With Malaysia’s property prices skyrocketing, purchasing a property may seem daunting.. if we could afford one in the first place that is.

Fellow Malaysian, Muhamad Iqbal Hafifi is fresh out of his tertiary education and has a starting salary of RM2,400. Seems pretty standard right?

Image credit: Facebook/Iqbal

But there’s one thing that sets him apart from most other fresh-faced graduates, and even working veterans — he owns 3 properties and in a mere 1 year 4 months.

Many have approached him for his secret of achieving the impossible, and he has taken to Facebook to share his wisdom.

He starts out by getting downright honest about the cash on hand, and other incoming cashflow. Follow his method step-by-step and you maybe can own 3 houses of your own?

Basic Salary : RM2,400

Date Started Work : Feb 2014 (fresh graduate)

Part Time: Cash – Sublet 1 unit (RM200/month)

*Don’t need to pay rental as sharing the sublet unit.

Asset on hand : 15g Gold Bar (savings from student days)

Cash on hand : RM1,000 (savings from 5 months of internship – RM200/month)

First Property Acquired (June 2014):

Apartment Harmoni, Damansara Damai (4th floor)

Selling Price : RM55,000

Bank Value : RM65,000

Down-payment Required : RM5,500

Method to acquire down payment : Net salary – RM2,100( save RM1,200, Balance RM900 = RM500 for parents + RM400 for daily expenses, food drinks, gas money, etc etc

*RM400 : RM100/week (be really frugal in every kind of spending)

*Tips : Save as much and live as poorly for 3 months. Put aside the RM200 from the sublet in case of emergencies, in desperate cases, pawn off the 15g gold bar.

Saving up for the first property is pure discipline and negligence of luxuries. But it gets better in time.

Accumulated Savings : RM1,200 x 4 months (February – May)= RM4,800

Total Cash on Hand : RM4,800 + RM1,000 = RM5,800 (use as down-payment)

Second Property Acquired (January 2015):

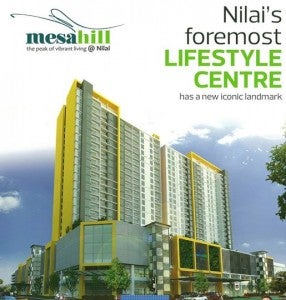

Apartment Mesahill@Nilai (still under construction)

Price of Property : RM169,000++

Loan Approved : 100% (10% discount by developer)

Booking Fee: RM3,000 (refundable)

Method to Acquire Booking Fee: Similar monthly savings as the first property

Once the ball starts rolling, the road ahead eases up.

Third Property Acquired (June 2015):

Apartment Kenanga, Putra Perdana, Puchong

Price of Property : Rm118,000

Bank Value : RM155,000

Loan Approved : 70% (RM108,500)

Down-payment Required : RM11,800

Method to acquire down payment : RM9,000 from the first property, presumably rental, RM2,000 from the monthly savings.

So here we are. The methods shared by Muhamad Iqbal. He also advises that to buy a property, one must have some knowledge on the subject. And the most common ways to learn more is to enroll for seminars or buy a book. Or maybe even through the very down-to-earth way he did it.

‘Cara saya, pergi MPH atau Popular, lepak sejam setiap minggu, cari buku pasal property, dapat ilmu free.’

Are you guys inspired? Or are skeptical about his method?