The world of online shopping has evolved so much that it could be overwhelming especially to those who don’t do a lot of it. For those who are not well-versed in monthly sales, contests, cashback rewards, exclusive bank card offers and other mechanics in the art of smart online shopping, you might be spending more money than you should.

To make things simple, let’s go back to basics and look at how you can shop smart before you click ‘add to cart’.

1. Shop with a debit or prepaid card instead of a credit card

When you shop with a debit or prepaid card, it makes you more conscious of your spending since you can actually see how much balance you have left. Using a credit card, which you can swipe endlessly until you find yourself buried in debt, is not a smart way of shopping.

If you do own a credit card, set it aside for emergencies in case you run out of cash. As for prepaid cards, you can set a limit for your shopping sprees or daily expenditures simply by crediting a set amount of money into it to ensure you don’t spend more than you intend to.

It helps you ‘see’ your money.

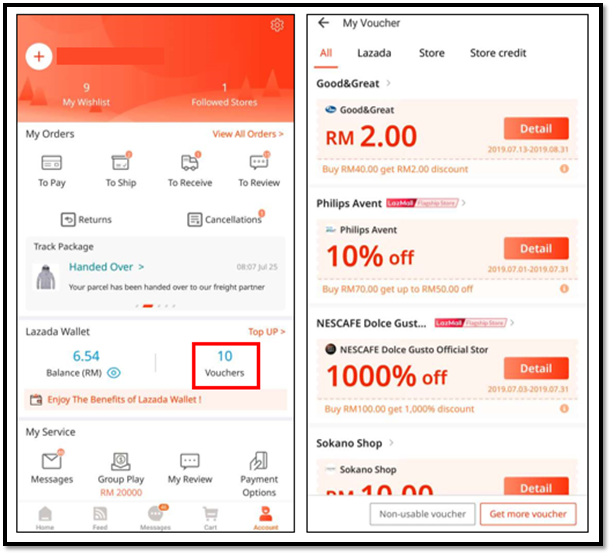

2. Use those coupon codes before they expire

Coupon codes tend to be given out generously but they do expire pretty quickly. These special codes are usually given out during birthdays, holiday seasons, clearance sales and monthly sales like 11.11 or 12.12 for example.

It’s always a good idea to take advantage of these codes when they are published by online merchants so you can make the most out of your shopping.

