You know you’re officially an adult when you realise that it’s high time you file your taxes. Welcome to the world of adulting! In Malaysia, you can start filing your income tax starting March 1 every year. In 2010, the government introduced the super convenient ezHASIL e-Filing system for users to submit their income tax online.

The deadline to submit your Income Tax Return Form (ITRF) for Year of Assessment 2017 for taxpayers who do not own a business is on April 30. However, an additional two weeks extension (approximately 15 days) is given if you use e-Filing. Yay!

Do take note that you must declare your income if you earn an annual employment income of RM34,000 (after EPF deduction). According to the Income Tax Act (ITA) 1967, there will be a penalty imposed on people who are late and you might even be restricted from travelling if you shirk your taxes. So, be a good citizen okay?

But how do you start? Well, here’s a simple guide on how to register as a taxpayer and submit your taxes using the e-Filing system!

1. Register yourself as a taxpayer

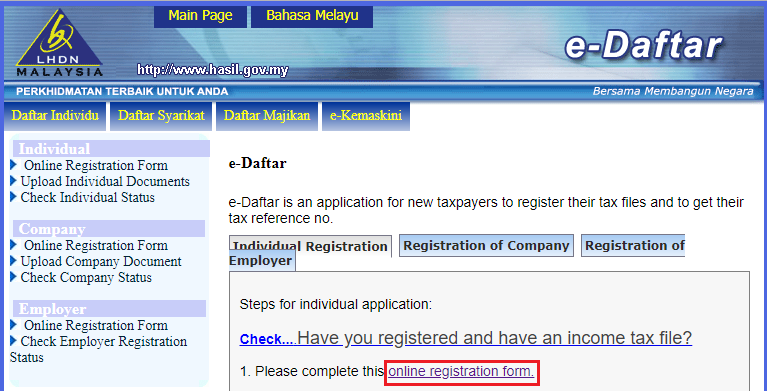

Source: e-daftar

Okay, you may not be in the system so you need to register! Just register as a taxpayer on the Inland Revenue Board’s (LHDN) website by clicking the ‘Online Registration Form’ link, which will lead you here. Make sure you key in all your information correctly before submitting.

As part of the registration process, you will need to upload a clear copy of your IC so that they can verify your identity. You will receive an application number for future reference and it’s best that you keep it in case you want to check your registration status here.

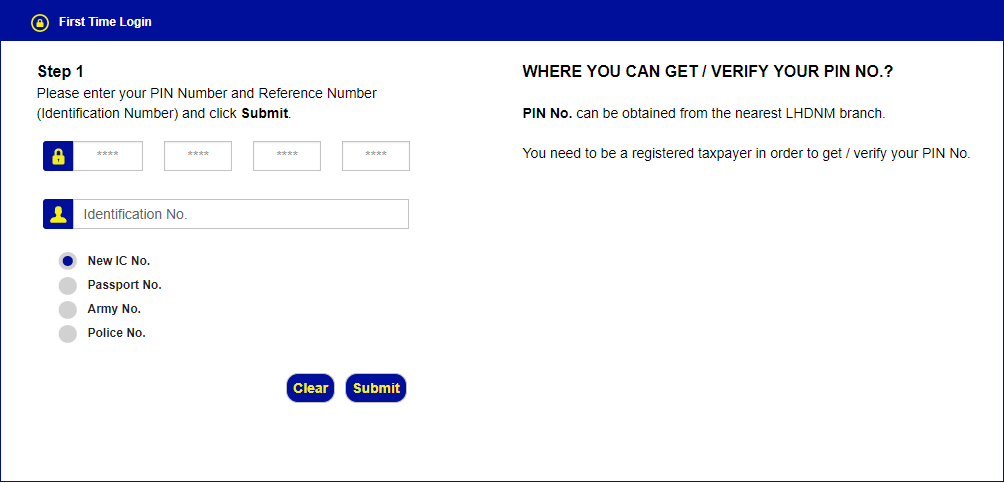

2. Register for e-Filing system

Source: lhdn

That’s not all you have to register though! The first step was just to establish yourself as a legit taxpayer in Malaysia. Here, you have to register for an account for the e-Filing system. Take note that you need a PIN when you login for the first time and this will have to be taken from your nearest LHDN branch.

