We know it all too well. We want the latest gadgets and designer clothing, yet our mum is bugging us to be more careful with our money and to prepare ourselves for the future. If you are between the ages of 25 and 30 and have a stable job, chances are you’ll be able to relate to this dilemma.

In addition, this is also the time when the age-old question of whether or not you should buy a house arises. Well, if this is you, we hope this article would help you make a wiser decision on what you should prioritise.

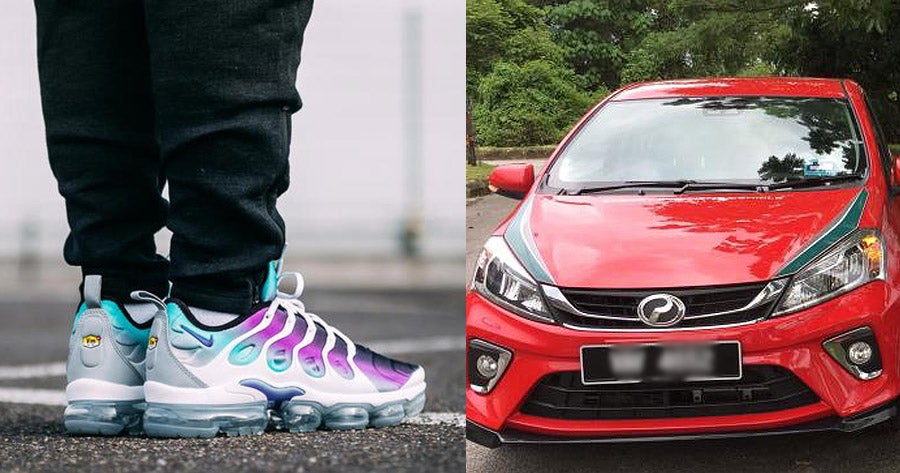

Those expensive and “uniquely designed” hipster sneakers

![[Test] Hipster Sneakers, Perodua Myvi Or Property: Which Should Millennials Be Investing In &Amp; Why - World Of Buzz](https://worldofbuzz.com/wp-content/uploads/2019/04/test-hipster-sneakers-perodua-myvi-or-property-which-should-millennials-be-investing-in-why-world-of-buzz.jpg)

Source: designer. Mens

![[Test] Hipster Sneakers, Perodua Myvi Or Property: Which Should Millennials Be Investing In &Amp; Why - World Of Buzz 7](https://worldofbuzz.com/wp-content/uploads/2019/04/test-hipster-sneakers-perodua-myvi-or-property-which-should-millennials-be-investing-in-why-world-of-buzz-8.jpg)

Source: air_vapormax

Pros:

- Can show-off on IG that you own branded shoes.

- There’s a chance people might think you’re pretty fashionable. In fact, studies have shown that our shoes reveal a great deal about our personality.

- Can take advantage of the hypebeast culture by purchasing sneakers for a low price and sell them higher.

Cons:

- You may think you’re impressing girls, but in reality, guys will be paying more attention to your sneakers rather than girls.

- You need to clean them regularly.

- Low resale value unless they’re limited edition sneakers.

- Have to worry about not creasing or wearing them out in the rain.

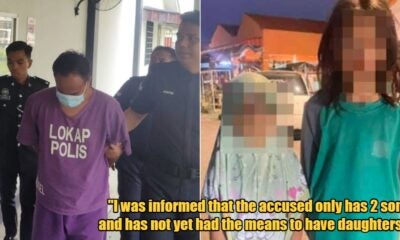

The iconic Perodua Myvi

![[Test] Hipster Sneakers, Perodua Myvi Or Property: Which Should Millennials Be Investing In &Amp; Why - World Of Buzz 2](https://worldofbuzz.com/wp-content/uploads/2019/04/test-hipster-sneakers-perodua-myvi-or-property-which-should-millennials-be-investing-in-why-world-of-buzz-3.jpg)

Source: behind the wheel

![[Test] Hipster Sneakers, Perodua Myvi Or Property: Which Should Millennials Be Investing In &Amp; Why - World Of Buzz 3](https://worldofbuzz.com/wp-content/uploads/2019/04/test-hipster-sneakers-perodua-myvi-or-property-which-should-millennials-be-investing-in-why-world-of-buzz-4.jpg)

Source: behind the wheel

Pros:

- It can get you to places. Duh!

- Value for money in terms of performance and cost.

- Less upfront payment and shorter loan terms (9 max) compared to houses.

- Easy to maintain and doesn’t give AS MUCH problems compared to other Malaysian cars. *cough* proton *cough*

- Spare parts are relatively cheap too. For instance, replacing the brake pad can cost as little as RM40 while a tyre can cost as little as RM130 depending on the brand, of course.

- Small-sized. So, parking is easy.

