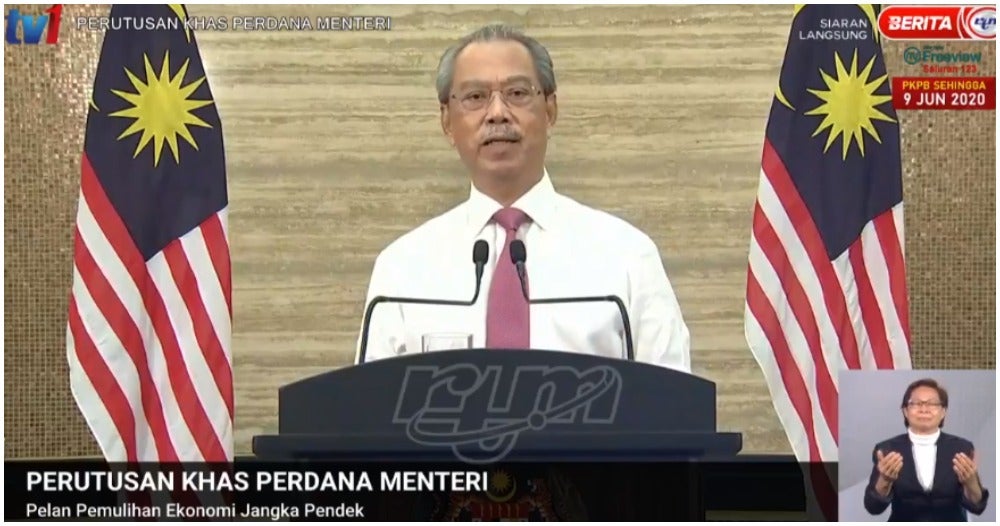

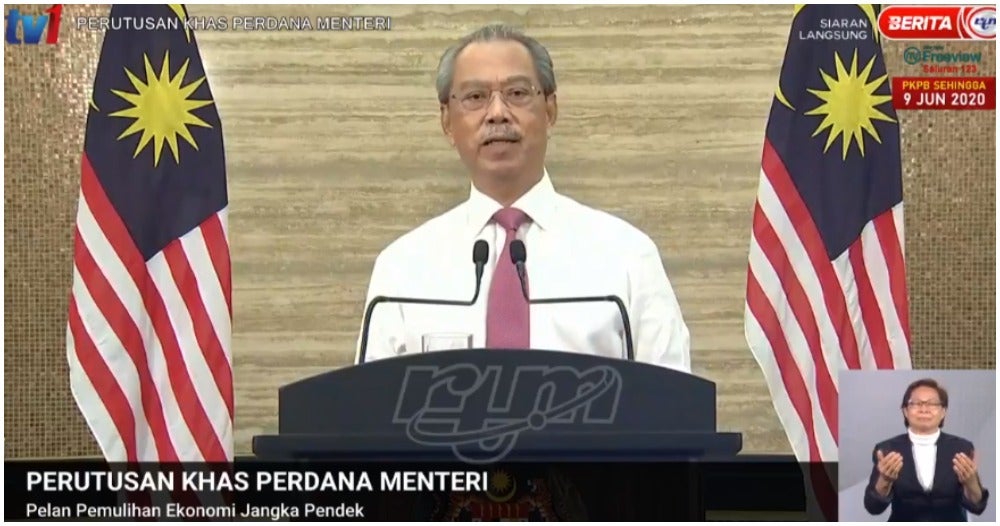

Prime Minister, Tan Sri Muhyiddin Yassin, addressed the nation today (5th June) in a live telecast to announce key details about the short-term economic recovery plan. While most of the nation eagerly tuned in to find out whether the MCO was lifted, there were many key points that he made concerning the economic plan. If you missed out on it, don’t worry! We’ve got all the important points summarised here for you:

- The short-term economic plan will be known as PENJANA and will include 40 different initiatives to help heal the economy.

- RM800 per month will be given to employers or companies who hire unemployed professionals under the age of 40 for a total of 6 months.

- RM600 per month will be given to companies who hire unemployed professionals over 40 years of age or the OKU for a total of 6 months.

- Companies/employers who hire fresh graduates will receive RM600 a month.

- Allowances up to RM4,000 can be redeemed by employees under PERKESO for skill courses.

- 1GB free internet from 8am to 6pm for news, education sectors and Covid-19 related news until 31st December this year.

- Subsidy programmes will be extended to three months (RM600) per employee for all industries applicable.

- The government will provide free RM50 Wallet for all Malaysians to go shopping.

- Malaysians can now use public transport for an unlimited number of times for RM30 under #MY30 which will be available starting 15th June until the end of the year.

- Employers who provide benefits for employees such as smartphones, laptops, tablets or purposes involving working from home may receive a tax deduction of up to RM5,000 per staff.

- In an effort to promote MDeC freelancing, RM25 million will be allocated to the Global Online Workforce (GLOW)

- 300,000 OKU and single mothers listed with JKM are eligible for RM300 one-off payment which will be paid before Aidiladha.

- Full travel tax exemption is effective from July 1, 2020 to June 30, 2021

- Those who are unemployed are entitled to a training allowance of up to RM4,000 even though they are not contributors under the Employment Insurance Scheme (EIS).

- The government will give 100 percent sales tax exemption on sale of domestic passenger cars, 50 percent for passenger cars imported from June 15, Dec 31, 2020.

- E-vouchers will be available for those who order child-minders’ services online.

- Up to a RM3,000 incentive of individual income tax for fees paid by parents to taska and tadika (kindergartens).

- The government will allocate RM70 million, to a campaign known as, Shop Malaysia Online, to encourage trade on e-commerce platforms using promo codes and discount vouchers. The government’s contributions will be matched by e-commerce platforms accordingly.

- RM400 million will be allocated to fund PENJANA microcredit by Tekun and Bank Simpanan Nasional with RM50 million allocated solely for female entrepreneurs.

- Exemption of services tax on lodgings and accommodation services will be extended from Sept 1,2020 until June 30,2021.

We will keep updating this list with more information so do check back in! Stay safe and stay informed, guys.

Also read: JUST IN: Malaysians Get Free RM50 eWallet From Govt To Go Shopping