Previously, you could get the PIN online but it looks like they have changed the rules and now you are required to go to their branches to get the PIN. Once you have it, login for the first time here.

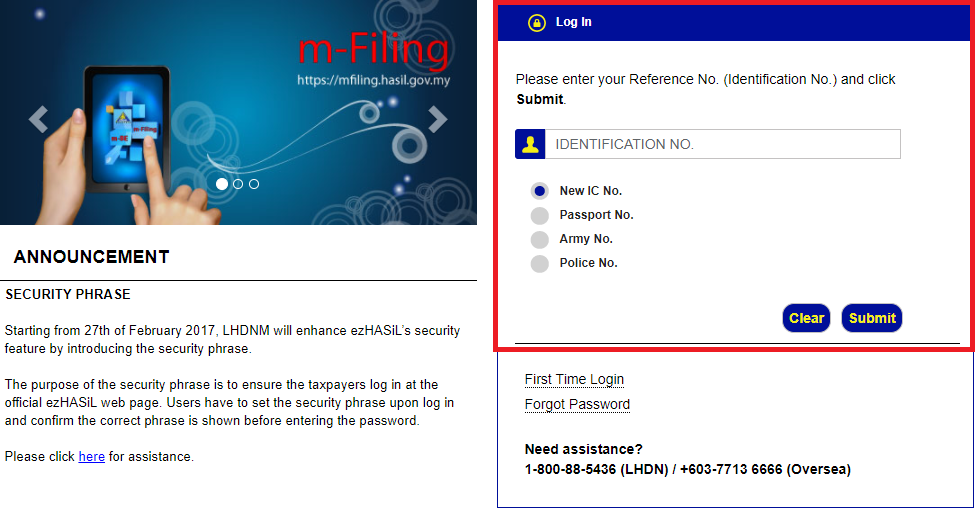

3. Login to the e-Filing website

Source: lhdn

Source: lhdn

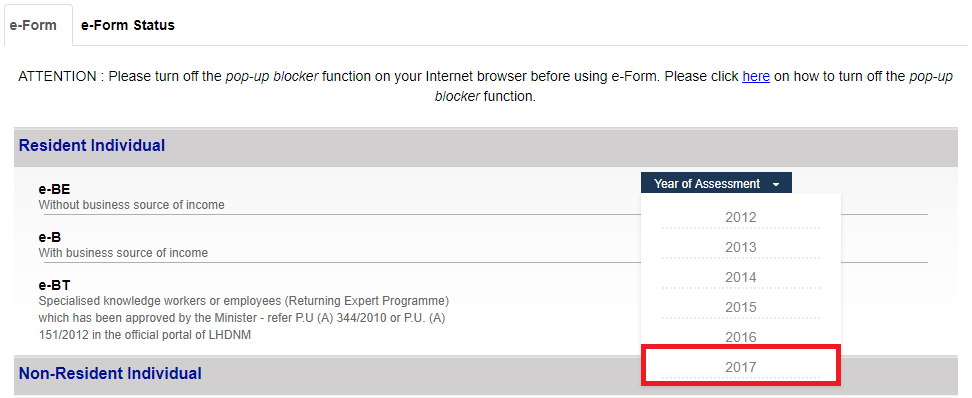

Now that you have registered as a taxpayer and gotten access to e-Filing, login and proceed to start filing your taxes. Don’t get confused by the options filling your screen. Keep calm and carry on! Under the e-Filing system, click on e-Form and choose e-BE for individuals without business source of income with assessment year 2017. Note: It’s important to allow pop ups once you clicked on the year!

