In case you didn’t know, the Malaysian government has announced that they will be charging 6% tax for digital services such as software, music, video, and digital advertising starting January 1st, 2020. This is set to affect our favourite digital services such as Spotify, Steam and Netflix but Facebook has also announced that advertisers on the social media platform will also get taxed 6% as well.

Source: business of apps

However, this is only applicable for Facebook ads and affects advertisers whose “Sold To” country on their business or personal address is set to Malaysia. This 6% is part of the Sales and Service Tax and in line with the tabling of Budget 2020. Facebook has mentioned that you will still get taxed regardless of whether you’re purchasing Facebook ads for business or personal use.

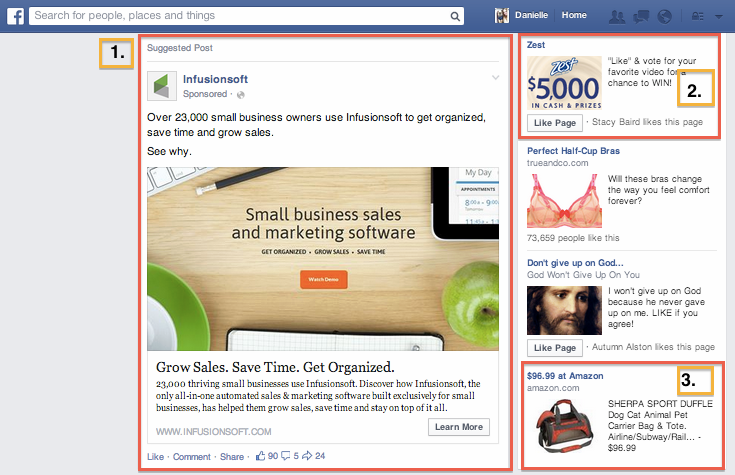

The 6% service tax is added when you need to pay for the ads and if you’re using a manual payment method, do note that the tax will be included whenever you fund your ad account. If you’re still feeling confused about how Facebook will be charging you for these ads, they have given a handy example to illustrate this.

Source: awsm digital

Here’s what they said:

You will be charged US$100 (RM414) when you reached your US$100 (RM414) billing threshold. This US$100 (RM414) is the subtotal as it is only the amount for the ad costs and you need to pay an additional 6% service tax which means the grand total will be US$106 (RM438) which is derived from US$100 + US$6 = US$106. Since service tax is added on top of the ad costs, you won’t reach your billing threshold faster, but you may be charged more than your billing threshold amount!

Get prepared to pay more next year, advertisers on Facebook!

Also read: 22 Things That Were Unveiled in The Latest Budget 2020