March is almost to an end and it usually signifies tax season for companies and individuals in Malaysia. The usual due date of filing taxes in Malaysia would be 30th April.

However, given the fact that our nation is currently in the midst of pandemic, the Inland Revenue Board of Malaysia (LHDN) has extended the filing date to 31st August 2020 for people to file their tax income. To increase efficiency, you can key in relevant claims through e-Filing.

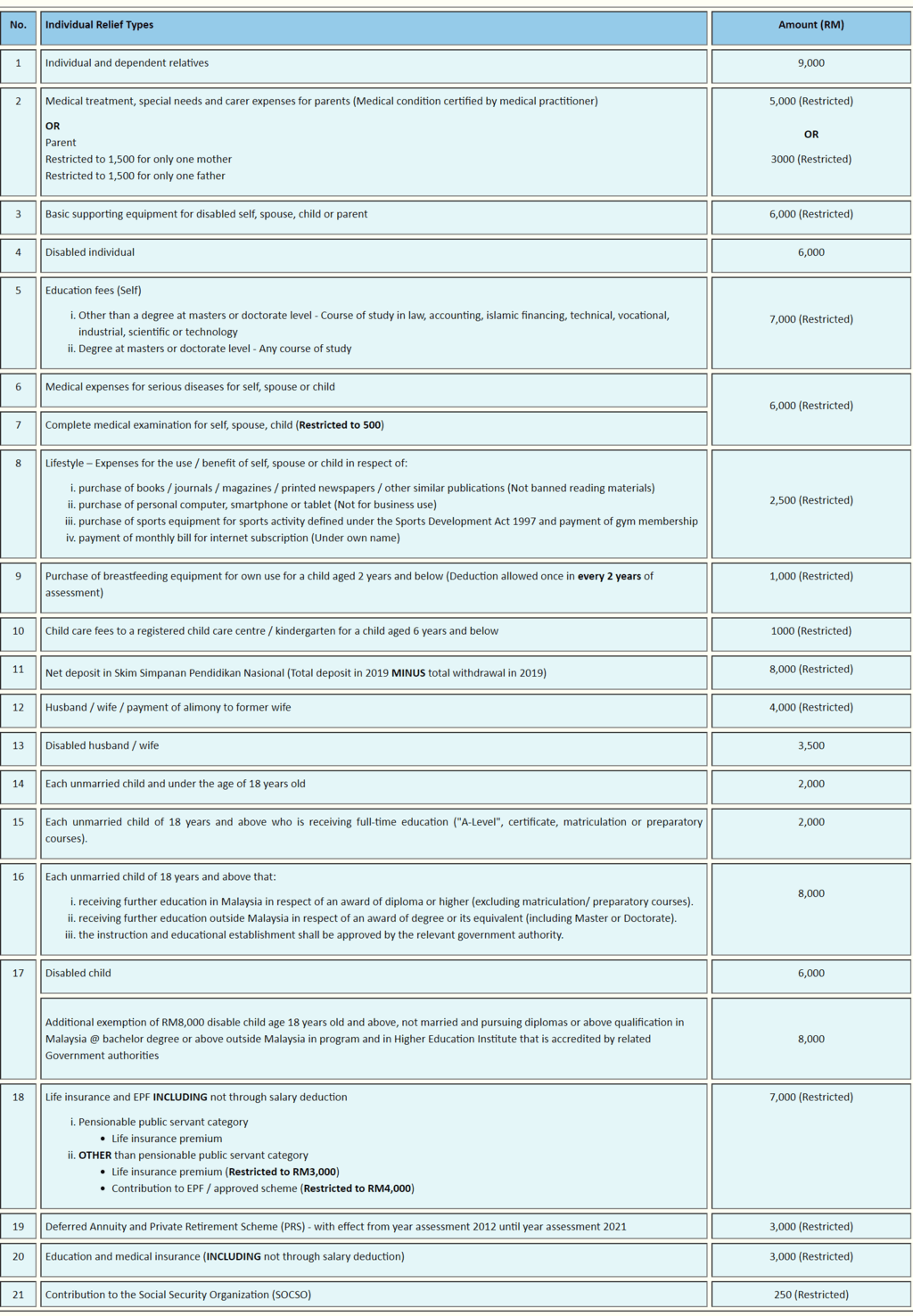

This year there are 21 tax reliefs available that we can take advantage of! Here’s the full list of tax reliefs that you can claim:

Here’s the common tax reliefs that you most likely want to take note of and not miss out:

1. Parents

You can claim up to RM5,000 for medical treatment, special needs and carer expenses for both parent OR you can claim RM1,500 per parent. When claiming for RM5,000, the medical conditions of your parents should be certified by medical practitioner.

Claim up to: RM5,000

2. Education Fees (Self)

You can utilise this if you are pursuing a Certificate/Diploma/Bachelor’s Degree in Law, Accounting, Islamic financing, Technical, Vocational, Industrial, Scientific or Technological skills or other relevant qualifications. If you’re doing masters or doctorate level of any course, you can also use this.

Claim up to: RM7,000

3. Complete medical examination for self, spouse, child

This amount can be claimed when you, spouse and child went through a complete and thorough medical examination.

Claim up to: RM500

4. Lifestyle

This tax relief would be the one that we could use the most. Under the lifestyle category, you can claim on the expenses that you, your spouse or child used or benefited from.

Under this category, items that are applicable include purchase of books, magazines, journals, printed newspapers and other similar publications that aren’t banned.

Apart from reading materials, this tax relief is also applicable for purchase of personal gadgets such as computer, smartphone or tablet. The list doesn’t stop there! Buying sports equipment or gym memberships and your monthly internet subscription is counted too!

Claim up to: RM2,500

5. Net deposit in Skim Simpanan Pendidikan Nasional (SSPN)

This is applicable to people who have deposited money in their SSPN account in 2019. However, any amount that is withdrawn after your first deposit in 2019 is not counted. It should be calculated as the total deposit in the year 2019 MINUS total withdrawal in the year 2019.

This can be claimed in your e-BE form as well!

Claim up to: RM8,000

6. Education and medical insurance (INCLUDING not through salary deduction)

This tax relief is applicable to medical and education insurance. It’s different from life insurance!

Claim up to: RM3,000

7. Life insurance and EPF INCLUDING not through salary deduction

There’s two categories under this: i) Pensionable public servant category which includes life insurance premium and ii) OTHER than pensionable public servant category. This category includes life insurance premium (Restricted to RM3,000) and contribution to EPF / approved scheme (Restricted to RM4,000).

Claim up to: RM7,000

8. Deferred Annuity and Private Retirement Scheme (PRS)

PRS is with effect from year assessment 2012 until year assessment 2021.

Claim up to: RM3,000

Malaysians should also take note that some changes may apply as the nation is currently in the midst of a pandemic. Always stay tuned to the LHDN’s official website for the latest info and happenings. Visit LHDN’s official website at http://www.hasil.gov.my/index1.php?bt_lgv=1

What do you think of this article? Share your thoughts down below.

Also read: How to Adult Right: File Your Income Tax Online With These Easy Tips