Anyone applying for a personal loan of more than RM100,000 will be required to attend and complete a financial education module.

This is according to Bank Negara Malaysia’s (BNM) latest Policy Document on Personal Financing, which applies to all licensed banks, Islamic banks, and designated development financial institutions.

Personal financing for housing loans is capped at 10 years

In its newly released policy, BNM said the move is meant to promote more careful and responsible lending practices among financial institutions, while also encouraging borrowers to take on debt more wisely.

The policy also sets out clearer rules for financial service providers, including BNM’s expectation that personal financing should come with a maximum tenure of 10 years for housing-related loans or those secured by property without encumbrances.

In addition, the document bans personal financing products that use flat interest rates or the Rule of 78, which are seen as unfair to consumers.

For illustration purposes only

Over 15,000 Malaysians went bankrupt due to personal loans

As we’ve reported previously, the Malaysia Department of Insolvency (MdI) revealed some eye-opening numbers on bankruptcy. Since the department was first set up, it has handled a total of 133,884 cases, with 31,387 of them recorded between January 2020 and December 2024 alone.

Looking at the overall stats, Selangor tops the list with 23,352 cases, followed by Johor (18,371) and the Federal Territories (18,191). Completing the top five are Penang (15,607) and Perak (9,500).

For the past five years (2020–2024), the states with the highest number of new bankruptcy cases are:

- Selangor – 7,581 cases

- Federal Territories – 3,954 cases

- Johor – 2,623 cases

- Kedah – 1,930 cases

- Penang – 1,723 cases

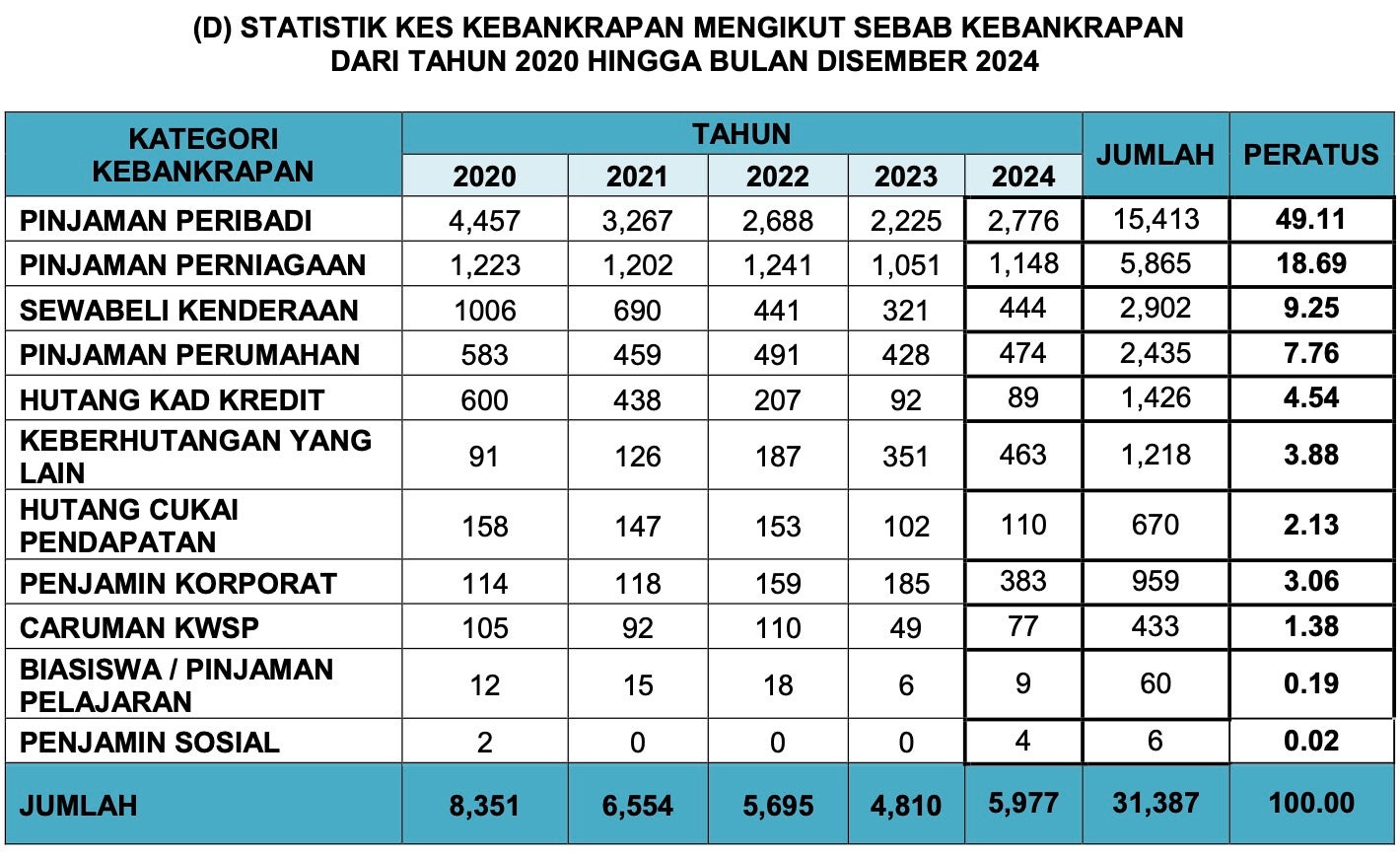

As for the reason behind these individuals going bankrupt, almost half of the cases since 2020, specifically 49.11% or 15,413 cases, were due to personal loans. The second highest is business loans, with 5,865 cases (18.69%), while the third highest is because of vehicle purchase agreements, with 2,902 cases (9.25%).

The full breakdown of the reasons behind insolvency cases from 2020 to 2024 can be viewed below:

What are your thoughts on this? Let us know down in the comments!