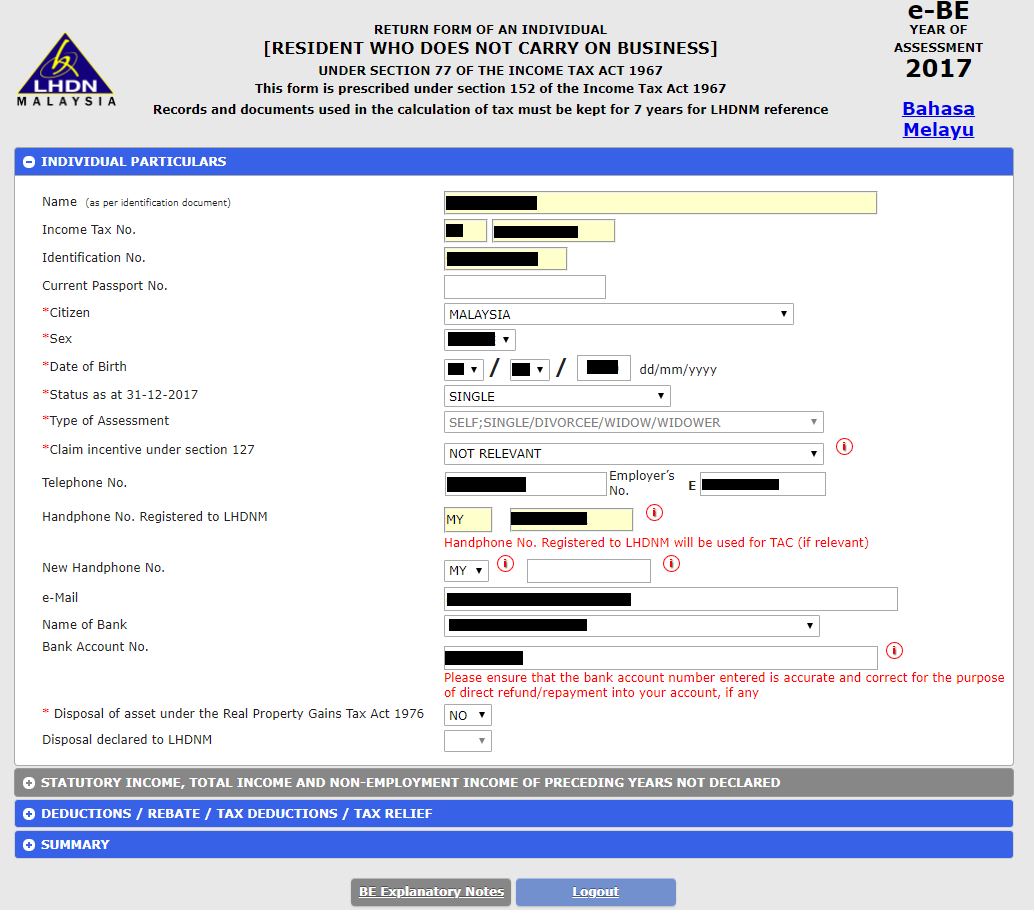

4. Check your details

Source: lhdn

Source: lhdn

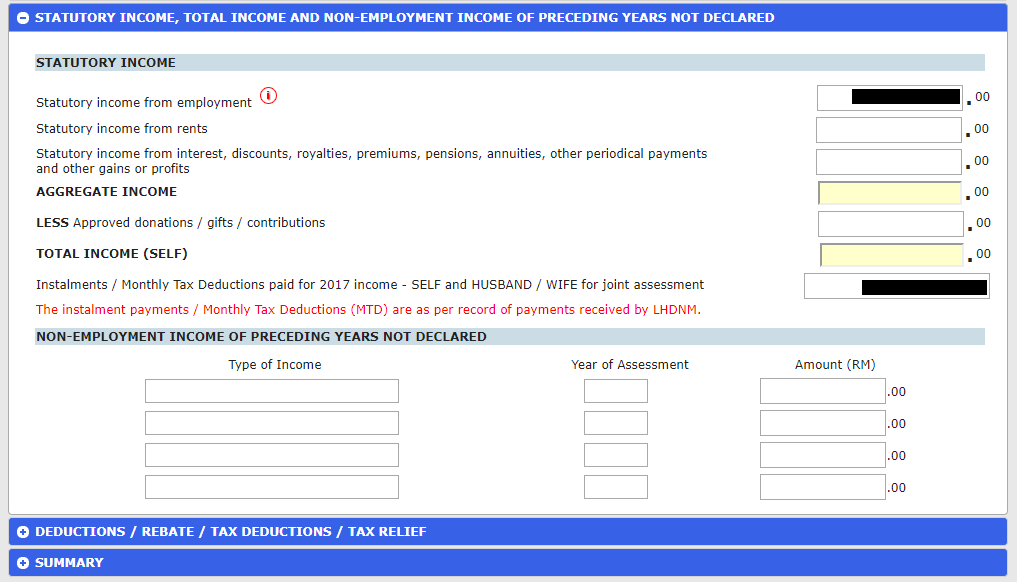

Your particulars will be automatically filled out in the columns and you have to ensure that it is correct. Fill in your bank account details for income tax returns so that the government can bank in the money to your account. Next, key in your income details in the relevant categories and remember to refer to your EA form for this part. Don’t worry, your company will give the EA form to you!

