Navigating the property market in Malaysia can be challenging, whether for first-time homebuyers or even for those seeking a rental property. For the former, they’ll quickly learn that purchasing a home is far more complicated than just picking a property, paying the deposit, securing the loan and paying the balance purchase price, as there are many other ‘hidden’ fees involved, which are not as publicly known.

These additional costs are also present in tenancy agreements for those renting a property in Malaysia. Hence, it’s important to be familiar with the additional costs so that you can prepare the proper budget and avoid getting swindled by irresponsible parties who overcharge more than what you are required to pay.

For illustration purposes

So, what are these ‘hidden’ additional costs, and how much exactly do you need to pay? Well, read on to find out.

Legal fees and Stamp Duty

For illustration purposes

Speaking to WORLD OF BUZZ, Ahmad Danial, managing partner of Kuala Lumpur-based law firm ADIL Legal, who specialises in conveyancing (the branch of legal practice that deals with the process of transferring a property title or real estate asset from one individual to another), elaborated that in Malaysia, there are two main additional fees when purchasing or renting a property: Legal fees and Stamp Duty.

Expanding on both, Ahmad Danial said that legal fees are what you pay to a lawyer for preparing and handling legal documents, namely the Sales and Purchase Agreement (SPA), Loan Agreement and Tenancy Agreement.

Meanwhile, Stamp Duty is a tax imposed by the Government to legally validate property documents such as the Memorandum of Transfer (MOT) or Deed of Assignment (DOA). Stamp Duty is payable whenever ownership of property changes hands or when a Tenancy Agreement is signed.

For illustration purposes

Legal fees for Property Purchase (general transactions), Developer Sales and Tenancy Agreement

Here’s a breakdown of each of the aforementioned legal fees:

Property Purchase (general transactions)

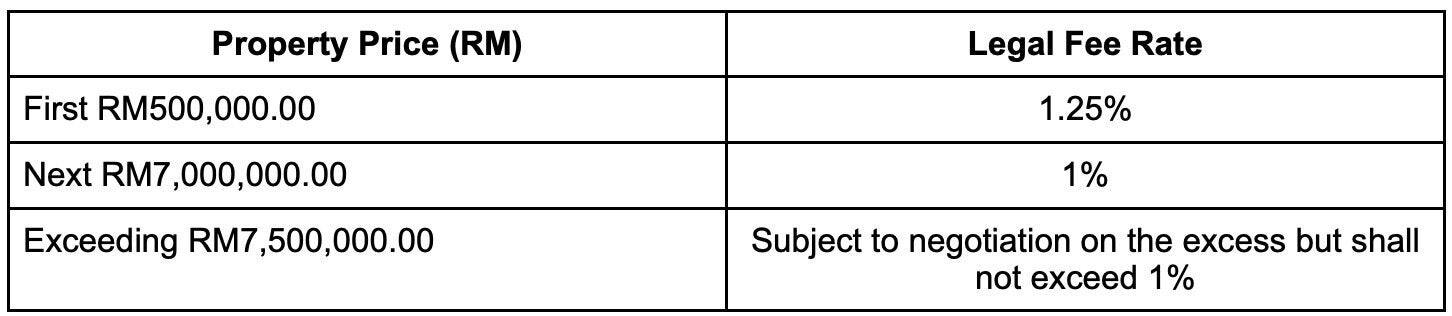

For subsale or commercial property transactions, the legal fees are set under the Solicitors’ Remuneration Order (SRO) 2023. The applicable legal fee rates are as below:

Image provided to wob

Do note that these rates also apply to loan agreements and are calculated based on the loan amount.

