Have you been delaying getting an insurance plan because you think it’s too expensive? Or do you think you don’t need one because you already have medical benefits from your workplace? If this sounds like you, you might want to reconsider because we recently discovered one of the most affordable insurance plans on the market…

Yup, we’re talking about Insure360 on the Touch ‘n Go eWallet which offers protection from only RM10 per month!

Touch ‘n Go launched this new feature on their eWallet app to give Malaysians the option to purchase a medical plan at a very affordable price through a hassle-free process. This way, everyone can be protected no matter what their budget is!

Think this sounds too good to be true? Then let us tell you everything you need to know about Insure360!

Pick a plan that best fits you and your lifestyle

To start, Insure360 comes with three different plans that you can choose from:

- Medical insurance

- Critical illness insurance

- 2-in-1 Bundle insurance (Medical + Critical illness)

Here’s what you should know about each plan and the benefits that you can enjoy:

? Medical insurance – Safeguard yourself from unforeseen emergencies

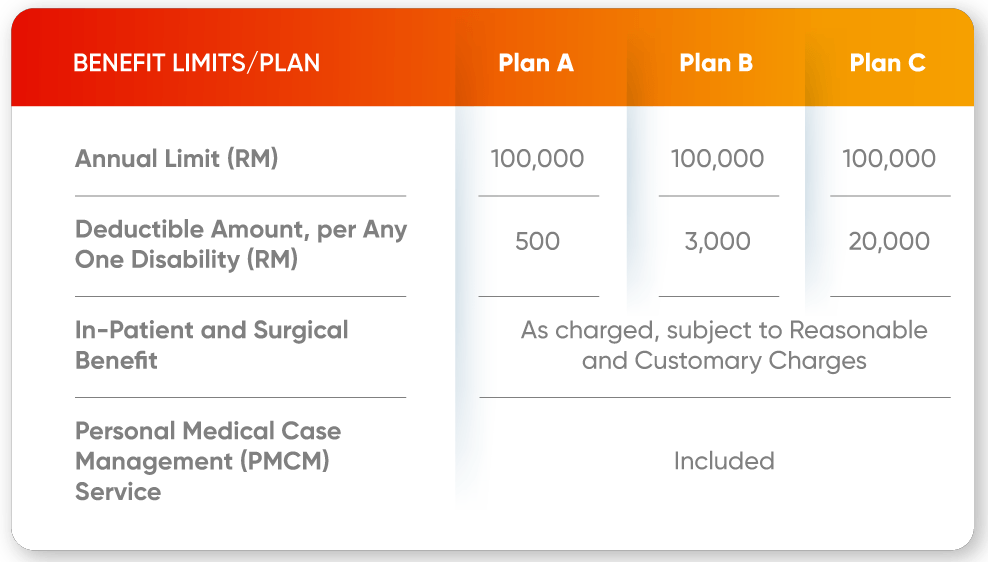

The medical insurance plan covers in-patients and surgical benefits with an annual limit of up to RM100,000. This includes necessary charges incurred for medical treatments and surgical procedures as an in-patient (including room & board).

So, whether it’s for a dengue infection or injuries from a car accident, you won’t need to worry about those hospital bills anymore if you need to get warded for emergencies.

There are three different plans with different premiums (the monthly fees) and deductibles (the amount you need to pay before the insurance kicks in) that you can choose from:

-

- Plan A: RM500 deductible

- Plan B: RM3,000 deductible

- Plan C: RM20,000 deductible

Not sure which plan you should take? Here’s what we recommend: Plan A, with a RM500 deductible, would be the best option if you do not have any existing medical plan and Plan B provides an affordable coverage plan for everyone.

For Plan C, it is ideal as a top-up for your existing medical plan or company employee benefit plan. You can maximise this plan by ensuring your existing plans cover the deductible amount and possibly some of your hospitalisation bill. On top of that, you can use the Insure360 Medical plan to cover the rest of your hospitalisation bill. This will help relieve your monthly premium paid with maximum coverage. The premium for these plans may also vary based on your age, gender and smoking habits.

