Previously, we shared how Malaysian entrepreneur and influencer Cik Epal claimed that her ex-husband, Jofliam, who owns a pizza business, has allegedly been evading taxes on his business, which allegedly makes up to RM600,000 a month in sales.

In a social media post, she urged the Inland Revenue Board (LHDN) to investigate her ex-husband on his alleged “100% cash” business and how he’s purportedly been paying his staff up to RM1,500 daily salary so that they’ll keep quiet.

With that in mind, if you ever find yourself with information about tax evasion or fraud, there are better ways to go about it than to make a viral post about it online.

In fact, did you know that LHDN actually has several methods for you to anonymously report tax-related offences, one of which is through an online portal?

Here’s everything you should know:

3 ways to report tax evasion and other fraudulent or criminal activities to LHDN

According to LHDN’s official website, the agency is committed to targeting tax evasion and the public can help it to make sure everyone pays their fair share of tax.

Accordingly, LHDN said that there are 3 ways for the public to lodge a report about tax evasion or any other fraudulent or possible criminal activity:

- Online: Through a dedicated platform aptly named e-Pelarian Cukai (translated to English as e-Tax Evasion)

- Walk-in: You can personally walk-in to LHDN State, Intelligence and Profiling Section at any of these locations

- Write to this address: Seksyen Aduan dan Sumber, Bahagian Perisikan Jabatan Perisikan Dan Profiling Lembaga Hasil Dalam Negeri Malaysia Level 3, Menara 2, No. 3, Jalan 9/10, Seksyen 9, 43650 Bandar Baru Bangi, Selangor

Besides that, LHDN clarified that it will require this information on the tax evader in the report:

- Name, IC number, full address

- Nature of evasion

- Supporting documents (if any)

- Other relevant information

The e-Pelarian Cukai online platform

For illustration purposes

Out of the 3 methods to report tax evasion, the most convenient way has got to be the e-Pelarian Cukai online system.

LHDN asserted that the system is a platform for the public to make complaints about tax evasion against individuals or companies that commit the offence of tax evasion. It’s also one of LHDN’s measures to encourage the involvement of the public in combating tax evasion through a more systematic and rapid distribution of information.

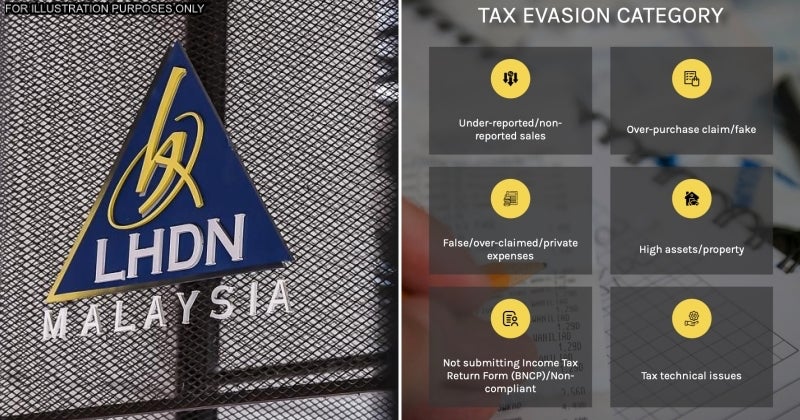

The online system can be accessed here and can be used to lodge tax evasion complaints in these categories:

In the system, you need to provide your details as the complainer (optional), the tax evader’s details, summary and finally confirm your report.

LHDN urges for information related to any tax evasion to be accurate, correct and clear. As for general information or information that is only based on observation of the ownership of valuable assets or a luxurious lifestyle, it’ll only be considered if there is an issue of tax evasion.

Moreover, LHDN iterated that the information received and your identity would be classified as confidential under Section 138 of the Income Tax Act 1967.

However, do note that LHDN will not notify you of any action status regarding the information that has been submitted and that the actions on information transmitted will be carried out in accordance with work procedures based on current legal provisions.

So, what do you guys think of the e-Pelarian Cukai online platform and other mediums used by LHDN for the public to channel information on tax evasion? Share your thoughts with us in the comments!

Also read: “RM600K sales monthly” – M’sian Tells LHDN to Probe Ex-Husband’s Cash-Only Wagyu Pizza Business