Well, it’s official peeps. Bank Negara Malaysia (BNM) has spoken!

Previously, it was reported that the Deputy Finance Minister Datuk Othman Aziz said that the surcharges on credit and debit cards would not be abolished, but now BNM has given their opinion on this issue.

Source: mpk732

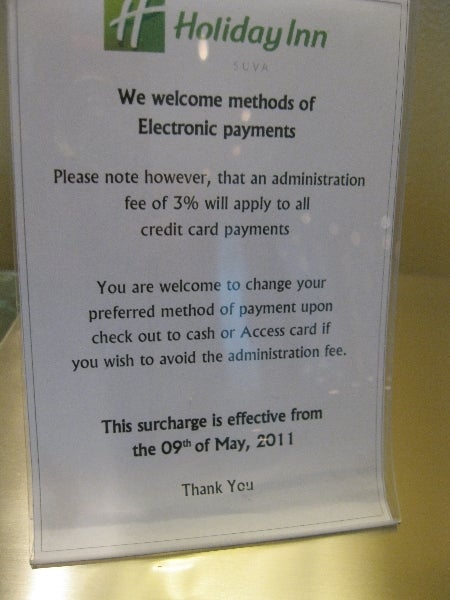

According to a statement released by BNM, they clarified that when Othman said that, he was referring to the interest rates that cardholders had to pay when they had overdue balances on their credit cards. However, the central bank says that for retailers, they have no right to impose surcharges on credit and debit card transactions. They said,

“Under the Payment Card Reform Framework introduced by BNM, retailers are not permitted to impose surcharges for payments using debit cards.”

“A similar prohibition is applied for credit card payments under the rules of international card schemes such as Visa and Mastercard.”

Source: ringgitplus

The banks who provide these e-payment facilities are required to monitor whether the retailers actually absorb the charges themselves or are passing them on to customers. They urge consumers who have encountered merchants that impose these surcharges to immediately lodge a report with the payment card issuers. You know what to do next time!

BNM explains that for every card payment a retailer receives, they are charged a transaction fee, which is known as the Merchant Discount Rate (MDR).

Generally, the MDR for credit cards will be higher than the MDR for debit cards. Many retailers will try to sneakily pass these charges on to their customers. A lot of Malaysians have surely heard before that we have to pay a higher price when we pay by credit card, but we get a “discount” only if we pay by cash!

For illustration purposes only | source: yqazus

This MDR is applicable globally, but different countries have different ways of dealing with it. In the European Union and UK, retailers are forbidden from imposing a surcharge on consumers for credit and debit card transactions.

In Malaysia, BNM has tried to reduce the cost retailers incur by introducing measures such as the Payment Card Reform Framework and the Interoperable Credit Transfer Framework. This helps lower the costs the retailers have to pay when accepting cost-effective electronic payment methods.

Source: business insider

BNM says, “To benefit from lower operational cost, retailers are encouraged to accept the more cost-effective payment methods, i.e. debit cards and mobile payments (instant fund transfers). Retailers who cannot afford to pay the higher MDR for credit card are encouraged to liaise with their respective acquiring bank to accept only debit card payments.”

So, now you know! Make sure to ask the retailer if they want to charge you extra for using your debit or credit card!

Also read: Is It True Malaysians Should Avoid Getting a Credit Card at All Cost?