Attention fellow business owners in Malaysia! Starting on 1st August 2024, the Inland Revenue Board (LHDNM) will launch a brand-new electronic invoice (e-Invoice) system. This initiative will require all businesses registered in Malaysia to generate e-invoices for all transactions.

In case you didn’t know, an e-Invoice is a digital record of transaction data for your daily business operations, replacing traditional paper invoices, credit notes, and debit notes. It applies to all commercial activities, including Business to Business (B2B), Business to Customer (B2C), and Business to Government (B2G).

Not sure how it works? Don’t worry! This article will guide you through everything you need to know to get started.

1. Mark your calendar for the implementation timeline

The introduction of e-Invoice has been carefully planned by LHDNM, taking into account the turnover and revenue thresholds, so that taxpayers have ample time to prepare and adjust to the new system. To ensure a smooth transition, the new system will be rolled out in phases:

- From 1st August 2024: Taxpayers with an annual turnover or revenue exceeding RM 100 million.

- From 1st January 2025: Taxpayers with an annual turnover or revenue from RM 25 million up to RM 100 million.

- From 1st July 2025: All taxpayers engaged in commercial transactions.

2. There are two transmission mechanisms

With two transmission mechanisms available, taxpayers can pick the most suitable way to report e-Invoices to LHDNM, depending on what best fits their business needs:

- MyInvois Portal (hosted by LHDNM)

This portal can be accessed by all businesses and is suitable for a small amount of data. Hence, it can be especially handy for Micro, Small, and Medium-sized Enterprises (MSMEs).

- Application Programming Interface (API)

An API is a set of programming codes that transfers data directly between your system and the MyInvois system. While it requires an initial investment in technology and adjustments to your existing setup, it’s perfect for larger businesses with high transaction volumes.

3. How it works: a step-by-step overview

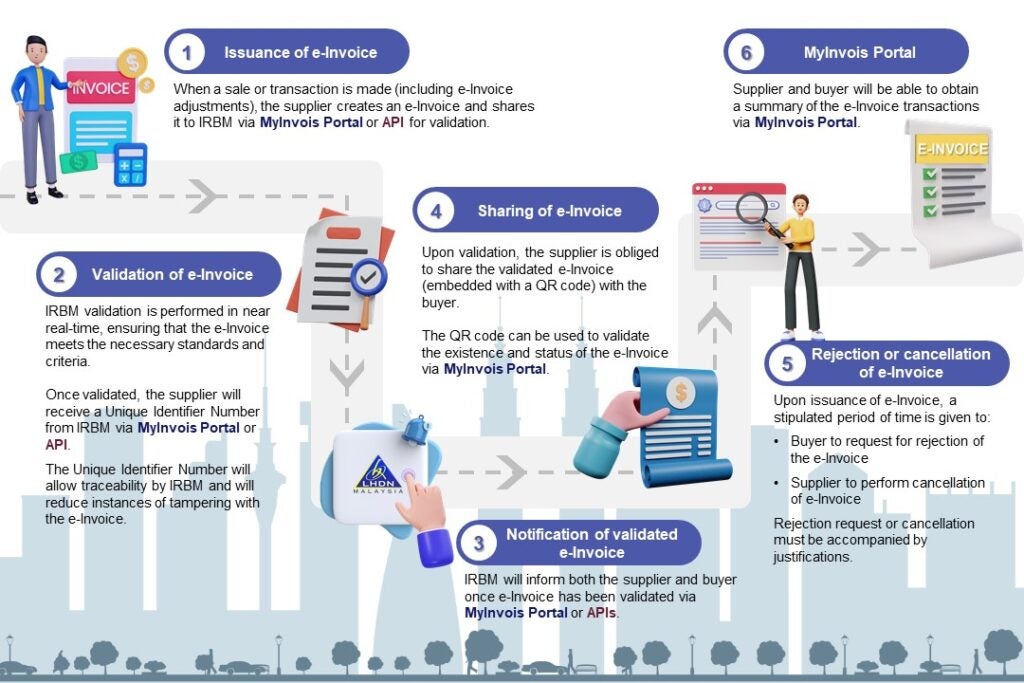

It’s perfectly normal for businesses to feel overwhelmed by the unfamiliarity of the new e-invoicing system. Hence, LHDNM has taken steps to simplify this transition by offering a step-by-step infographic that illustrates how e-invoicing works:

This visual guide is designed to demystify the process and show businesses just how straightforward and convenient e-invoicing can be once they get the hang of it!

4. The e-Invoice system benefits businesses

Switching to e-invoicing might seem like a hassle and unnecessary change for some business owners at first. The truth is that this digital system ensures a streamlined experience for taxpayers, boosts business efficiency, and enhances tax compliance, making it a win-win for everyone involved!

Here’s how e-Invoice contributes to overall business success:

- Reduces manual effort and human errors: Unifies and digitalises data entry and transaction processes, ensuring greater accuracy and efficiency.

- Facilitates efficient tax filing: Automatically records and organises transaction data, making tax reporting faster and more accurate.

- Streamlines operational efficiency: Enhances business operations, resulting in significant time and cost savings.

- Digitalises tax and financial reporting: Transforms tax and financial reporting into a seamless digital process, aligning with industry standards.

Ready to ditch the tedious paperwork and embrace the future of invoicing? With e-Invoice, you’re not just streamlining business operations and boosting efficiency—you’re also saving time and cost! So, why wait? Join the digital revolution today and discover just how easy e-invoicing can be!

While you’re at it, don’t hesitate to send your enquiries or feedback on the new system by emailing ym.vog.lisah@siovniym or by filling up this feedback form. For more information about e-Invoice, visit LHDNM’s official website. Don’t forget to follow them on these social media platforms for the latest updates: