In recent news, Khairy Jamaluddin was recently crowned “popular radio presenter” despite not being in the world of politics anymore. The minister-turned-radio DJ won the award at the 36th Anugerah Bintang Popular Berita Harian (ABPBH).

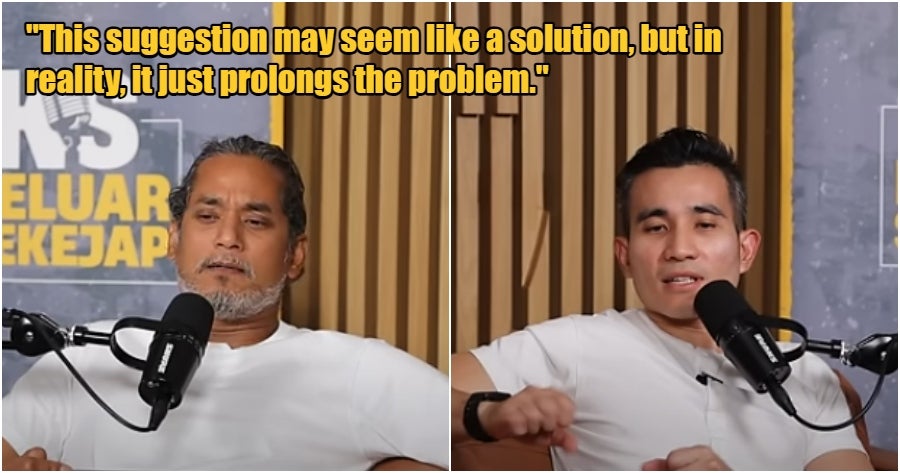

In addition to his radio appearances, Khairy, along with co-host Shahril Hamdan, discussed their views on the idea of long-term housing loans during their podcast called “Keluar Sekejap”.

Why longer housing loans wouldn’t work

In their podcast, former UMNO officials Khairy Jamaluddin and Shahril Hamdan shared why they believe extending housing loans beyond the current 30-year limit wouldn’t work, referring to the recent suggestion made by Deputy Prime Minister Ahmad Zahid Hamidi.

They explained that the shortage of affordable homes won’t be solved by offering longer mortgages, as it would primarily benefit property developers.

On top of that, they suggested the government should put limits on houses bought for investment as a way to address the affordable housing shortage.

“They’re high-end properties that people can’t afford”

Shahril said it’s better to focus on controlling home prices by limiting how many homes people can buy.

“The government should cap how many homes people can purchase for investment, since the market is full of expensive homes that aren’t selling, pushing prices up. Around 60% of unsold homes are high-end properties that most people can’t afford,” Khairy and Shahril added.

Khairy pointed out that developers build without thinking about what buyers can actually afford. When these expensive homes don’t sell, they pressure the government to create policies that benefit them, like extending loan terms.

“Developers are the ones gaining from this”

Khairy described longer mortgages as “debt until death,” saying they cause financial problems for buyers without really fixing the issue of too many unaffordable homes.

“I’m worried it’s just delaying the problem. Developers are probably the ones pushing for this because they benefit. Who gains from this? Developers, of course,” Khairy said.

Shahril also mentioned how this move would only pile more debt onto young people. He added that while it might seem appealing on paper, it could be risky and harmful if not handled carefully.

What are your thoughts on this? Let us know down in the comments below!