Buying a house is probably one of the biggest (and most expensive) milestones in every adult’s life. However, there have been a lot of misconceptions going around about buying property.

If you’ve been dreaming about owning your forever home but you feel intimidated about taking that first step, this list is for you! Read on to find out the truth behind these misconceptions about buying a home in Malaysia.

1. “If your mortgage loan is approved, it means you can truly afford it”

Just because your loan has been approved by the bank, does not mean you can truly afford it. A good rule of thumb to remember when calculating a loan is the monthly repayment should not exceed one-third of your monthly salary.

Sure, your loan might get approved for your dream (expensive) house. But if you have to stinge on other necessities just to afford your monthly mortgage, then it is not worth it!

2. “You should pay no less than 20% of the down payment for a house”

Malaysian law requires you to pay only 10% of the property price as the down payment. It’s true that paying a larger down payment will allow you to save more on monthly repayments but there is also no harm in paying 10% only. Remember, your budget should also cover the additional cost of buying a house such as stamp duty, legal fees, memorandum of transfer (MOT), mortgage insurance and so forth.

3. “Buying a house is an easy way to earn passive income”

Many Malaysians think that renting out their home is an easy way to earn passive income. In reality, a landlord has several responsibilities for the property, such as:

- Paying mandatory fees (eg: security and maintenance fees)

- Insuring the unit against fire and flood

- Repairing damaged appliances

Because of this, the landlord needs to be fully prepared to bear any unexpected costs as you will never know when an incident at the property could happen.

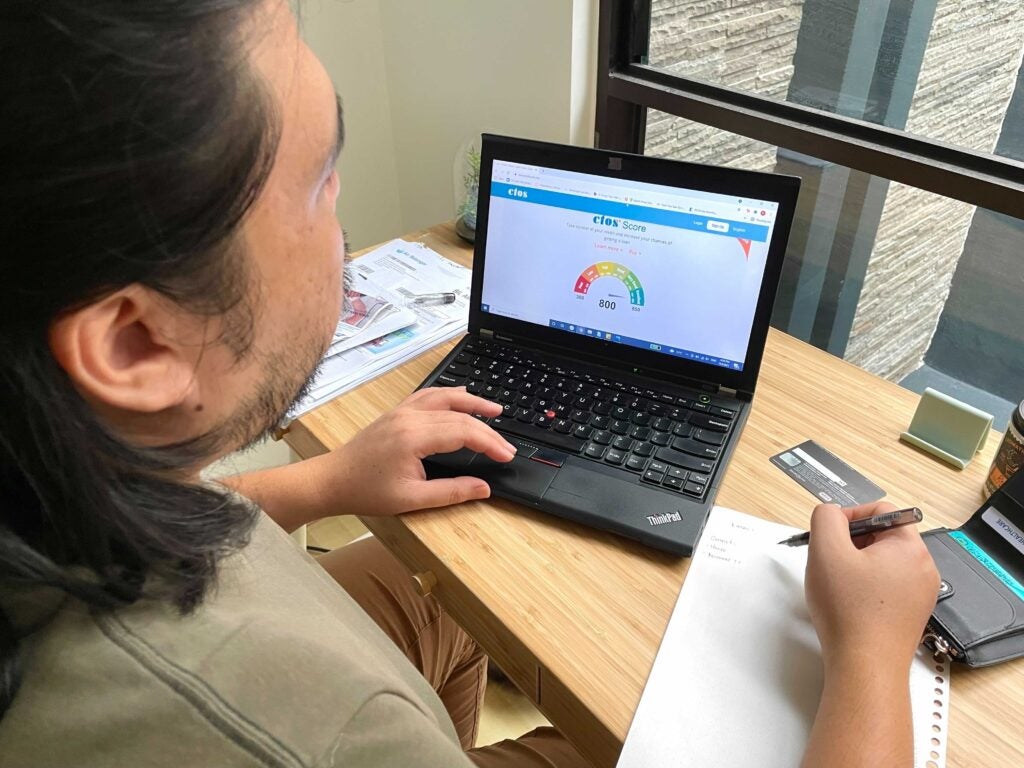

4. “You can only buy a house if you have a perfect credit score”

Having a good credit score can certainly improve the chances of getting loan approval. However, it is not necessary to have a maximum credit score of 850 in order to get your mortgage approved.

The reason you need a good credit score is for banks to see how trustworthy you are when it comes to paying off your loan. Most banks would consider a good credit score to be in the range of 697 and 850. The higher your credit score, the higher your chances of getting your loan approved.

5. “Buying a house is a huge investment so you should wait until you’re older”

Buying a house when you’re younger can be a good move as you will have more working years to pay off your mortgage, especially because the term for mortgage loans can go up to 35 years. If you buy a house when you’re older, your loan might get approved with a shorter term which equals a higher monthly repayment.

If you’re currently looking to buy your first home, there are several financial solutions that are available for first-time homebuyers in Malaysia, such as stamp duty exemptions, My First Home Scheme and many others.

Plus, did you know that you can also gain other perks from buying a house such as getting health coverage worth RM15,000*? Yup, it’s true!

With the GL Cares For You campaign, Malaysian homebuyers can enjoy health coverage when they buy any selected Gamuda Land property from now until 31 October 2023!

Gamuda Land‘s GL Cares For You campaign is in collaboration with Vsure (Malaysia’s first on-demand lifestyle digital insurance) and DOC2HOME (a subsidiary of DOC2US which is Malaysia’s first and largest e-prescriptions and digital health provider).

With the health and wellness coverage, homebuyers will be entitled to get services such as complimentary health screenings and 365-day digital health consultations where you can get basic health advice services through texts and video consultations from doctors, nutritionists and pharmacists. The health and wellness features can be accessed via the GL Lifestyle App (available on App Store and Google Play), making it convenient for all residents.

However, this benefit is limited to the first 300 buyers during the campaign period so you better hurry! As for existing Gamuda Land homeowners, you will also be able to enjoy a 20% discount if you would like to purchase the same coverage.

Not only that, if you live in Gamuda Land’s townships, you can also have access to essential healthcare knowledge through health and wellness events such as health talks, balanced diet talks, chiropractic demonstrations, first aid workshops and so forth.

But wait… the perks don’t stop there!

Did you know that Gamuda Land also provides numerous financial aids and incentives to ensure a hassle-free process for their homebuyers? Here’s what you can enjoy:

- RM500 to own: You can book your dream home from only RM500*.

- 10% discount and free MOT: Get a 10% discount* on selected properties and enjoy free memorandum of transfer (MOT) fees*.

- Cashback: Purchase your dream home and walk away with cashback worth up to RM20,000*!

- Free maintenance and legal fees: Enjoy free legal fees during the buying process and free maintenance fees for the first two years*.

- Refer and earn: Refer your friends and family to buy any Gamuda Land’s properties and you can earn rewards worth up to RM120,000*!

For more information on this campaign or if you want to find out more about Gamuda Land’s properties, you can visit their website here or follow them on Facebook and Instagram to get the latest news on their promotions and deals.

*Terms and conditions apply. For selected properties only.