Developer Sales

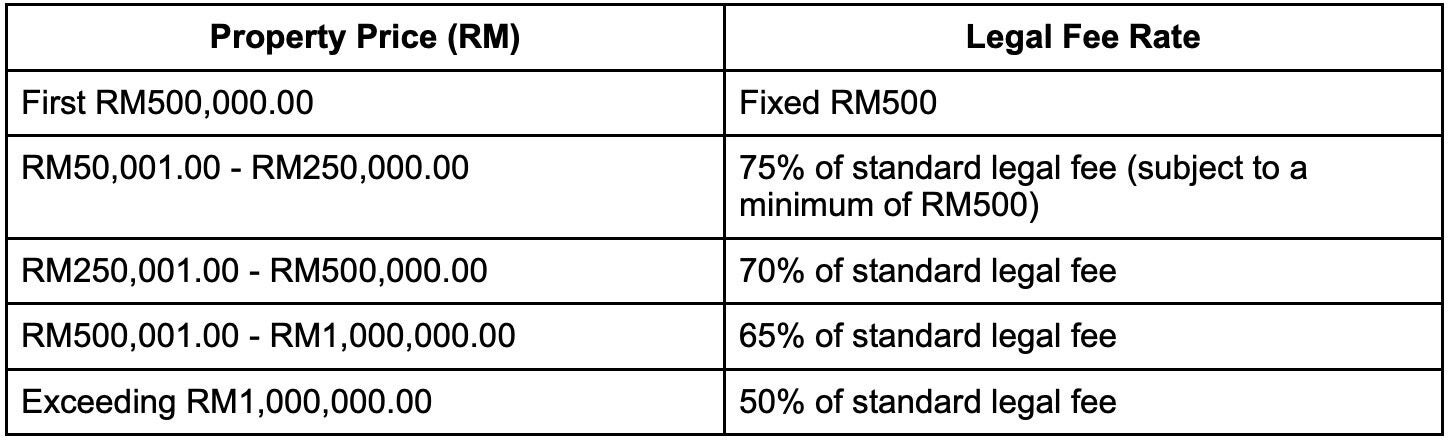

If the transaction is governed by the Housing Development (Control and Licensing) Act 1966, the remuneration of the solicitor who conducted and completed the transaction is as follows:

Image provided to wob

Tenancy Agreements

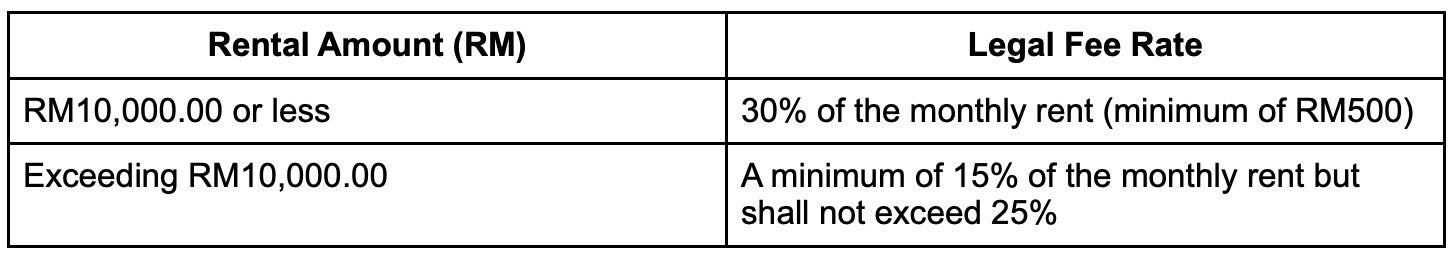

When renting or renting out a property, legal fees cover the preparation or review of your tenancy contract. These fees are usually based on the monthly rental amount:

Image provided to wob

As for who will bear the legal fees for a Tenancy Agreement, there is no fixed law in Malaysia on whether it is the responsibility of the tenant or the landlord. Usually, when parties enter into an agreement, they would appoint their own lawyers and pay the respective legal fees to their appointed lawyers.

Do note that all of the above fee calculations are only estimates for the principal documents, namely the SPA, Loan Agreement and Tenancy. Additional legal documents, such as Consent to Transfer and Charge, Statutory Declarations, Real Property Gain Tax (RPGT) forms and others may incur separate charges. Hence, for an accurate and comprehensive quotation tailored to your specific transaction, it is advisable to consult a qualified lawyer.

