Buying your very first property can be daunting as it’s probably the most important purchase you’ll make in your life! It also doesn’t help that the world of property is filled with tricky aspects and unfamiliar jargons that you’ve never heard of. With that said, we’ve approached a few experienced homeowners for some tips to keep in mind when buying your first property:

1. Choose a house type that fits you

Houses can mainly be categorised into two types: landed or high-rise. In order to choose the right one for you, you should consider aspects such as your lifestyle, family size and your long-term plan. We asked Lydia, who has had experiences living in both categories, to list some of the pros and cons, such as:

LANDED:

- Pros: More privacy, free parking, bigger space

- Cons: Lower rental value, can be costly, a bigger commitment

Plus, for investors and business owners, there’s also the option of commercial spaces such as shop lots and offices.

HIGH-RISE:

- Pros: More amenities, tighter security, more affordable

- Cons: Monthly maintenance fees, higher population density

“I loved living in my condo when I was single up to when I first got married. But we just had our first baby (and we plan to have more haha) so my husband and I agree it’s time to move to a landed house. It just makes more sense.” – Lydia, 32

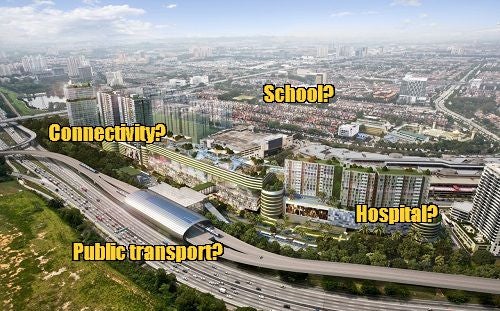

2. Do some research on the surrounding area of the property

Hakim, 37, advised not to just focus on the house that you like but to also do some research on the surrounding area of the property. Some things you should note are:

- The available amenities in the area

- Will there be any future development projects?

- Connectivity to your workplace or key areas

- Access to public transport

- Crime rates within the area

Hakim states, “These are all aspects that will affect your quality of life if you do purchase a house in that area, especially if you have a family. You wouldn’t want to buy a house and then suddenly realise you need to drive 40 minutes just to buy groceries.”

3. Calculate your affordability

Probably the most important rule in buying a house: stay within your budget! Lee, 28, shared a very crucial aspect that you should take note of, which is the debt service ratio (DSR).

“The DSR is usually the first thing banks will look at when you apply for your loan. To put it in simple terms, it’s basically a calculation method used by banks to see if you can afford to pay back your loan.”

If you’re not so good with numbers and you don’t know what kind of home you can afford, worry not! You can use the free Tropicana Loan Aid tool powered by Finology which facilitates instant calculations for home loan eligibility with up to 18 banks!

From there, you’ll be able to know how much you’ll need to pay on a monthly basis and decide if you can afford that house.

BUT DO TAKE NOTE! When calculating your affordability, you also need to take into account additional payments such as:

- Downpayment: 10% of the total amount that needs to be paid upfront

- Stamp duty: Tax that you will need to pay along with your sales documents such as SPA and MOT. The amount depends on your property price. The rates are:

- 1% for the first RM100,000

- 2% for the next RM101,000-RM500,000

- 3% for RM501,000 to RM1 million

- Legal fees: This is only if you decide to employ a lawyer during your purchasing process. The fee is also counted based on the property price with the rates ranging from:

- 1% for the first RM500,000

- 0.8% for RM500,000 to RM1 million

- 0.7% for RM1.1 million to RM3 million

- Home insurance: In Malaysia, buyers can choose between Mortgage Reducing Term Assurance (MRTA) or the Mortgage Level Term Assurance (MLTA). The cost of MRTA is based on your age and the total mortgage of the property (usually about 3-5%) while MLTA offers repayment of your outstanding loan or a guaranteed cashback value at the end of the scheme. The main perk of these insurance plans is if the property owner passes away, the remaining payments will be covered by the bank/insurance company.

So if that house you want is just within your budget with no room to spare, we’d recommend going against it as you never know what other fees might come up.

4. Check if you’re eligible for housing schemes

One good news about buying a house for the first time is that there are many initiatives carried out by our government to help first time home buyers to afford a house. There are schemes that can assist you with financing from banks and some would help in terms of downpayment. Also, if you’re a bumiputera citizen, you can always make use of the advantages such as bumiputera lots, quotas and discounts.

5. Make sure you understand the documents you need to sign

Now comes the tricky part in the house-buying process: the many documents that you need to sign. The steps you have to go through can get long and winding but here are some of the most crucial legal documents that you should know:

- Letter of Offer (LO): The first document in this process that basically states that you intend to purchase a property

- Sales and Purchase Agreement (SPA): The most important legal document in this process that states all of the terms and conditions of your purchase.

- Memorandum of Transfer (MOT): This will legally confirm the transfer of ownership from the seller to the purchaser.

Of course, these aren’t the only documents involved. Which is why Danny, 34, decided to get the help of a lawyer to assist him with this process. “While I do need to fork out extra, it’s a one-time thing and I don’t mind it if it means I can really get the best deal for my house.”

6. Look for crazy deals offered by property developers

Another important tip you should look out for is the crazy deals offered by property developers themselves. Not only are these deals trusted, but they can also ease up the process as they include offers like cashback or referral programmes, free MOT, zero downpayments, low booking fee, and many more. Nina, 29, shared with us the reason that she chose to purchase her current apartment is because of the deals that were offered at the time which allowed her to pay a zero downpayment fee!

If you’re wondering where you can find the best deals in town, you can consider checking out Tropicana 10-TEN, featuring 10 not-to-be-missed deals with more than 10 signature Tropicana properties to choose from!

Now that sounds crazy!

Wanna know what deals are in store for you?

- Enjoy low booking fee with only RM1,000.

- Flexi-buy which allows FREE cancellation and SPA revocation within 30 days.

- You can also enjoy zero downpayments during the purchasing process.

- They provide packages where you can receive cashback from your purchase.

- You’ll also receive mortgage relief in the form of reimbursements to ease your interest repayment.

- The 10:90 scheme allows you to lock in your purchase with just 10% payment, while the remaining 90% is payable upon completion of your house.

- Easy payment scheme means you can get zero-interest instalment up to 18 months to ease your commitments.

- With FREE MOT, you don’t need to pay anything to legally claim the house is yours!

- You can enjoy up to a 6-month moratorium period and interest waiver in case of unforeseen circumstances such as unemployment, pay-cut or even diagnosis of COVID-19.

- You can earn double referral rewards of up to 2% of the nett purchase price when you refer your friends and family.

Not only that, you can choose from Tropicana’s signature properties ranging from residential to commercial, which you can consider as an investment or for your own stay within Klang Valley!

And if pictures aren’t enough for you, you can visit their website to get a virtual tour of these houses. Alternatively, you can also visit Tropicana’s property galleries that have now been reopened to welcome you (with proper SOPs, of course)! FYI, this campaign won’t be here forever so if we were you, we’d really hurry and start choosing our dream home now!

To find out more about the campaign, you can visit Tropicana’s website here.

Have you had experiences buying a property? Or are you planning to buy your first one soon? Let us know in the comments below!