Recently, cryptocurrencies have been making headlines all over the world as Bitcoin rises in value and popularity. Although some of us may still be a bit lost about how these currencies work, a Bitcoin alternative that was created as a joke back in 2013 broke the charts and reached a market cap of more than USD$2 billion (approx. RM8 billion). Yes, that much!

Source: mashable

Known as Dogecoin, it was modelled after the hugely popular meme, Doge, which features a Shiba Inu that makes funny but ungrammatical declarations. Created by Jackson Palmer and Billy Markus in 2013, they only ever meant it to be a joke and didn’t even care about the price, according to BBC.

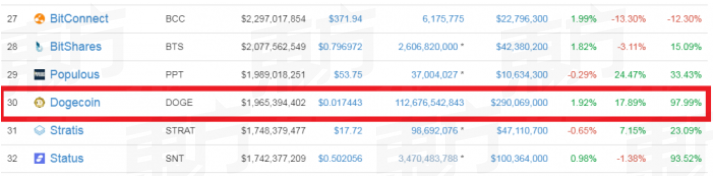

It was a simple currency that was not undergoing active development and did not have much features. However, just last weekend on January 6, the value of all the Dogecoins in circulation suddenly doubled its value and reached USD$2 billion (approx. RM8 billion).

Source: oriental daily

There are about 100 billion pieces in existence and Dogecoins have been gaining steadily throughout December 2017 but this surge in value has not made the founders happy. One of the founders said that this is indicative of a bubble and it is worrying.

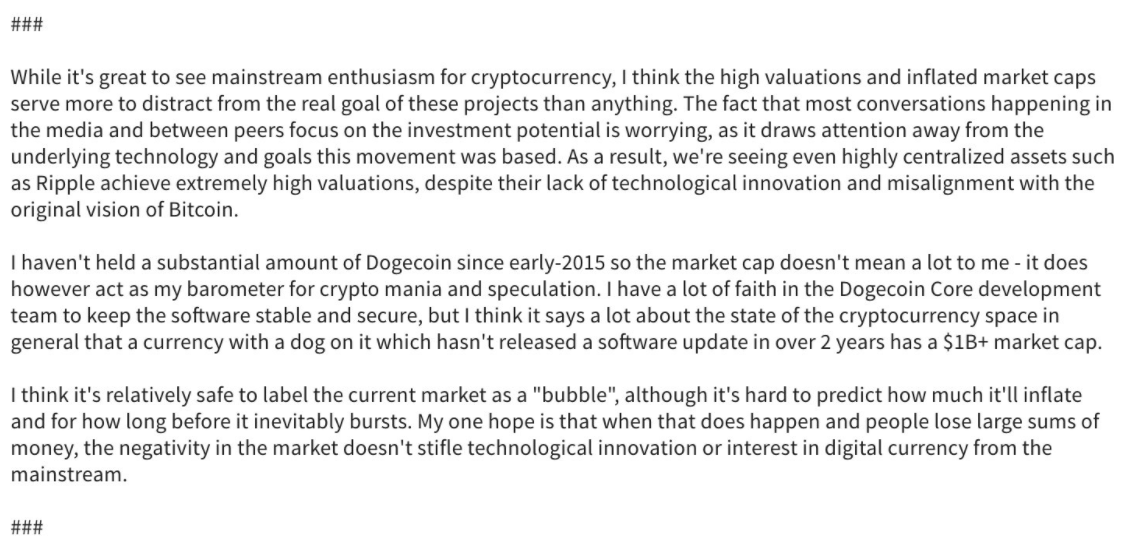

Here’s what Palmer said on his Twitter:

Source: twitter

While this has set off some alarm bells in the industry, it looks like there are many new investors who are still jumping on the cryptocurrency bandwagon. CNBC reported that Dave Chapman, managing director at Hong Kong-based commodities and digital assets trading house Octagon Strategy explains that this popularity may be due to buyers wanting to own something in its entirety.

Source: make use of

“The two most well known cryptocurrencies (i.e. bitcoin and ethereum) are considered too expensive for most new entrants. Despite being able to purchase a fraction of each, there is a real psychological barrier around owning something in its entirety,” he added.

So, what do you think about cryptocurrencies? Do you feel the pressure to invest in them? Let us know in the comments!

Also read: Co-Founder of World’s Top Bitcoin Site Just Sold All His Bitcoins, Here’s Why