Travelling can be as hectic as it is exciting. You prep for weeks and months before the trip to make sure you’ve got everything you need to enjoy that much needed getaway. One of the most important things to prepare beforehand is the money. Without it, you won’t be able to do, well… Anything! While most travellers have their preference on whether they choose the cash or credit route, it’s always good to prepare a contingency for when you need to withdraw some cash while you’re already there.

Here are some things you should take note of in the event you ever need to withdraw some money while you’re overseas.

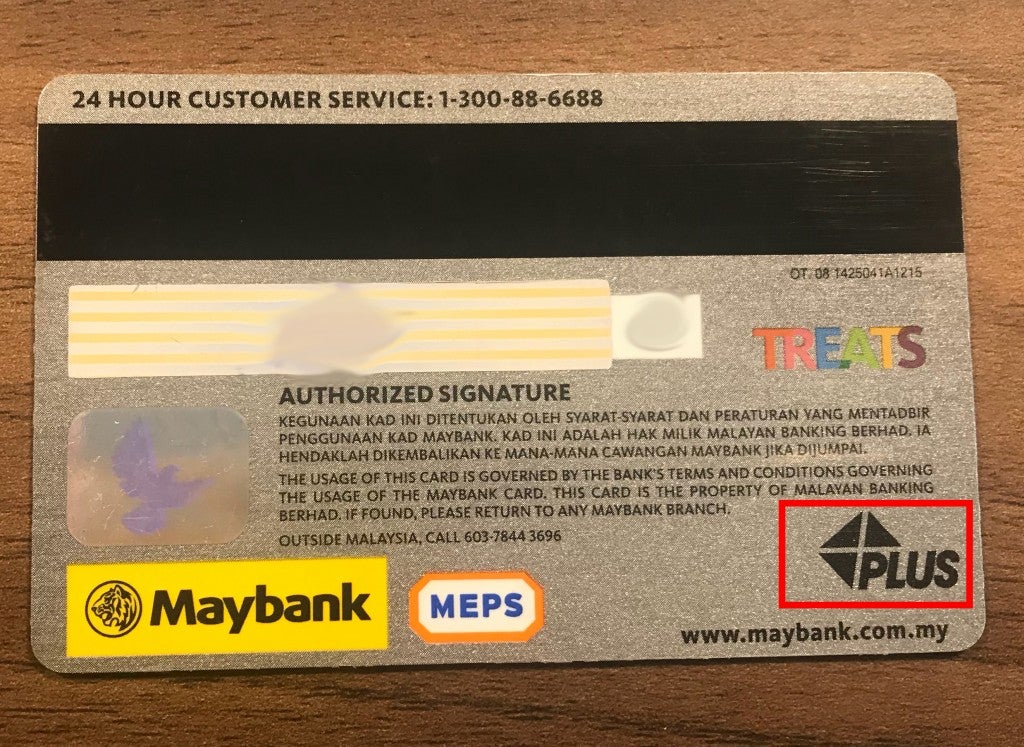

1. Look for ATMs with CIRRUS or PLUS networks

If you turn to the back of your debit card, you’ll be able to see a CIRRUS (for MasterCard holders) or PLUS (for Visa cardholders) logo that looks something like this:

Source: world of buzz

Source: world of buzz

These refer to two of the largest ATM network providers globally. As most Malaysian ATM cards are part of these networks, you won’t have much of an issue withdrawing money overseas. Take note on the availability and locations of these ATMs for your convenience.

2. Take note on the withdrawal charges you will incur

Source: daily mail

When withdrawing money overseas, there will be a few withdrawal charges you will have to pay as well. These are:

- Overseas transaction fees: the fee charged by your bank for conducting a transaction outside of their network. This can be from anywhere between zero to RM12 per transaction

- Currency conversion fees: the fee charged by the bank to convert your currency to the local currency of the country you’re in

- Local ATM owner’s fees: the fee charged by the local provider for the use of their ATM machines

3. Frequent withdrawals from foreign country ATMs may trigger fraud alerts

Source: welcoming olim

Banks have put in place certain precautions to ensure anti-fraud activity. That being said, sudden changes in your account activity such as frequent withdrawals – especially in a foreign country – may trigger fraud alerts. This will result in your bank freezing your account. To ensure this doesn’t happen, make sure to contact your bank beforehand to let them know you’ll be travelling soon and plan on using your debit card overseas.

4. You may need to change your PIN number

Source: pond5

Although the standard length for Malaysian bank accounts are six-digit PIN numbers, most places overseas operate on four-digit PINs. Even having PIN numbers that contain a zero may prove to be problematic in some countries. Ask your bank beforehand if your PIN number will work wherever you’re going. You’ll also be able to request for a new one and memorise it in time for your trip. Gentle reminder: do NOT write your PIN number down and carry it around!

5. Know the withdrawal limits

Source: nerd wallet

ATMs have a daily withdrawal limit that might or might not be in line with your account’s transaction limit. Ask your bank beforehand on these limits and plan ahead in case you’re faced with a low withdrawal limit while on your trip. It’s also good to note if there’s a window in which your ATM card will not function in, which you can also find out from your bank.

These are just a few things to keep in mind the next time you’re on holiday and need to withdraw some money while you’re there. Of course, the best plan of action is to ensure that all your money matters have been sorted out at least two weeks before you leave. Remember to call your bank to inform them on where you’re going and get all the necessary information and emergency numbers needed just in case. That way, you no need to gabra so much and can really enjoy your holiday!

ALSO READ: Should Malaysians Use Their Credit Card or Cash When Travelling Overseas?