According to Malaysiakini, a 2013 1Malaysia Development Berhad (1MDB) bond offering was diverted to private accounts of the sovereign fund’s Senior Executive and two Saudi Arabians who funnelled a part of the money to the Hollywood production company of Najib’s stepson Riza Aziz and Joey McFarland.

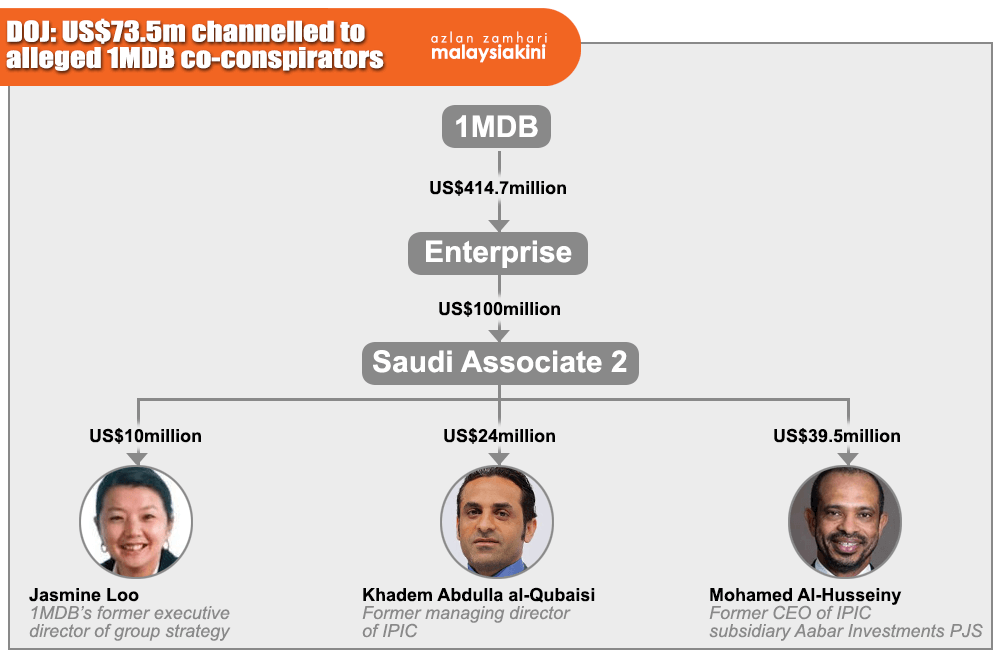

Documents filed by the US Department of Justice (DoJ) in California to recover US$38 million worth of assets showed that US$37.5m was transferred to 1MDB’s former Executive Director of Group Strategy Jasmine Loo Ai Swan, former Managing Director of Abu Dhabi sovereign wealth fund International Petroleum Investment Company (IPIC) Khadem Abdulla al-Qubaisi and former CEO of IPIC subsidiary Aabar InvestmentsPJS Mohamed Al-Husseiny.

Source: cnn

The transaction which took place between April and May 2013, was made from a Riyad Bank Account in Saudi Arabia held by a person dubbed “Saudi Associate 2”.

Loo received US$10m, Khadem US$24m and Mohamed’s former wife Suaad al-Attas US$39.5m.

Source: malaysiakini

Of the millions received by the three, Loo paid US$3.1m on a London property via Red Mountain Global Ltd whilst Mohamed spent it on a New York property called Oceana 57 for US$4.1m.

Khadem, alleged to be the beneficiary of the 1MDB financial scam, lent US$4.2m to Red Granite Capital, owned by Riza Aziz.

The loan was made via Telina Holdings owned by Khadem and registered in tax haven, the British Virgin Islands.

Khadem also supposedly funded a 43.37% purchase of a facilities management company in Kentucky, believed to be in the home state of McFarland.

Another series of transactions were also made to Red Granite Investment Holdings, wholly owned by Riza and another executive dubbed “Company 1 Executive 1”.

Source: malay mail

Reportedly, McFarland received US$3.5m from “Company 1” in January 2015 and transferred US$1.5m to Riza’s personal account.

In the previous month, “Company 1” spent US$28.1 million to buy back the shares from Red Granite Investment Holdings and McFarland through an affiliate company called New FM Acquisition Company.

The company have since deposited the funds in an escrow account held by a US-based international law firm called Squire Patton Boggs.

Reuters reported that the US DoJ had made a new civil filing to recover these new assets through the bonds arranged by Goldman Sachs, placing their total forfeiture attempt to US$1.7b.

Also read: Bill Gates Recommends Reading “Billion Dollar Whale”, Says 1MDB Scandal is “Thrilling”