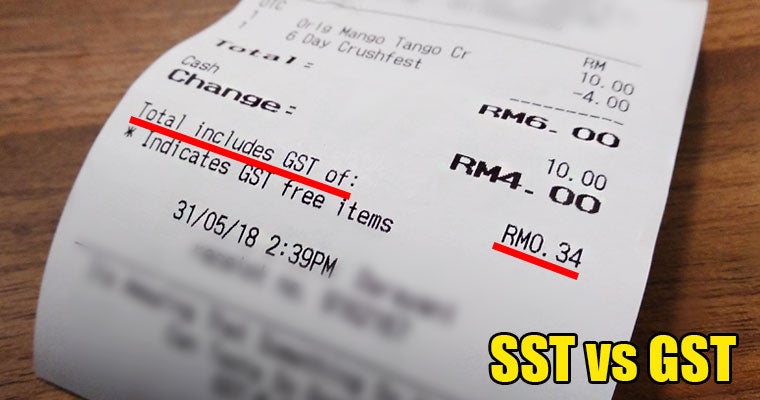

The reintroduction of the sales and services tax (SST) has been the talk of the town for the past weeks and honestly, most Malaysians don’t know what to feel about it as there’s so much fake and inaccurate info about SST being circulated on social media. Hence, our Finance Minister Lim Guan Eng has stepped out to clear the confusion.

Source: sinchew

He made it clear that it’s impossible for the SST to burden the rakyat more than GST, as the collection from the SST is much lower compared to the projected collection of GST.

According to Sinchew, the items that will be exempted from the SST include, but not limited to, the following:

1. Sardines

Source: eat this much

2. Dairy products

Source: indian express

3. Coffee

Source: medical news today

4. Tea

Source: carnival munchies

5. Chilli / tomato sauce

Source: yogitrition

6. Grains

Source: nature’s path

7. Tofu

Source: portugal resident

8. Kaya

Source: wikimedia commons

9. Butter

Source: hu. Ski

10. Bicycles

Source: evosportz

11. Motorcycles (below 250cc)

Source: motorcycle usa

12. Construction materials such as sand, bricks and cement

Source: technology training course

13. Medical consultation

Source: the sun daily

14. Medicine

Source: web md

15. Ambulance services

Source: cyber rt

Guan Eng also announced some good news for fishermen and farmers, as he said that the purchase of fishing boats, tractors and fertilisers will be exempted from SST as well. He added that the government had reviewed SST comprehensively so that it will impact the lower income group proportionately less.

[Update] The full list of proposed goods to be exempted from SST has been uploaded by the Customs Department on its website. Click here to view the full list! Be warned: It’s 300 pages long!

Let’s see how the reintroduction of SST will affect our livelihood once it’s implemented – only time will tell! What’re your thoughts on this issue? Share with us in the comment section!

Also read: SST is Replacing GST Real Soon: What is it & Who Will be Affected By it?