We can all agree that being insured is important as it protects us from unwanted incidents. Yet, sadly, many young Malaysians often neglect getting an insurance plan wanting to save a couple of extra bucks every month instead. What’s worse is that some of us believe in plenty of misconceptions.

Well, we recently spoke to a couple of Malaysians to get their take on the subject. Here’s what they said:

1. A family close to my own was left financially stranded after their ONLY child passed away

![[Test] From Uncovered To Protected: Young M'sians Share Why They Finally Got An Insurance Plan - World Of Buzz 2](https://worldofbuzz.com/wp-content/uploads/2019/10/test-from-uncovered-to-protected-young-msians-share-why-they-finally-got-an-insurance-plan-world-of-buzz-3.jpg)

Source: wob

I think most millennials are ill-informed about the whole process of applying and claiming insurance. In most cases, you’ll realise that the fault lies in themselves not fully understanding the coverage policy which complicates the claiming process when something unwanted happens. It sure doesn’t help that SOME insurance agents don’t take the time to thoroughly explain the insurance policy to buyers and push too hard to get the sale. I think an insurance policy that’s clear and easy to understand is definitely needed so young Malaysians will be more confident in applying.

-Lee, 27, Sungai Petani.

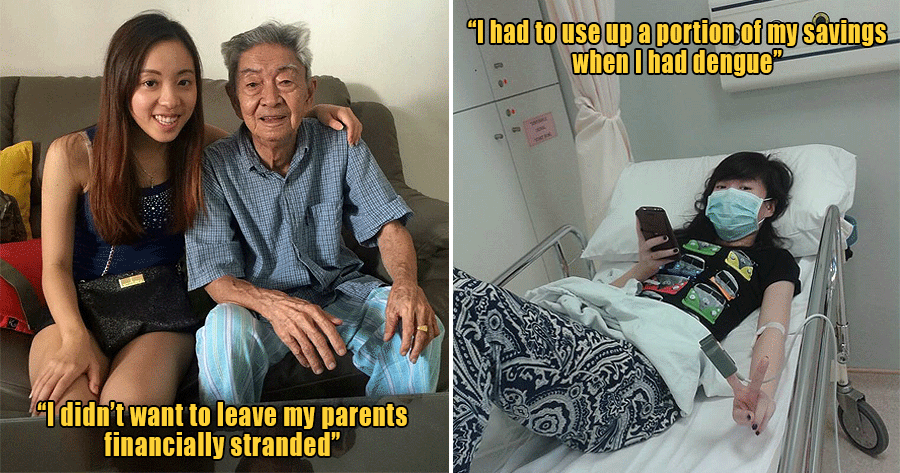

2. I didn’t want to financially burden my family should anything happen to me

![[Test] From Uncovered To Protected: Young M'sians Share Why They Finally Got An Insurance Plan - World Of Buzz 8](https://worldofbuzz.com/wp-content/uploads/2019/12/test-from-uncovered-to-protected-young-msians-share-why-they-finally-got-an-insurance-plan-world-of-buzz-9.jpg)

Source: wob

Let’s also not forget the low starting salaries of fresh grads. Thus, it’s only common for them to feel like life insurance is a costly investment that they can’t see short term returns. However, one thing most fail to realise is that insurance premiums get pricier as you age — which is why getting it while you’re young can actually save you money!

– Pui Fun, 29, KL.

![[Test] From Uncovered To Protected: Young M'sians Share Why They Finally Got An Insurance Plan - World Of Buzz 10](https://worldofbuzz.com/wp-content/uploads/2019/12/test-from-uncovered-to-protected-young-msians-share-why-they-finally-got-an-insurance-plan-world-of-buzz-11.jpg)

Source: wob

3. I had to use up a portion of my savings when I had dengue

![[Test] From Uncovered To Protected: Young M'sians Share Why They Finally Got An Insurance Plan - World Of Buzz 1](https://worldofbuzz.com/wp-content/uploads/2019/10/test-from-uncovered-to-protected-young-msians-share-why-they-finally-got-an-insurance-plan-world-of-buzz-2.jpg)

Source: wob

I think most millennials are aware that life insurance is important but most tend to avoid getting one because they believe it’s costly. This can’t be further away from the truth as there are insurance plans out there that are super affordable.

– Chloe, 28, Seputeh.

To start a life insurance plan, here a few pointers to take note of when applying:

- Learn what are the exclusions in any given policy and ask experts on the different types of policies so you can make an informed decision.

- Assess your needs and budget first so you won’t overinsure yourself and end up paying for something which isn’t beneficial to you.

- If you have a pre-existing medical condition, it’s possible that it would not be covered by any future coverage.

- Utilise the company’s free look period to determine if you’re financially capable of maintaining the insurance for the duration of the contract.

- Policies may have differing exclusions so having two policies covering different illnesses will provide better protection.

So, if you’re looking to be insured but the monthly commitment is an issue to you, you’ll be glad to know that there are life insurance plans which are super affordable.

How affordable, you ask?

Believe it or not monthly premiums start as low RM13 with coverage of up to RM76,000!

![[Test] From Uncovered To Protected: Young M'sians Share Why They Finally Got An Insurance Plan - World Of Buzz 5](https://worldofbuzz.com/wp-content/uploads/2019/10/test-from-uncovered-to-protected-young-msians-share-why-they-finally-got-an-insurance-plan-world-of-buzz-6.gif)

This applies to:

- Death / total permanent disability due to all causes (coverage: RM38,000).

- Death / total permanent disability due to specified infectious diseases (coverage: RM76,000).

- Specified infectious diseases medical and surgical expenses benefit (coverage: RM1,000/year).

- Specified infectious diseases daily hospital income benefit (coverage: RM100/day).

You can also opt to purchase additional riders offering Snatch & Robbery cover including an Active Lifestyle cover to better prepare for an unfortunate event.

Here’s what’s great about it:

- Registering is quick and easy! All you have to do is answer a simple health question, no medical check-up required.

- Making claims is fast and easy which only takes 5 working days.

- The plan comes with a 60-day satisfaction guarantee where you will be given a full refund upon cancellation.

So, which life insurance are we talking about? It’s none other than GoLife Plus, of course!

GoLife Plus is part of the GoPayz app, a universal e-wallet offering digital financial services, money transfers, and online currency exchange.

The e-wallet is accepted online and retail be it in Malaysia or overseas via GoPayz’s Mastercard, UnionPay, Visa virtual and physical cards.

So you can rest assured that you’ll be able to make payments anywhere and at any time with the convenience of your mobile app.

More information on GoLife Plus and the GoPayz app can be found here.

Download it from Google Play Store on Android or the AppStore on iOS today.

Existing U Mobile users can choose between GoLife 5 or GoLife 10 with monthly premiums as low as RM5 based on their needs. Find out more here.

Do you think it’s time for young Malaysians to start taking greater precautions by being insured? Let us know in the comments below!