Over the years, the stigma around personal loans has never been properly addressed. This is mainly because many Malaysians are misinformed about the topic, hence the many misconceptions. If you dig deeper, you’ll find that personal loans can serve many benefits. You can leverage it to pursue your dreams, upgrade your home or even as a safety net during rainy days. It’s true!

So, in order to give you a better insight on the topic, we’ve decided to debunk some of the most common misconceptions about personal loans that you should definitely STOP believing!

1. “Personal loans are not a good option for financial assistance”

One of the biggest misconceptions about personal loans is that Malaysians don’t truly understand how personal loans can be used as a source of financial assistance. Due to the reputation that it has, people fail to realise that you can utilise it in emergency situations where you’re in need of a large sum of money in advance, such as having to get hospitalised or needing to give your car a major repair.

This has definitely become a need for many people, especially during uncertain times such as right now with the MCO. By applying for a personal loan during your time of need, it establishes a financial safety net which can save you from draining up your emergency funds and be better prepared for the future.

2. “The high interest rates can trap you in debt for a long time”

Ask anyone around you about personal loans and the first thing they’d say is, “the interest rate is really high!”. But surprisingly, this is just a myth!

Contrary to what people believe, the interest rate for personal loans can be lower than you’d think. For banks in Malaysia, you can find interest rates as low as 5.33% per annum!

And don’t worry, you won’t be ‘trapped’ as long as you make repayments on time. Additionally, most banks in Malaysia also allow flexible payment terms where upon application, you can state your preferred tenure period of your loan. However, the tenure you get will still be up to the bank’s discretion and your credit assessment. Generally, the preferred loan tenure is about 24 to 60 months so that the repayment period won’t be too short that you can’t handle it, but it also won’t be dragged out too long and bog you down with unnecessary commitments.

But do remember that both interest and tenure would vary widely depending on which bank you choose so make sure to do your research so you can choose wisely!

3. “It can heavily damage my credit score”

Personal loans will only damage your credit score IF you’re unable to handle the monthly repayments. However, if you keep a steady repayment history every month, personal loans can help to improve your finances, especially during times of need.

For example, you can use personal loans for debt consolidation (which is when you use the loan to pay off other outstanding commitments to avoid raking up more interest). This method can help relieve your financial problems and build a healthy credit score instead!

4. “The application process is long and tedious”

This may have been true years ago but thanks to technology, we no longer need to worry about this since you can now apply for a personal loan online! This will definitely come in handy especially during the MCO when we can’t move about freely.

However, the processing time would depend on which bank you go to. With certain banks, you can get conditional approval instantly with just a few simple steps online! In this case, you will then be contacted by the bank to verify your application so you won’t have to worry about whether or not you’ve filled in the forms correctly. Simple, right?

5. “It’s better to apply for a car or mortgage loan rather than a personal loan”

When it comes to loans, most Malaysians would only consider them for buying cars or houses. But the truth is, you can also apply for a personal loan to help you with other huge commitments in life. This is because personal loans offer a bit more flexibility with how you choose to spend the money.

You might be thinking, “won’t personal loans just damage my finances even more?” Actually, personal loans can be beneficial, as you can utilise them on various things, such as:

- Pursuing post-graduate studies

- Carrying out house renovations

- Managing credit card or loan debt

- Unplanned emergency cases

And more! In case you’re still curious (but hesitant), we’d recommend you find a bank that offers attractive promos with their personal loans in order to get the best terms and ensure a smooth repayment process. While you’re at it, we’d recommend checking out Citibank too! Simply because…

Citibank is introducing a new flat interest rate that will start from as low as 5.33% per annum on their Citi Personal Loans!

Not just that, their personal loans also come with several other perks including:

- Loan amounts ranging from RM5,000 to RM150,000 (up to 10x your monthly gross income)

- Low repayment tenure from 24 to 60 months

- No processing fee

- No guarantor/collateral required

And that’s it! Interested? If you meet the requirements, you can make your application online and get your conditional approval status with just three simple steps!

- Go to Citibank’s website and fill in your contact details.

- Proceed to fill up your personal details and upload an image of your ID.

- Fill in your employment details.

From here, you just need to confirm your loan terms and upload other necessary documents, and that’s it! ?

Sounds simple, right? But before you proceed, do remember that a personal loan is not meant to give you extra cash to spend, but instead, it is meant to assist those who absolutely need it. Thus, always make sure to practice healthy spending habits and save responsibly, okay?

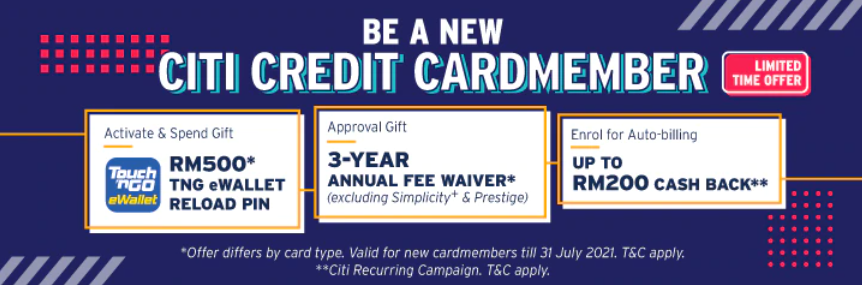

FYI, apart from personal loans, you can also consider credit cards as a great option for emergencies or a way to manage your finances or payments better. While credit cards have had their fair share of negative impressions due to reckless spenders too, it won’t ruin your credit score if you make your repayments on time!

In fact, credit cards are very helpful during emergencies where you’d need to make a big payment in advance. Credit cards give you the option to pay for it later or even through instalments. Not to mention, credit cards often have their own exclusive promotions that you can take advantage of in order to spend and earn rewards at the same time!

- Citi Cash Back Card: Get up to 10% cashback on Grab, groceries, dining, petrol and food delivery when you meet the minimum monthly total spend.

- Citi Rewards Card: Get 5x Citi Rewards points when you shop on Taobao, Lazada, and Amazon or at supermarkets and departmental stores.

New-to-bank customers can also get a welcome offer of RM500 in TnG e-wallet credit.

If you’re eager to find out more about the rewards offered by Citibank, simply visit their website.

What other misconceptions about Personal Loans have you heard before? Share them with us below!