It’s not that hard to maintain your savings. The key is to “possess” a high discipline and the ability to say no to your wants, as well as prioritising your needs. As of 2024, how much do you have in your savings?

A 21-year-old Malaysian student recently admitted that he has managed to save up RM500,000 and not only that but he has also bought a house. Given his age, that is an exceptional achievement and on his post in Dcard, he shared a lot about how he managed to be financially stable.

For illustration purposes only

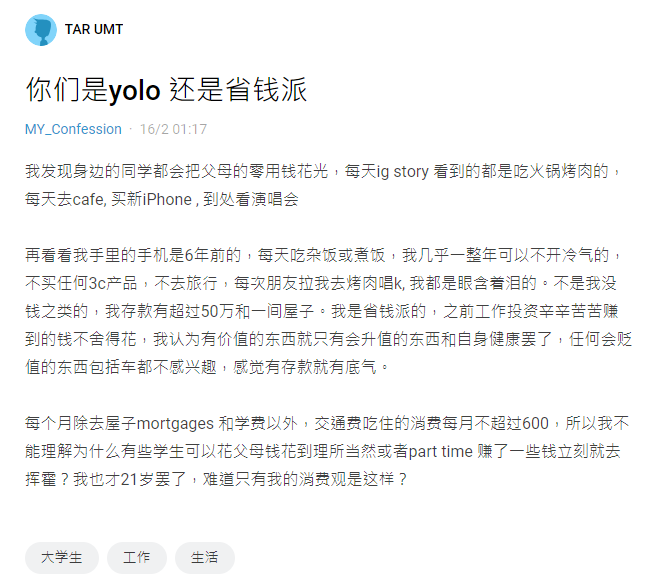

“Are you team YOLO, or are you team save money?”

Achieving a financially stable status takes a lot of discipline and hard work, including rejections. The student revealed that he is not as trendy as his peers, who are always out there enjoying the bits of life.

“On IG stories, I see a lot of them wasting their parents money by going to BBQ often, going to expensive cafes, using latest iPhones and going to concerts.”

For illustration purposes only

The student, however, is not on track with this lifestyle. He admitted to still using his 6-year-old phone and mostly preparing his meals or spending on mixed rice. Another key to his financial success is rejection. A LOT of them.

“I said no to BBQ and trips with my friends. It wasn’t easy for me. But I didn’t want to spend my hard-earned money that I got as a teenager.”

To him, he values health and savings. When it comes to spending on food, rental, and transport, the student said he doesn’t spend more than RM600 a month.

“I also spend for house mortgage and my education fees. That’s it.”

For illustration purposes only

He’s also baffled to see how his peers are happily spending their parents’ money and perceive it as something reasonable.

“Some of my friends also spend their earnings from part-time jobs immediately after they get their pay. Are you team YOLO (You Only Live Once), or are you team saving money?”

RM500,000 of savings for a 21-year-old sounds a little far-fetched, but do you think it’s possible if you can handle the outside temptations?

Also read: M’sian Gets Rejected After Telling Woman He’s a Hawker Because “Hawkers Have No Future”