? Critical illness – The extra coverage you need during those rainy days

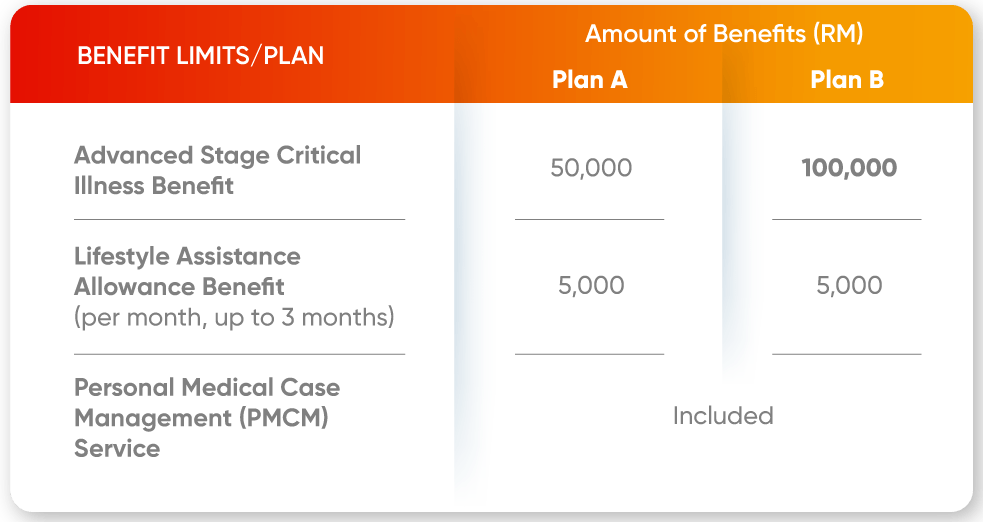

The critical illness insurance plans provide coverage for five main critical illnesses which are cancer, heart attack, stroke, kidney failure, and serious coronary artery disease. With this plan, you will receive a lump sum payout of up to RM100,000 if you get diagnosed with an advanced stage of the top 5 critical illnesses.

If your family has a known history of any of these illnesses, then we’d highly recommend this plan. It even includes a Lifestyle Assistance Allowance Benefit which provides a monthly cash allowance of up to RM5,000, for up to 3 consecutive months (RM15,000) for home nursing care, hospice care, palliative care, and home cleaning services so that you can seek treatment with peace of mind.

There are two different plans you can choose from which are:

-

- Plan A: RM50,000 sum insured

- Plan B: RM100,000 sum insured

Similar to the medical insurance plans, your premium may vary based on which plans you take as well as your age, gender and smoking habits.

