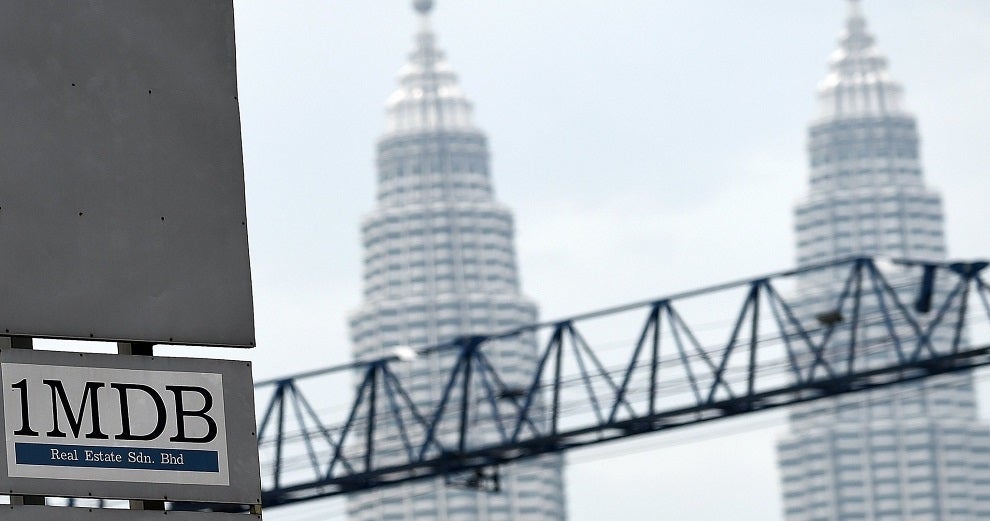

According to a report by Berita Harian, state investment firm 1Malaysia Development Berhad (1MDB) will reportedly shut down after all of their debts have been settled. The firm’s treasury secretary-general, Tan Sri Mohd Irwan Serigar Abdullah, was quoted as saying that he was confident they would be able to repay their debts through their rationalisation plan.

He added that the debt can be paid with revenue from government “mega projects” such as the construction of the Tun Razak Exchange’s (TRX) Exchange 106 building, the East Coast Rail Line (ECRL), and Phase 2 of the MRT line. The treasury secretary-general stated at an event in University Malaysia Kelantan (UMK),

“Soon, TRX City will have tenants who will pay rent and we will also sell plots of land. Bandar Malaysia, which is currently being developed, will soon become modern and sophisticated once the ECRL and MRT are completed.”

Source: mmo

“Using funds from this, we will be able to repay our debts… these proceeds won’t come in a day or two, but will take more than 10 years to generate income from long-term development.”

“Once our debts have been settled, 1MDB does not need to exist anymore.”

Last year, according to an agreement between the Ministry of Finance and International Petroleum Investment Company PJSC (IPIC), 1MDB has already repaid debts to the IPIC that were due on 31st December 2017.

Now, the investment firm owes about USD$600 million (RM2.43 billion) to the IPIC as part of their agreement in April 2017.

According to Free Malaysia Today, Prime Minister Datuk Seri Najib Tun Razak stated that 1MDB, which incurred debts of up to RM50 billion as of January 2016, has since cleared all of its bank and short-term debts.

Source: malaysia outlook

Earlier in January, Prime Minister Najib also acknowledged that there were “lapses in governance” in the investment firm, which was why it launched an investigation among multiple authorities.

The daily listed the following debts that have already been settled by 1MDB, according to the ministry of finance:

- RM229.5 million revolving credit facility to Affin Bank in full by Nov 23, 2015

- RM950 million standby credit to the government in full by March 31, 2016

- RM2 billion term loan facility to Marstan Investment NV by April 8, 2016

- USD$150 million term financing facility with EXIM Bank by April 15, 2016

What do you think of 1MDB’s move to shut down after it has settled all of its debts? Let us know in the comments below!

Also read: “1MDB Showed Failings And Lapses of Governance,” PM Najib Publicly Admits