Stamp Duty on Property Purchase and Tenancy Agreements

For illustration purposes

As for Stamp Duty, here’s a breakdown of the applicable fees:

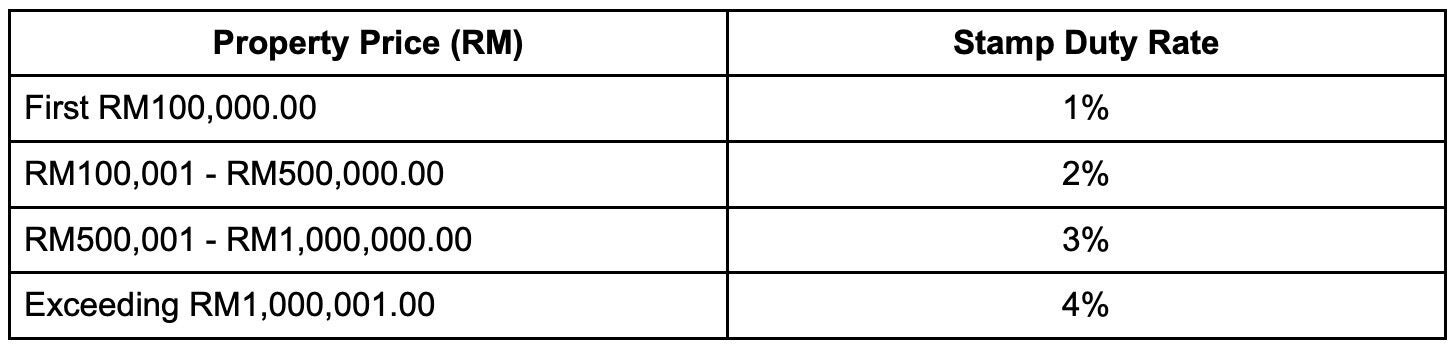

Stamp Duty on Property Purchase

Stamp Duty is calculated based on the property price or market value — whichever is higher — according to this tiered system below:

Image provided to wob

Do note that Stamp Duty also applies to loan agreements, but it is capped at a maximum rate of 0.5%.

Stamp Duty on Tenancy Agreements

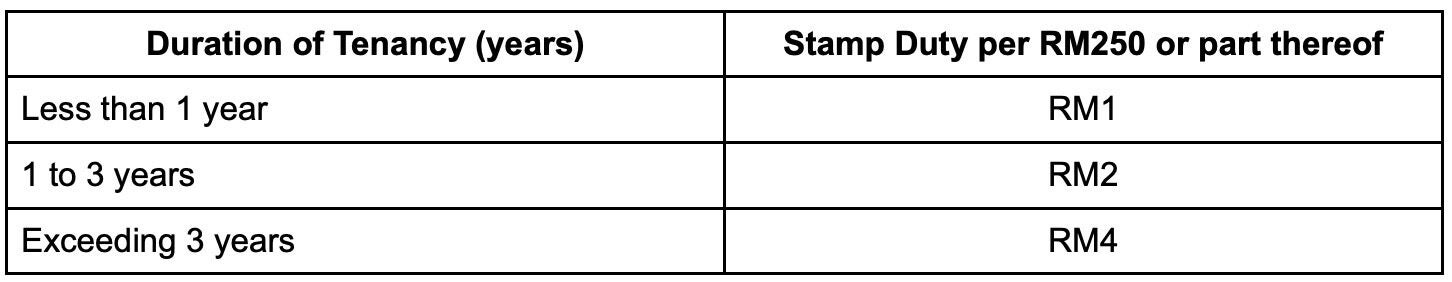

As for Tenancy Agreements, the rate of Stamp Duty is based on the total annual rent stated in the contract, with the first RM2,400 of the annual rent being exempt from stamp duty. Beyond this, every RM250 (or part thereof) is subject to stamp duty based on the lease duration:

Image provided to wob

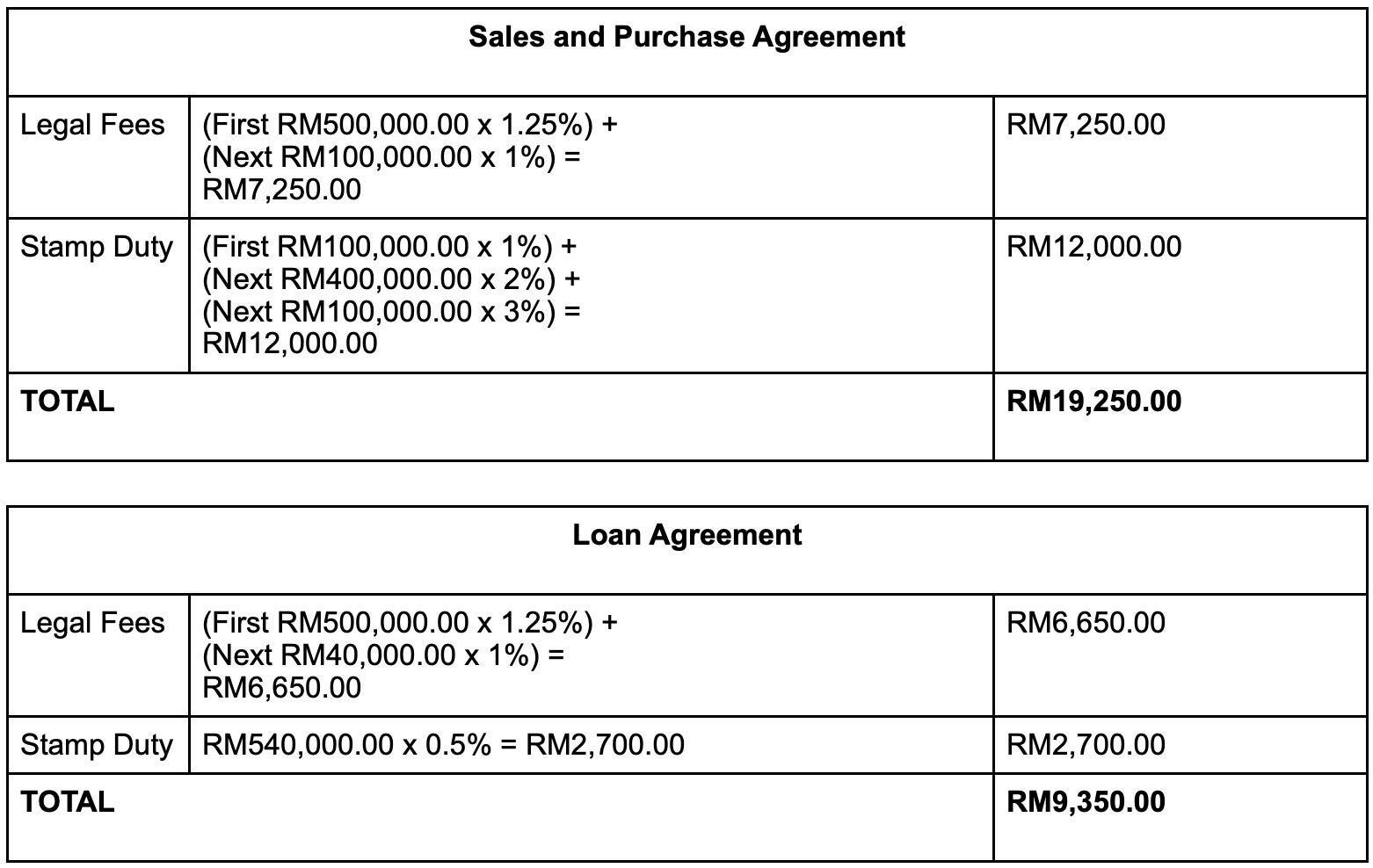

With the legal fees and Stamp Duty rates established, Ahmad Danial provided an example breakdown for the applicable fees for a purchase of a property worth RM600,000, with a loan amount of RM540,000 (90%):

Image provided to wob

For the theoretical scenario above, the total legal fees and Stamp Duty payable would be RM28,600.

You can be exempted from paying Stamp Duty under certain conditions

Ahmad Danial noted that if you’re a Malaysian buying your first residential property, you may be eligible for a 100% exemption on stamp duty for both the MOT/DOA and the Loan Agreement. He added that Stamp Duty exemptions are special waivers or reductions granted by the Malaysian Government to lessen the financial burden on eligible individuals or transactions.

These exemptions are governed by:

- P.U.(A) 53/2021 – Stamp Duty (Exemption) Order 2021 (Instrument of Transfer)

- P.U.(A) 54/2021 – Stamp Duty (Exemption) (No. 2) Order 2021 (Loan Agreement)

However, these exemptions are not automatic, and you must meet these specific conditions set by the Government:

- The agreements are executed between 1 January 2021 and 31 December 2025

- The property is a residential property (excludes SOHO, SOFO, SOVO, and commercial serviced residences)

- You are a Malaysian citizen buying your first residential property

- You do not own any other residential property, including inherited or gifted properties

For illustration purposes

So, what do you guys think of all the applicable additional fees when purchasing or renting a property in Malaysia listed above? Do share your thoughts and personal experiences in navigating through these fees in the comments!