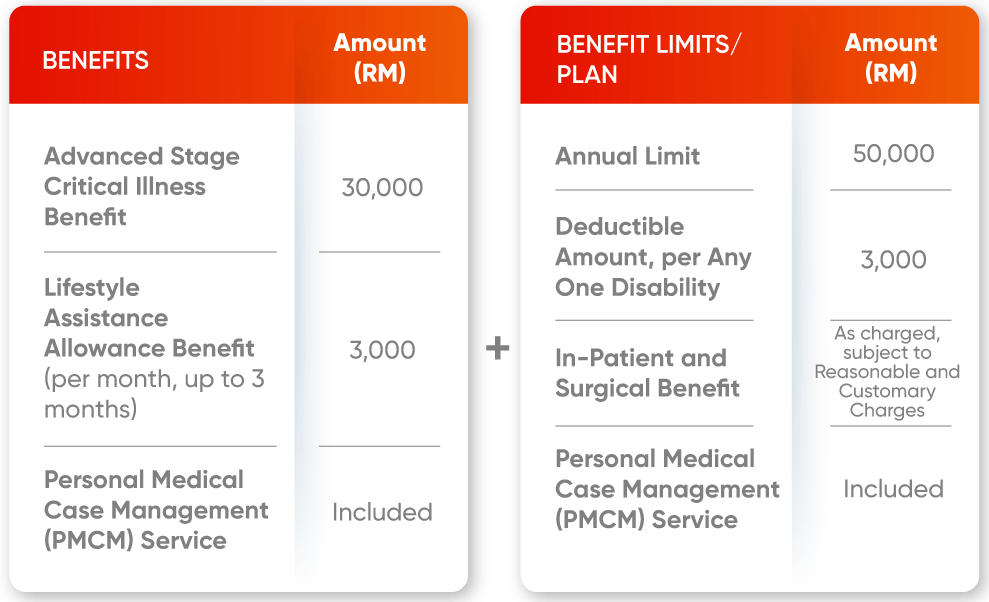

? 2-in-1 Bundle plan – Live worry-free knowing you’re protected at all times

The third plan is specially designed for first-time insurance buyers who want to ensure they are protected no matter the circumstances as it combines the best features of the Medical and Critical Illness plans which include:

-

- Covers in-patient treatment and surgical benefits with an annual limit of up to RM50,000

- Lump sum payout of RM30,000 upon diagnosis of an advanced-stage critical illness

- Up to RM9,000 in lifestyle assistance allowance for three months

There is only one plan available and the premium will depend on factors such as your age, gender and smoking habits.

One of the main concerns for patients is the many questions they have about their condition. It’s common to wonder “I can’t believe my diagnosis, should I try seeking a second opinion?” or “Is surgery really the right treatment for me or should I explore other options?”. But it can also be tricky to get the answers to these questions.

To combat this, Insure360 has the perfect solution as the plans also include a value-added ‘Personal Medical Case Management (PMCM)’ Service which gives you access to global medical experts who can offer a second opinion about your diagnosis and treatment options.

Additionally, we like how Insure360 is not only great for protecting your health, but can also act as a financial safety net that safeguards you from any unexpected emergencies. This way, it provides Malaysians with better access to healthcare, especially at a time when the costs of medical treatments are rising.

Apply through the app with no medical exams needed!

When we said the application is hassle-free, we meant it! Insure360 can be applied through the app and you don’t need to go through any medical check-ups beforehand. All you have to do is answer 3 health-related questions during the purchase process.

All in all, we can confirm the application process would take you not more than 5 minutes.

You’ll also be glad to know that the Insure360 plans are all underwritten by AIA General Bhd and you’re able to seek treatments from AIA panels! In fact, if you’re hospitalised at an AIA panel hospital, you can access additional benefits like cashless admissions (admission to a non-AIA panel hospital will require admission fees).

Imagine this: you’re in pain and have to be rushed to the hospital to get treated. Instead of having to go through a tedious admission process, you could simply provide your IC and get admitted without any fees! It’s literally a lifesaver~

Additionally, you’ll be able to claim income tax relief for insurance payments like this. So, if you’ve always viewed paying insurance as a ‘waste’, we hope this changes your point of view from now on!

Like everything you’ve read so far? Here’s how you can purchase your own Insure360 plan

To apply for Insure360, you need to be a verified TNG eWallet user. All you need to do is follow these steps:

- On the homepage of your TNG eWallet app, tap on the ‘GOprotect’ icon > tap on ‘Insure360’.

- Answer a few simple questions regarding your gender, marital status and smoking habits.

- Select between Medical, Critical Illness or the 2-in-1 Bundle plan. (Or you can also purchase medical and critical illness individual plans together!)

- Once you’ve selected your plan, select your preferred payment plan (either monthly or yearly basis) > tap ‘Next’.

- Share a little more about yourself by answering three simple questions.

- Review and confirm your details > tap ‘Continue’ > complete the payment and you’re done!

Yup, it’s that easy! But there’s more good news, Touch ‘n Go is giving WORLD OF BUZZ readers an exclusive promo code to purchase an Insure360 plan!

Just use the promo code <INSURE360A> upon checkout and the first 20 users will get RM20 cashback in their Touch ‘n Go eWallet!

If your application is a success, you will receive your e-certificate along with the detailed policies via email on the same day.

If you’d like to know more about Touch ‘n Go’s Insure360 plans or you’d like to apply for it, head over to their website here or better yet, download the TNG eWallet app from the Apple Store or Google Play. You can also follow them on Instagram and Facebook to find out all the latest news and offerings from them.