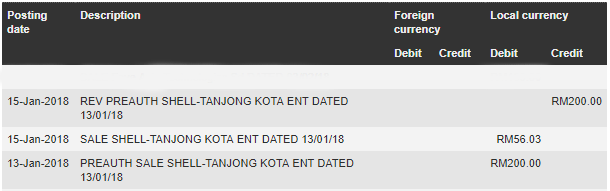

Ever refuelled your car using your debit or credit card at a self-service petrol pump? If you have, you probably got the shock of your life when you spent just RM50 but for some odd reason, your card’s online history shows a whopping RM200 was debited instead. You probably panicked a bit right?

However, don’t worry! The RM200 would be credited back into our accounts after just a few days. Phew! So why does this happen? Can’t the banks just debit the exact amount? Why must take so much money from me!?

Well, here’s why:

It is used to verify that the card is active and has sufficient available credit limit

Source: pinsdaddy

Basically, this pre-authorisation allows banks to have a temporary hold of a specific amount from your savings account. In this case, it’s RM200. This is to ensure you’re actually able to pay for the petrol in your tank, as a safety measure. Also yes, this amount is the same regardless which bank or petrol station you frequent.

However, this doesn’t mean the RM200 is actually debited from your account. Your card’s balance is simply temporarily reduced until the actual amount is debited. Meaning, that RM200 is still in your account, it’s just frozen for the time being.

After approximately three to five days, the pre-authorisation amount will be reversed back and the actual filled-up amount will be charged to your bank account.

But why must it take so long? Why can’t they just charge me the exact amount instantly?!

source: wob

Unfortunately, when it comes to banking and finances, things like this take time. Once you are done refueling your petrol tank, the actual amount will be sent to your issuing bank, and from there they will do the necessary to get the exact amount debited from your account and un-freeze the RM200.

Is there any way to avoid this pre-authorisation charge?

Source: shutterstock

Yes, there is!

However, to avoid these charges, you would have to make payment at the cashier where the exact purchase amount would be deducted from your account. You can also opt to pay in cash. Either way works! You cannot avoid pre-authorisation charges if you make payment using the self-service pumps.

What other instances will allow this sort of pre-authorisation and holding of funds?

Source: tripadvisor

Thankfully, not many things require pre-authorisation. Besides petrol, the other instance that requires holding of funds is when you check-in to hotels. However, the pre-authorisation amount is not capped at RM200 as it depends on the duration of your stay.

This pre-authorisation amount will be reversed and the actual amount will be charged to your bank during check-out. Again, this is to ensure you’re actually able to pay for your hotel stay and to cover any incidental charges that might take place during your stay.

Now that you know what on earth a “pre-authorisation” charge is, you don’t have to kelam-kabut the next time you see a large amount debited from your account after pumping petrol or checking-in to a hotel. Just know that it’s completely normal and all banks across Malaysia do it, regardless which petrol company or hotel you frequent!

Also read: Starting April, You Can Earn At Least RM46/Hour Working in New Zealand!