Do you consider yourself a smart spender? If you’re the type who likes to get the best out of your buck, we’re sure you’re aware that there are various ways you can shop smart. It can be in the form of earning cashback every time you shop or utilising flexible payments to manage your finances.

Well, what if we tell you that you can now enjoy all of those rewards with one card?

We’re talking about the Beyond Card – Malaysia’s first global prepaid card with a PayLater feature!

This first-of-its-kind card in Malaysia, launched by Boost in partnership with CelcomDigi and Mastercard, is said to be an ideal and safer choice for those looking for credit card alternatives because it provides a rewarding and extensive PayLater feature through responsible financing. Read on to learn more about the unique benefits of the Beyond Card!

1. A Shariah-compliant PayLater solution accepted by over 100 million Mastercard merchants worldwide!

First things first, the Beyond Card is a prepaid card that allows you to set the source of funds, either:

- Via direct deductions (pay-now transactions) from your Boost app’s eWallet balance, OR

- Via the built-in PayLater solution, known as Boost PayFlex™, which can stretch payments by up to 3-month instalment. Psst…there’s a 6-month instalment option coming soon too!

Through Boost PayFlex™ within the Beyond Card, you can make a PayLater transaction through its Shariah-compliant credit line, where users can stretch payments by up to 3 months through instalments (the 6-month instalments option will be available in the near future!).

The Beyond Card is also one of the most comprehensive and wide-reaching PayLater options in the market as it can be used around the world across over 100 million Mastercard merchants, for both online and in-store transactions.

This helps users consolidate all expenditures onto one platform, instead of having to use multiple PayLater providers for specific merchants, making it easier to keep track and monitor your payment schedules efficiently on Boost’s all-in-one fintech app.

Before you worry about overspending with this card, fret not! As a responsible and regulated fintech leader, Boost employs robust scoring techniques to offer a controlled and personalised credit line based on each Beyond Card user’s affordability assessments to safeguard customers from an excessive debt burden. Additionally, all fees are transparently disclosed upfront for users to make informed decisions.

2. Exclusive cashback and premium rewards when shopping locally or travelling abroad

Another great feature of the Beyond Card (and arguably one of the most important functions for any thrifty spender!) is the rewards programme because that’s where you can leverage additional savings to maximise value for money!

In this regard, the Beyond Card offers one of the most premium reward experiences in the market as it is the first card in Malaysia and Southeast Asia to offer Mastercard Travel Rewards. This exclusive rewards programme provides a diverse range of deals spanning travel, shopping, culinary, entertainment, arts, culture, sports, wellness, and more from local and international brands.

Some of the top deals include:

- Up to 11.05% cashback when you shop from Shopee (online offer)

- 6% cashback when you shop from Zalora (online offer)

- 10.5% cashback when you from Nike Malaysia (online offer)

- 6% cashback when you shop from Adidas Malaysia (online offer)

- 12% cashback when you shop from lululemon Malaysia (online offer; valid until June 2024)

- 9.5% cashback when you shop from Calvin Klein Malaysia (online offer)

- 7% cashback when you shop from CHARLES & KEITH Malaysia (online offer)

- 6% cashback when you shop from Swarovski Malaysia (online offer)

- Get IDR1,000,000 cashback at Grand Hyatt Bali

- Get THB1,000 cashback at JW Marriott Hotel Bangkok

And so much more! You can check out the full list of rewards on this page. (Terms and conditions apply.)

That’s not all. When you use Beyond Card’s PayLater solution, Boost PayFlex™, every Ringgit you spend will earn up to 3 Boost Stars. These Boost Stars are ‘as good as cash’ because they can be used to redeem even more rewards on the BoostUP Rewards Catalogue and unlock savings from ‘Pay With Stars’ direct discounts on bill payments.

Additionally, users who successfully apply and opt in for the Physical Beyond Card from now until 30 June 2024 can redeem a free scoop of Inside Scoop ice-cream using a Partner Wallet voucher on the Boost app. Act fast, though, as this exclusive promo is available on a first-come-first-served basis!

If used strategically, such as during festive sales and discount periods, when it can be coupled together with various offers on the Beyond Card, users can amass huge savings on top of enjoying flexible payments. Score!

3. Seamless security at your fingertips!

In terms of security, you can also rest assured that each transaction is password-protected. In case of theft or suspicious activity, you will also have the option to freeze or unfreeze the card immediately via the Boost app.

4. Enjoy a hassle-free process when you apply for the card via the Boost app

Interested in getting your hands on the Beyond Card? Then, you’ll be glad to know that the application can be done online and it is fuss-free! All you have to do is follow these simple steps:

- Make sure you’ve downloaded the Boost app (available on Google Play and App Store) and have created a Premium Wallet (which can be done for free by completing a simple e-KYC registration process).