- Fuel-efficient. A full tank can get you about 350km which is about the total distance of travelling from KL to Penang!

Cons:

- People will automatically assume you’re a bad driver regardless of whether you are or not. #Myvidrivers

- There are a million other Myvi cars out on the road, so there’s nothing special if you own one.

- Finding your car in a shopping mall carpark is a pain because there’s bound to be loads of other Myvis parked there too.

- Depreciating value. On average, the value of cars in Malaysia depreciates 10% to 20% annually.

Property

![[Test] Hipster Sneakers, Perodua Myvi Or Property: Which Should Millennials Be Investing In &Amp; Why - World Of Buzz 5](https://worldofbuzz.com/wp-content/uploads/2019/04/test-hipster-sneakers-perodua-myvi-or-property-which-should-millennials-be-investing-in-why-world-of-buzz-6.jpg)

Source: property guru

![[Test] Hipster Sneakers, Perodua Myvi Or Property: Which Should Millennials Be Investing In &Amp; Why - World Of Buzz 6](https://worldofbuzz.com/wp-content/uploads/2019/04/test-hipster-sneakers-perodua-myvi-or-property-which-should-millennials-be-investing-in-why-world-of-buzz-7.jpg)

Source: property guru

Pros:

- A chance to live on your own without your parents bugging you with their house rules.

- You’ll have to buy a house eventually mah, so might as well buy now before property prices increase further.

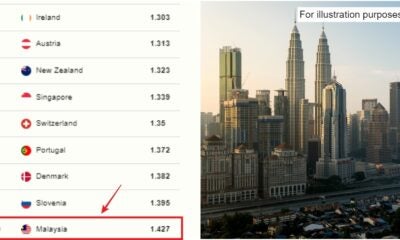

- Excellent ROI as prices of property in strategic locations are constantly on the rise. Houses in Selangor showed an annual increase of 7.6% from 2016 to 2017.

- Lower interest charge compared to cars. This is because mortgage interest is applied based on reducing the balance interest rate. This means the bank charges interest on your loan’s remaining balance unlike flat interest rates of car loans.

- Can enjoy discounts and waivers during the 2019 Home Ownership Campaign.

Cons:

- Huge commitment as you would need to repay the housing loan over a long period. Unless you’re super rich then no problem lah

- Longer loan tenure compared to buying a car which can take up to 35 years.

- Higher upfront payment needed compared to a car. For instance, a house priced at RM500,000 would require RM50,000 as a down payment.

- High-interest charge on monthly installment.

- Would affect our lifestyle as most of our savings and salary would be spent on the hefty downpayment and repaying the loan.

Final thoughts

To be fair, there isn’t a right or wrong answer in deciding what to invest in as the decision relies heavily on your goals, lifestyle preferences, and financial standing.

For instance, sneakers can be a pretty worthwhile investment, provided if you’re in the know with the hypebeast culture and are able to predict the resale value of one pair from another. In fact, one study found that some sneakers had a resale value of more than 60 times the original price, even surpassing the appreciating value of gold!

In a similar vein, investing in a well-made car particularly one as affordable as the Perodua Myvi is also worth the money, especially since it can be used to earn us side income by doing e-hailing services.

Lastly, due to recent market trends, perhaps the safest and most beneficial investment we can make these days is buying a house. What’s more, it’s also a necessity if we’re planning to settle down or raise a family in the future.

Well, if you’re planning on being a homeowner, it’s important to seek out projects from trusted developers while keeping an eye out for attractive discounts such as Mah Sing’s ‘RM500,000 in your bank’ promo as part of their 25th Anniversary campaign.

What’s great about this promo, is that it lessens our financial burden due to its attractive discounts, refer & reward incentives, and interest-free installment plans, making now an ideal time for anyone looking to buy a house.

In conjunction with their anniversary, you can get up to RM500,000 in your bank when you purchase a home from one of Mah Sing’s participating projects:

- M Vertica, Cheras KL City (High Rise Residential)

- M Centura, Sentul KL City (High Rise Residential)

- M Vista, Bayan Lepas Penang (Serviced Apartment)

- M Aruna, Rawang (2-storey linked homes)

- Meridin East, Pasir Gudang Johor (2-storey linked homes)

- Sensa Residence, Southville City (High Rise Residential)

Not only that, as part of their Refer & Reward incentive, you can even be rewarded with up to RM60,000 when you refer one of your friends or family members to any participating Mah Sing projects.

If that’s not enough to get you excited, here are other incentives they are offering:

- Lucky draw with cash prizes up to RM50,000.

- Interest-free installment based on differential amount.

- HOC incentives. 10% discount on all projects and stamp duty exemptions.

Interested? Find out more here!

Which would you choose though? Are you ready to take the next step in life by becoming a homeowner? Let us know in the comments below, we’d love to hear your thoughts!