If you have been working the past few years but did not declare your income, then you should fill in the section called ‘Income Of Preceding Years Not Declared’.

5. Claim, claim, claim

Source: lhdn

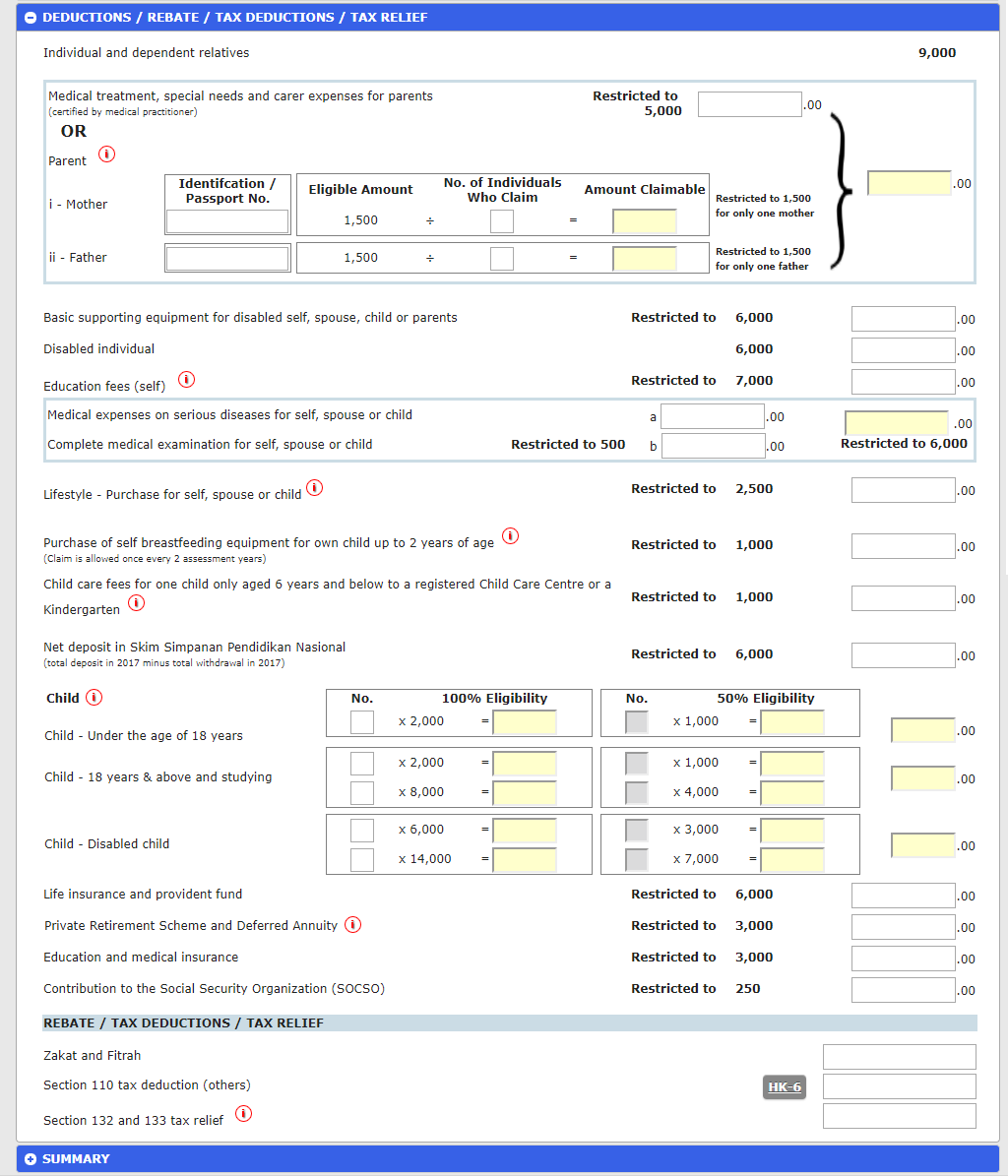

This is where you try your best to get some income tax refund! To reduce the amount of taxes you have to pay, you need to spend wisely and utilise your exemptions, reliefs and rebates. Things like medical and life insurance, buying books or even medical expenses for parents can be claimed.