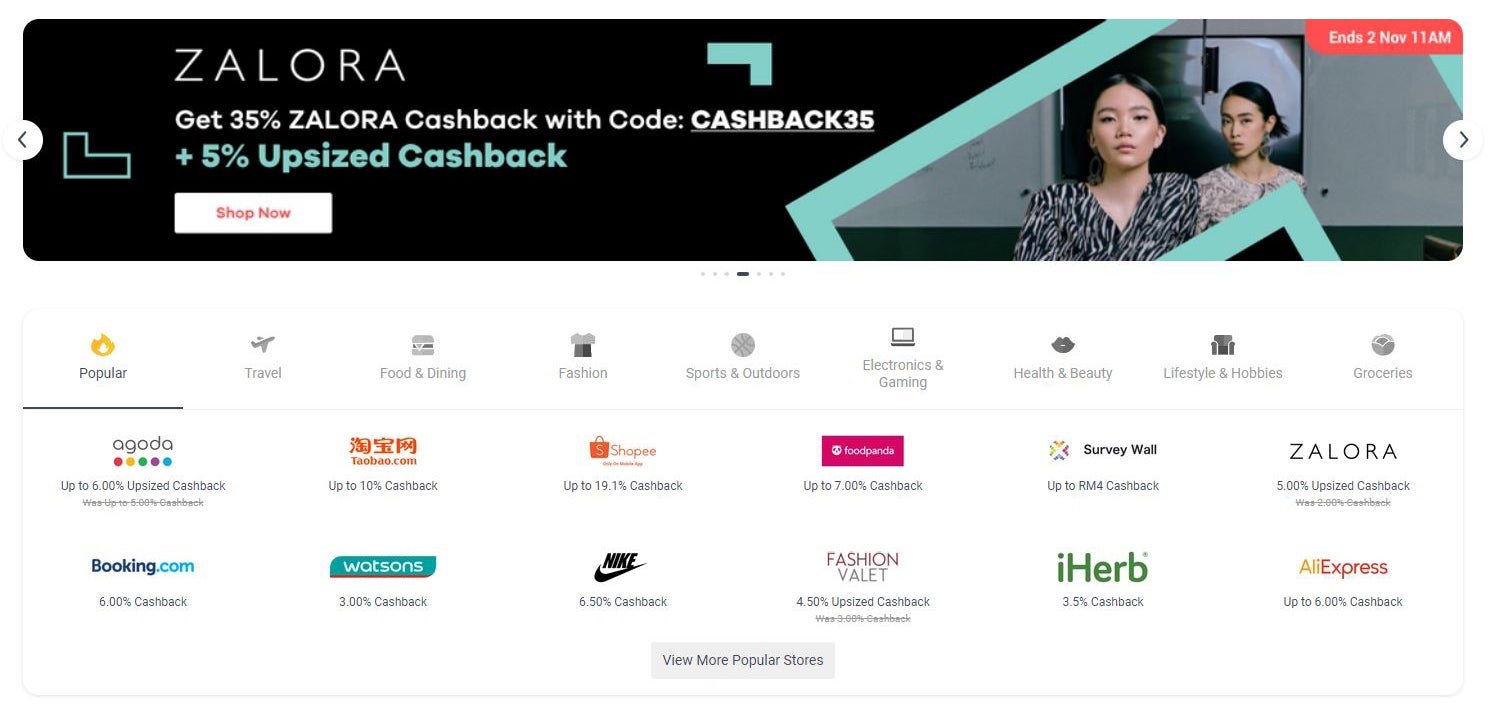

3. Make money back after shopping by using cashback websites

Perhaps one of the most underrated things about online shopping at the moment, cashback websites allow you to earn some money back after you spend on digital purchases. We think the benefit of this is pretty clear. It’s practically free money back for buying stuff that you want.

Originally, cashback rewards are offered by banks for their credit cardholders. But today, you can earn cashback from your favourite merchants or when purchasing from brands directly!

4. If you see an outfit or collection you like, get them next season

Just because you’re wearing last season’s clothing collection doesn’t mean it’s not cool anymore. It’s a matter of taste and if you have a knack for styling, there’s nothing stopping you from looking good no matter what you throw on. Not like Malaysia has four seasons anyway…

It’s pretty easy to spot an off-season collection if you basically know how the four seasons work in other countries. For example, if you’re shopping at a UK-based outlet like Topshop and you like their new summer collection, buy it at the end of the year when they are headed into winter. That’s when all the summer clothing that wasn’t sold will be at a lower price!

5. Add to cart and wait for a special event like Christmas or New Year sales

Online merchants are always jumping on the monthly sales bandwagon where they offer discounts you won’t get at any other time of the year. Just add the stuff you want to buy to your cart and wait for that special day to get a big, discounted haul which will leave a smile on your face (and your bank account’s face if it had one).

There’s really no reason to shop at full price when there are so many holidays and festive sales that happen throughout the year in Malaysia.

6. Be a better overall shopper by prioritising essentials over stuff that you don’t need

It’s easy to get caught up in the crazy sales period that comes every once in a while and let us tell you, Malaysia has sales pretty much all year round! More sales mean more temptations to purchase stuff you don’t actually need.

Having an e-wallet might help though, and that’s where GoPayz comes in!

GoPayz is a one-stop app that offers MORE financial services than any other money-related app out there! Talk about digitalising traditional services!

In a time where saving money and spending smart is all the more important, we’ve got to make sure we’re not spending our hard-earned money on unnecessary things.

In order to further raise awareness on smart spending and the importance of saving money, GoPayz is running a RM100 challenge on their website for all GoPayz users to stand a chance at winning RM100 FREE credit right in their account!

What’s more, this challenge was started in hopes of raising awareness on the importance of affordable financial products and why Malaysians should be investing in these smartly without breaking their bank.

FYI, not one, not two, but 250 winners will be chosen throughout this challenge period!

Every week, 30 winners will receive RM100 in their GoPayz account, while another 20 winners will receive RM20 worth of e-vouchers. What!?

The challenge is super simple, all you have to do is:

- Join GoPayz RM100 Challenge on gopayz.com.my/spendsmart

- Tell them why you need this FREE RM100 in less than 100 words

- Download and sign up for GoPayz if you haven’t yet

- Fill up your name, mobile number and email and you’ll be contacted if you’re the winner

The challenge will take place over five weeks from 5 November to 9 December 2020 so get on the website now and don’t miss out on getting RM100 for your GoPayz account!

And in case you’re wondering what makes GoPayz stand out, here’s why: an e-wallet app typically allows you to not only pay for food or make retail purchases but also for gas at petrol stations, bills, among other things. For GoPayz, on the other hand, it comes with a bunch of other financial products and features such as:

- GoLife Plus – Affordable life insurance from RM13/month

- GoTakaful family insurance – Family Takaful plan from RM18/month

- Contribute Zakat – Skip the queue and make Zakat payments straight from your phone!

- GoInsure – Insurance on-the-go for personal accidents, motor and travel

- Simple & secure remittance – Remit your money overseas as fast as 5 minutes!

- Exchange currencies and get it delivered to your doorstep

- Invest & grow your Ringgit

- Donate to your preferred charities

Saving money or preparing for a rainy day in the future just got so much easier.

You can get their services from the app itself, e-commerce sites or make retail transactions anywhere in Malaysia or overseas that accepts MasterCard, UnionPay and Visa. This is because unlike other e-wallets that require QR codes, GoPayz comes with these three card schemes.

For more info on GoPayz and its features such as insurance coverage details or exchange rates, go ahead and check out their website.

So what do you think of this app? The features so berlambak right? Download and sign up today!