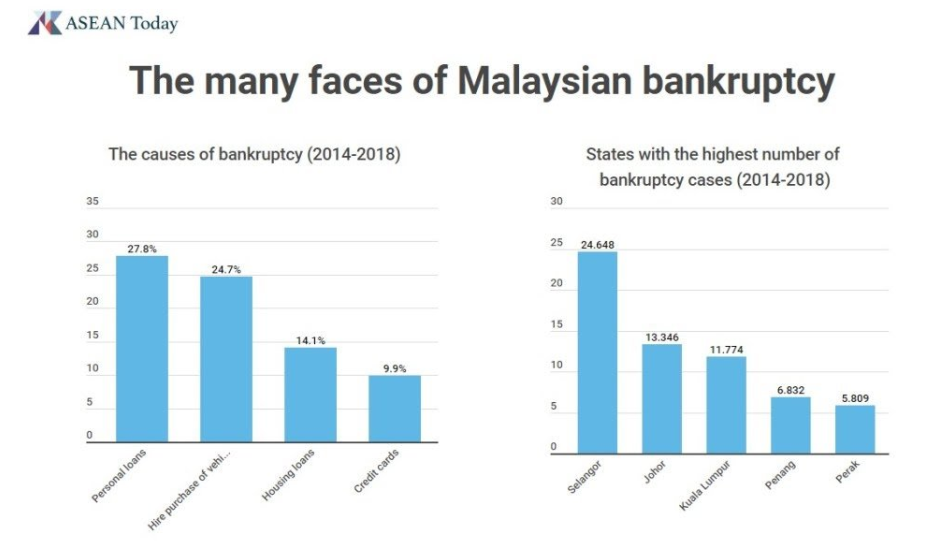

Quoting ASEAN Today, @AimanIAbdullah shared that 24.7% of bankruptcy is caused by HIRE PURCHASE OF VEHICLES based on statistics taken from 2014 to 2019.

So who’s to blame in these situations?

According to @AimanIAbdullah, predatory sales advisors.

“This is why I have such an issue with ‘predatory’ sales advisors saying RM2k is enough for an RM56k car.”

So if you are thinking of buying a car in the near future, why not consult with those who REALLY know the subject and avoid being a victim of your own blunder.

Also read: Irresponsible M’sian Parents Force Toddler to Beg in Penang to Pay Off Ah Long Debts