If you’re a frequent traveller or you often shop on foreign websites, you’d know that it can be costly to convert the Malaysian Ringgit to foreign currencies. Not only that, it’s even more troublesome if you have a family member who’s studying overseas and you have to wire them money but you end up getting charged so much just for the transfer fees.

If you’ve ever dreamed of making borderless payments without any hassle, then we have some good news for you!

Malaysians can now get the RHB Multi Currency Account with RHB Multi Currency Visa Debit Card where you’re able to save, shop, transfer and even invest money in up to 16 different currencies with just 1 card!

Yes, this type of bank account exists!

If this is your first time hearing about a multi-currency account, we understand that it can be a bit puzzling. But fret not! We’ve compiled a list of basic things that you need to know about a multi-currency account and why you might just need one in your life! Just read on below to find out more~

What exactly is a multi-currency account (MCA) & how does it work?

As you can probably tell from its name, a multi-currency account is a bank account that allows you to save, receive and send money in more than one currency. This way, instead of having to register multiple bank accounts for different currencies, you can perform all your desired transactions with just one account. Sounds super convenient, right?

But you might still be wondering, how do you utilise such an account? The answer is fairly simple! An MCA works just like any standard bank account. For instance, with RHB’s Multi Currency Account, you can use the account to save, transfer and even invest in up to 16 currencies! Yes, this means you can also earn interest in different currencies at the same time!

You can check out these tutorials to see how easy it is to convert Ringgit Malaysia to other foreign currencies via RHB Online Banking or the RHB Now Mobile Banking app:

Here are some of the other benefits of RHB’s Multi Currency Account

Now that you know the basics about an MCA, you should also know that this account actually comes with various benefits. From sending money effortlessly to keeping a diverse investment profile, this all-in-one account makes banking transactions all the more convenient! If you’re curious to know more, just read on to find out some of the highlights of RHB’s Multi Currency Account:

1. 1 card, 16 currencies

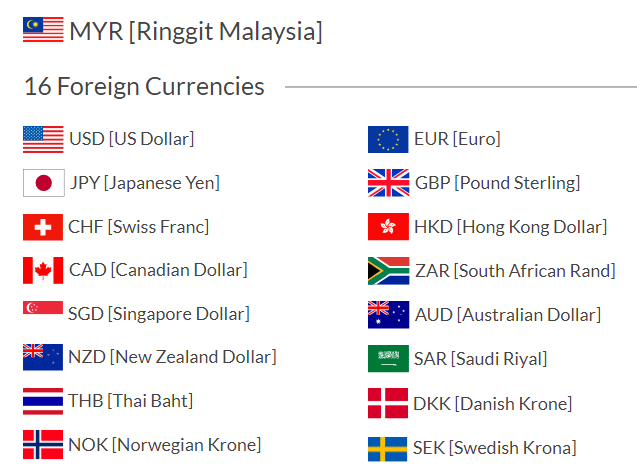

As we mentioned earlier, the RHB Multi Currency Visa Debit Card provides access to 16 different foreign currencies with just one debit card. The currencies include most major foreign currencies, which are:

With access to so many currencies from just one debit card, you can travel to these countries without the hassle of converting a ton of cash and instead, freely perform transactions in their currencies with your debit card. Plus, you can also enjoy instant currency conversions via RHB Online Banking or at any RHB branch.

2. Hassle-free spending with the RHB Multi Currency Visa Debit Card

The RHB Multi Currency Visa Debit Card can also be used to conveniently shop overseas. In fact, the RHB Multi Currency Account is the first in Malaysia to come with a multi-currency debit card! This means that you can spend anywhere (that accepts card payments and is using a currency compatible with the RHB Multi Currency Visa Debit Card, of course!) just by carrying this debit card. Not only that, but this debit card also comes with no currency conversion fees! This means that if you shop overseas, you won’t have to worry about the additional fees every time you swipe your card!

3. Easily transfer money to family members overseas

For parents who have children studying abroad, they would definitely know that the process of wiring money abroad can be a bit of a hassle. Not only is it inconvenient to have to go to the bank at times, but the transfer itself can also take up to several days to be completed!

To avoid this situation, we’d highly recommend opening up a joint RHB Multi Currency Account for both the parents and the child. This way, the parents can streamline the transaction by simply converting money into the joint account. The child will then be able to access and use the money instantly for their overseas expenses with the RHB Multi Currency Visa Debit Card. Super easy, right?

4. Travel without worrying about carrying thousands of Ringgit everywhere

Are you the type of Malaysian who would always convert thousands of Ringgit into foreign currencies before you go on a holiday? Many people believe that carrying cash while travelling overseas is the most convenient method but the truth is, it is highly risky and unsafe!

This is where a multi-currency debit card will come in extremely handy! This way, you no longer have to worry about whether or not you converted enough money for the holiday or somehow losing all that cash. All you need is your RHB Multi Currency Visa Debit Card and you’re good to go! Just bank in the money you wish to spend during the holiday beforehand into your RHB Multi Currency Account and make sure to convert the money into the correct currency (as shown in the video above) and voila, the debit card is ready for use!

5. Invest safely with a diversified currency portfolio

Another great feature of the RHB Multi Currency Account is that you can also invest in foreign currencies with just one portfolio! The RHB Multi Currency Account allows you to trade in up to 24 foreign currencies so that you can invest like a local on a global scale. Plus, you can also use this account to diversify your investments in multiple currencies at once. You can also decrease the overall risk by hedging against fluctuations according to the market conditions.

Interested? Here’s how you can apply for one today!

There are two types of RHB Multi Currency Accounts that you can choose from based on your needs:

- Education & Employment Account which is suited for:

- Parents – to manage their children’s educational funds, especially if they study abroad.

- Malaysians living and working abroad – to retain their overseas salaries or investments.

- Non-residents employed in Malaysia – to retain foreign currency salaries received here or overseas.

- Individual Account which is suited for Malaysians/non-Malaysians who would like to:

- Retain investment funds from abroad.

- Invest in foreign currencies.

- Seamlessly convert the Malaysian Ringgit to any foreign currency.

Once you know which type of account you want, make sure you suit all of these criteria:

- Malaysian/non-Malaysian

- Individuals aged 18 and above

- A non-profit organisation, club or society

- Sole-proprietors/associations

Psstt… it’s also compulsory to open an RHB Ringgit Current or Savings Account before you apply for the RHB Multi Currency Account, okay!

Are you all set to apply? Just follow these simple steps:

- Complete the application and declaration form which you can find here.

- Provide a copy of your identity card and/or passport.

- Provide your enrollment letter (if you’re applying for education purposes) or a working visa (for employment purposes)

If you’re unsure of the process, you can also drop by the nearest RHB branch and make your application there! If you need more information regarding the account or the terms and conditions, simply visit the RHB website here. You can also follow them via Facebook or Instagram to get the latest news or financial tips.

Disclaimer: RHB Multi Currency Account is an account that holds up to 24 foreign currencies and precious metals such as Paper Gold and Paper Silver in one account. The opening of an RHB Multi Currency Account will come with an RHB Multi Currency Visa Debit Card that supports the transaction of up to 16 foreign currencies and Malaysian Ringgit. RHB Multi Currency Account is protected by PIDM up to RM250,000 for each depositor. Multi Currency Account Gold Investment and Multi Currency Account Silver Investment are not protected by PIDM.