A recent survey conducted by the World Bank, we millennials are out of control when it comes to the expenditure of our incomes to the point where we’re on the verge of going bankrupt!

It turns out that 40% of Malaysian millennials are spending beyond what we can afford, exposing us to the risk of bankruptcy. They also revealed that Malaysians aged 23-years-old to 38-years-old not only admitted to spending more than their means, but also complain that they don’t earn enough to support their lifestyle.

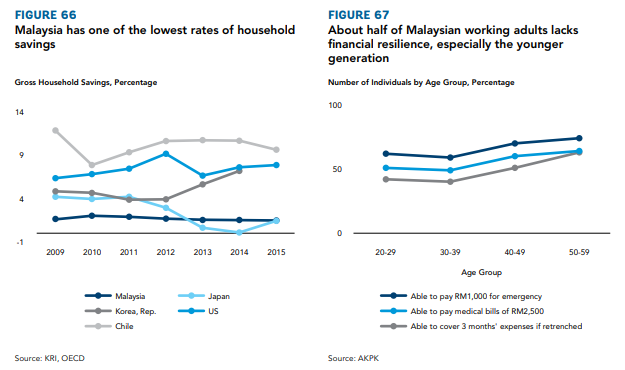

But in our defense, it is said that our financial struggles go beyond the rising cost of good and services, which includes idle income growth and constantly increasing housing costs. This, unfortunately, also results in lowered discretionary income, inadequate financial savings and high indebtedness.

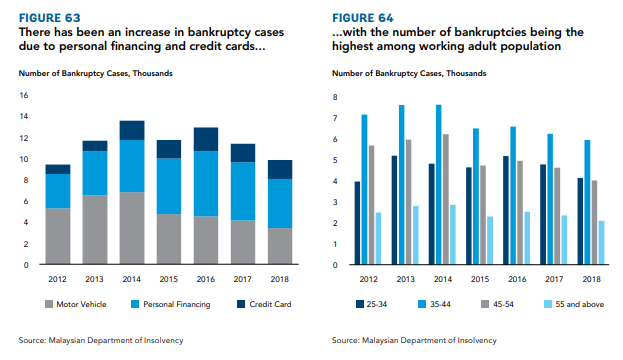

Speaking of which, debt may very well be one of the most impactful reasons as to why young people are heading towards bankruptcy, with the biggest causes being motor and personal finance loans, as well as credit card debts.

What’s scary is that Malaysian millennials seem to be taking up loans for the sake of keeping up with their instant-gratification ridden lifestyle instead of investment purposes.

Source: worldbank

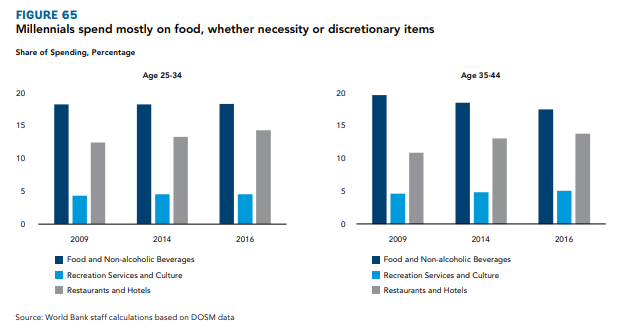

But the one thing millennials can’t seem to hold back spending on is food. In fact, it’s reported that almost 40% of our income goes towards food and non-alcoholic beverages. Surprisingly, we spend the same amount eating at home as we do eating out.

Source: worldbank

Though those of us who spend more on consumption are from the middle-income group, there are others from the lower-income group that are struggling to make ends meet in general.

Among the focus groups consulted by World Bank in the Klang Valley and Terengganu with 3,540 random working adults, the need for dual incomes and working multiple jobs were widely discussed as a necessity as at least 28% of them have to borrow from family members and friends in order to buy essential goods.

Hence, most Malaysians can barely save enough, though this goes especially to the lower-income groups as they already barely make enough to sustain their lives.

Source: worldbank

This also leads to most of us not having enough saved up for emergency purposes such as medical costs, accident costs and job loss.

Hence, the conclusion of the entire study is that young Malaysians are clearly very uneducated regarding their financials and if this keeps up, we’ll all be on out on the streets and wishing we lived simpler lives instead of living large before we had large pockets.

What do you think? Are you having difficulties saving up?

Let us know in the comments section.

Also read: It’s Official, Study and Statistics Show That Women Are Better Drivers Than Men