Once you have keyed in the details, keep the proof of purchase neatly because you need the proof for seven years.

6. Check your total taxes

Source: lhdn

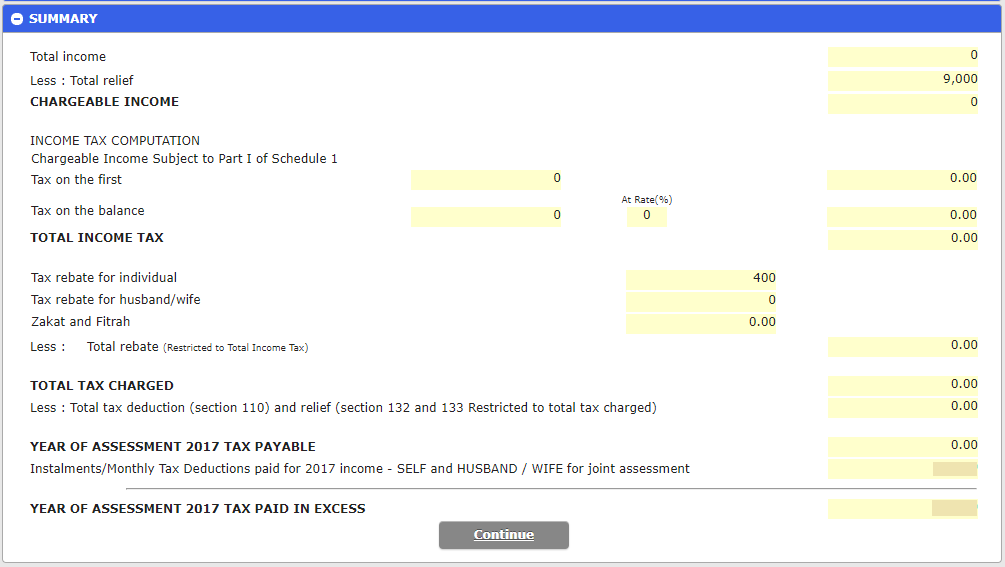

No, all this adulting hasn’t ended yet! After filling all your tax reliefs, the system will automatically help you calculate your taxes. Scroll to the ‘Summary’ section and it will indicate the amount of taxes you need to pay or whether there is any excess that will be refunded to your account. LHDN will refund the excess within 30 working days, so keep an eye out!

If you need to pay any taxes, you can pay it through various methods using e-banking, collection agents, ATM and credit card.

7. Signed, sealed and deliver

Source: imoney

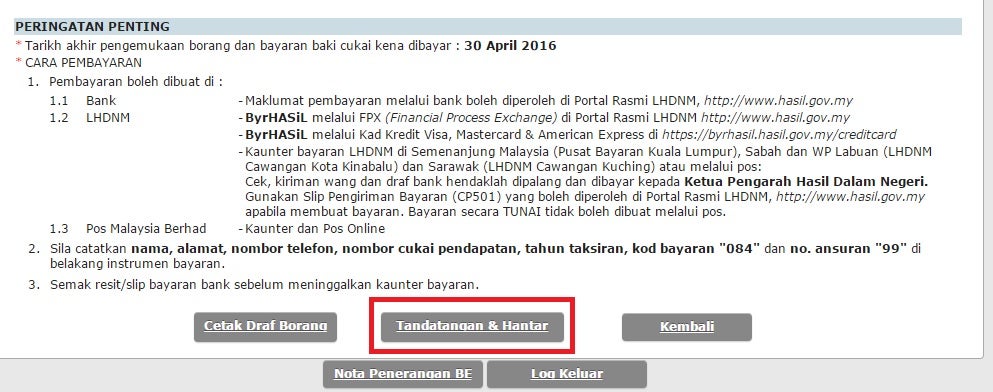

At last, you can click on sign and submit your taxes! The last step is to electronically sign your submission to declare that all your information is true and once you’ve done so, you’ve settled your taxes for the year. Phew!

Now that you know how to file and submit your income tax online, there’s no reason that you should shirk your duties as a responsible citizen. It isn’t that hard!

Also read: Malaysians Reminded to Be Cautious of This ‘LHDN’ Email Scam During Tax Season