If you’re an employer, you might want to double check whether you have registered or paid your employees’ Social Security Organisation scheme (Socso) contributions.

This is because, according to The Malay Mail, employers who haven’t registered or paid their employees’ Socso contributions will be investigated during a nationwide hunt for errant employers in August 2018, revealed Human Resource Minister M Kulasegaran.

Source: the malay mail

So, this means that employers have less than two months to fulfil their obligations!

According to reports, there are “6.8 million active workers nationwide working for 435,801 employers registered under Socso” but 10 per cent of the registered employers haven’t registered their employees under the scheme.

“We want employers to register their workers and pay the necessary contributions to prevent legal action,” said Kulasegaran after handing over Socso contributions to a family in Taiping.

Source: the malay mail

He shared that some employers refuse to register their workers because their businesses aren’t prospering. Nevertheless, he criticised them by claiming that it’s a ridiculous excuse.

“We don’t see them paying double contributions when their businesses are doing well,” he said.

He has a point!

Therefore, the Ipoh Barat MP insisted that employers should come forward to fulfil the necessary requirements before action is taken.

“We don’t want to drag them to court and put them in jail. What does that achieve?”

“I urge them to come forward and engage with us so we can see what we can do to help them,” he urged.

Source: vocket

If employers fail to do as required by the Human Resource Minister, they could face up to a RM5,000 fine or further prosecution under the Employees’ Social Security Act 1969. This is serious, guys!

This is definitely a great effort to ensure all employees and employers’ rights are kept in check. Hopefully, employers who have yet to register or pay their employees’ Socso contributions will do so soon before the government comes after them. Don’t say you weren’t warned!

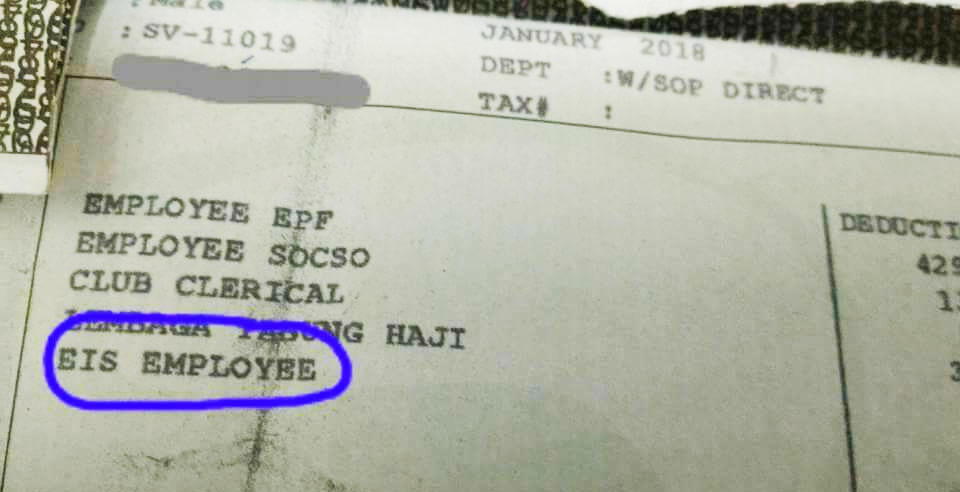

Also read: Did You Notice the Extra New Deduction On Your Latest Payslip Called “EIS”?