Most Malaysians earn salaries within the lower spectrum of 4 digits and are doing everything they can to save as much as possible from that amount.

Hence is why it is shocking to hear how someone who was earning 5 digits does not have savings.

A Malaysian took to the SecretsMY Twitter page to anonymously confess that they’re struggling to pay off their loans and credit card bills after losing their RM30,000 a month job about 4 months ago and had already blown through their savings last year.

This image is for illustration purposes only.

They wrote, “I’m terrified. I lost my job last October and have missed payments for my loans and credit cards for 4 months. I’ve started getting lawyer letters and one personal loan has asked me to pay the full amount.”

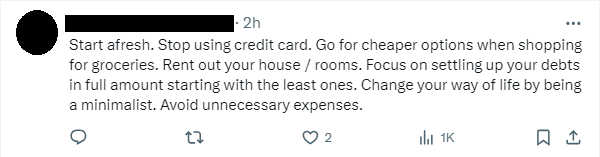

“I just got a new job. I’m starting next week. But, how am I supposed to pay for everything now? What am I supposed to do with all the lawyer letters? The calls? I don’t know what to do. I’m paralysed by fear and anxiety and I can’t think of what to do.”

This image is for illustration purposes only.

They went on to share further details into their finances.

“I used to make about RM30,000 a month. Last year, I finally got the keys to my house and have unfortunately used up all my money, plus I had taken additional loans for this. In October, I got laid off due to budget cuts.”

“And now I’m stuck and stranded. My new job has cut my pay down to less than half of what I used to make. I’m just happy to finally be getting a job. But now, what am I supposed to do? Please, somebody. Tell me what I can do. I’m clueless and I can’t think,” they added.

This image is for illustration purposes only.

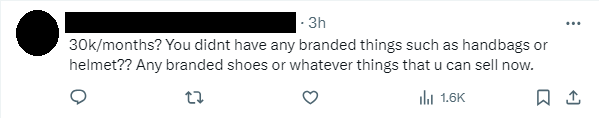

RM30,000 a month but no emergency savings?

While some answered their pleas for a solution, others chose to question how someone who was earning RM30,000 a month can have no money kept away for emergencies.

We genuinely hope that they manage to get through this and build back their financial security.

What do you think about this? Do feel free to share your thoughts in the comment section.

Also read: Sarawak Ex-Governor’s Stepson Slammed for Eating Burger & Wiping Mouth with Euro Banknotes