- On the app’s homepage, click on the ‘Beyond Card’ icon.

- Fill in your necessary details and submit your application. That’s it!

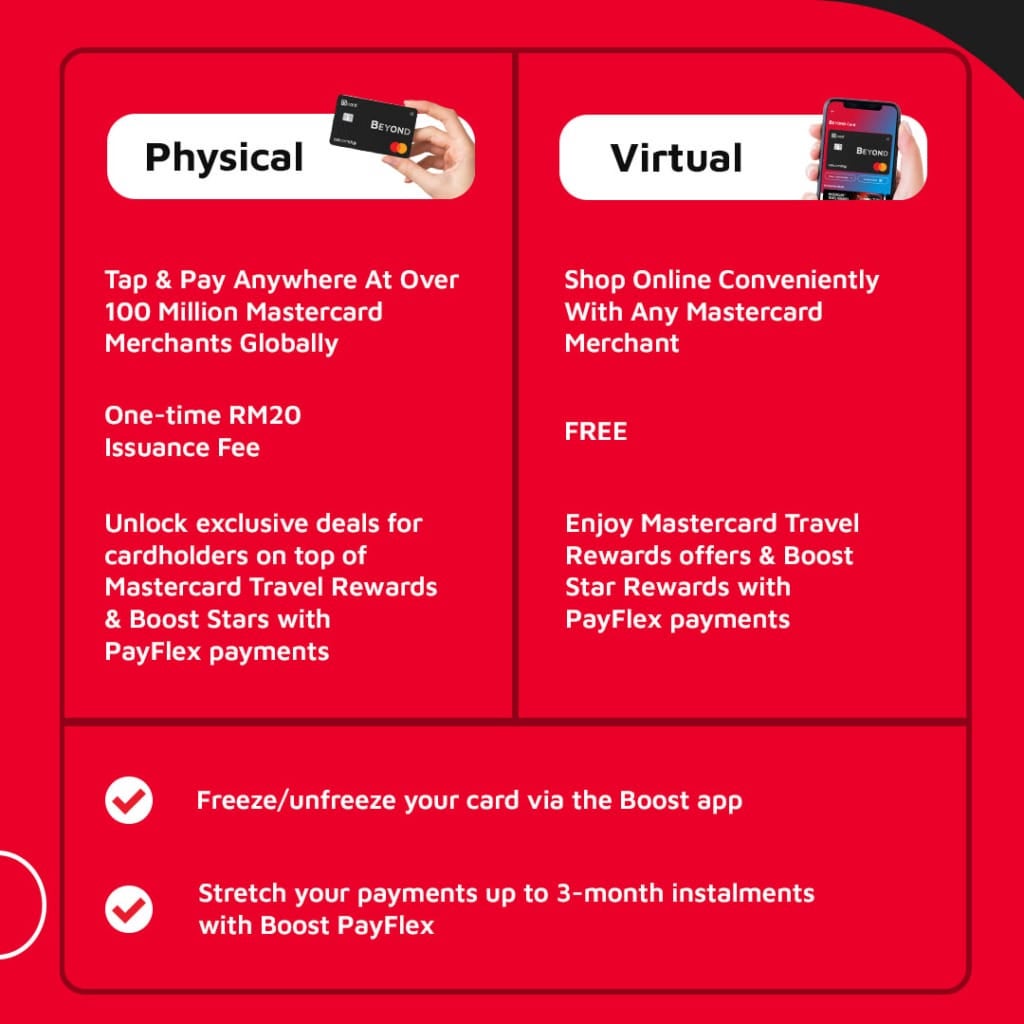

Upon completing the application, you will be issued a virtual Beyond Card instantly once approved. As for the physical Beyond Card (for in-store transactions), you can request it via the app and it will be delivered to you within five to seven working days (there will be a one-time RM20 issuance fee).

The card is currently exclusively available for CelcomDigi users only. However, if you’re not a CelcomDigi user, you can still apply for Boost PayFlex™ to enjoy flexible payments on the Boost app.

With Boost PayFlex™, users can stretch payments by up to 6-month instalments at over 1.8 million DuitNow merchants nationwide, as well as to top up their eWallet balance on the Boost app to enable PayLater for all in-app transactions, including digital bill payments, online shopping, food delivery, and more!

For more information on the Beyond Card and Boost PayFlex™ , please visit their website here. You can also follow Boost on their Facebook and Instagram pages to be the first to know about the latest news or promotions. Don’t forget to also download the Boost app (available on Google Play and App Store) to start your rewards-filled journey with Boost!