As you enter the world of adulthood, achieving financial stability is part and parcel of growing up. Learning the ropes of ‘adulting’ is a slow but sure process especially when it comes to dealing with money. The broke life struggles are real dey Y_Y

We, here at WORLD OF BUZZ, understand these struggles well enough. Got personal experience kut. We’ve come up with a checklist for all you Malaysians to really know if you’ve finally escaped the broke life. See how many of these you can check off!

1. You’re healthily moving towards a ‘debt-free’ status!

In short, keeping track of your debts – regardless of what they are – and making an active effort to achieving that ‘debt-free’ status should be your number one priority. Debt makes you a slave to your finances and restricts much of your freedom. Not to mention that some debts have an increasing interest the longer you put off paying them back. Which would only end in a larger debt the more it accumulates. Never settle PTPTN how to travel and apply for loans?!

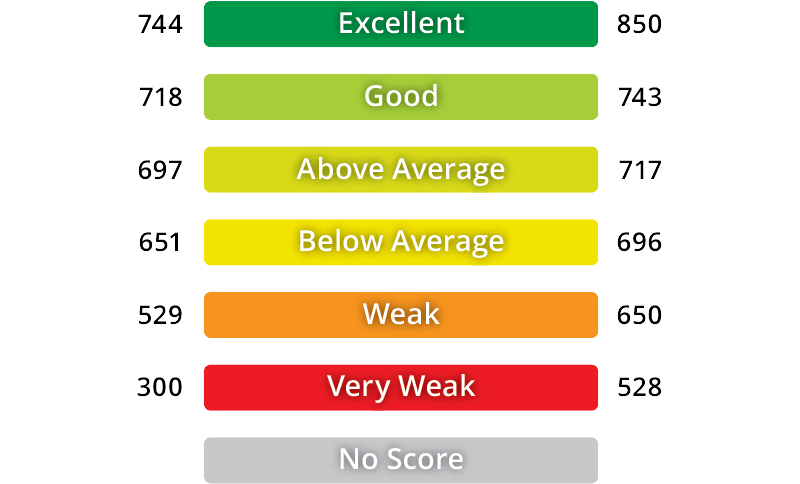

2. Your credit score is rated as ‘good’ or ‘excellent’

Source: ctos credit

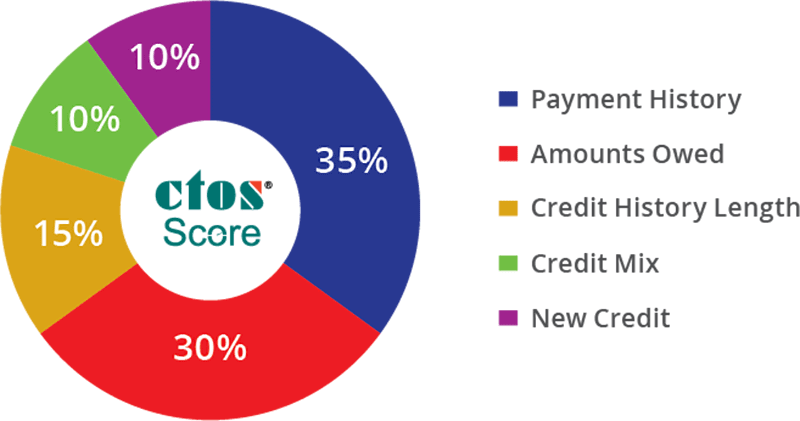

A credit score is a three-digit summary of your debt repayments and existing debts or loans. It’s a simple and reliable way to keep track of your credit history and know if banks and other financial institutions will approve your loan or card applications. A credit score is calculated based on five factors:

Source: ctos credit

The higher your credit score, the better your chances of approval. You can check out your credit score here.

3. You actually HAVE savings in your savings account

Admit it, most of the time when your pay cheque comes in you’re probably thinking ‘I deserve to splurge a bit’ or ‘spend a bit only mah won’t be so bad!’. And then you check your account balance and all you see is cobwebs and spiders.

Source: pinterest

When saving money becomes more habitual than spending money, you know you’ve escaped your broke life struggles. You make an active and disciplined effort to put aside a certain amount every month. One rule of thumb is “70% save, 30% spend”.

Of course, saving money doesn’t mean you have to put away large chunks of your pay cheque though. Start small and slowly work your way up to saving larger amounts when you’ve got the hang of it. Better yet, set up an automatic payment into your savings account. It’s convenient and there’s no risk of spending the money because you technically won’t see it.

4. You use the power of credit cards wisely

Diving into the world of credit cards can be a scary thing, especially for the younger generation. It was one of those things that were ‘only for the adults’. Even as the young make their descent ascent into adulthood, the thought of having a credit card meant you were bestowed a great amount of responsibility. Quite literally! Credit card horror stories don’t make it any better.

Instead of spending it on unlimited shopping sprees, you know the REAL use of a credit card: It’s convenient, great in times of emergency and users can reap many benefits and rewards. Just make sure you’re able to pay them off (in full!) every month and use it according to your own budget capabilities.

5. The word ‘bills’ won’t make you hyperventilate

You’re always on top of your bills and monthly commitments without having to stress-plan your finances just to be able to pay them off. For some, you’re even able to pay off your bills in advance!

6. You take over paying your Takaful contributions

For most Malaysians, your parents were the ones who set up your Takaful for you and payed for the contributions. Now that you’re older, you’re able to take over the payments from them. Better yet, you meet with your Takaful consultant to decide on the best plans according to your monthly budget and needs. Some plans will even give you full coverage and major savings, just like this one. Two-in-one doh!

Fun fact: Takaful consultants are also great financial advisors so you’re actually getting more than your money’s worth when you deal with them for your Takaful plan!

7. You don’t ‘gabra’ when there’s an emergency

To be fair, emergencies are a plausible cause for anyone to panic. Your car broke down? Need to spend extra on medical fees? Not a problem! Having to spend money in order to fix and overcome these emergencies don’t faze you anymore.

If you’ve gone down the list and have checked off on almost all of these things, then congratulations! You’re finally free from the broke life! Achieving financial stability is an important milestone that is definitely a #KitaOK moment in life. Have you encountered any other OK moments in life so far? Why not share your #KitaOK story and stand a chance to win some prizes too!

PruBSN Takaful is giving away some amazing prizes to all PruBSN Anugerah customers with their #KitaOK Hashtag Contest! All you have to do is share your #KitaOK moments with them!

Simply:

- Snap your selfie or wefie on your personal Facebook and/or Instagram

- Include #KitaOK and #PruBSN in your photo caption

- Email a screenshot the URL of your posting and your PruBSN Anugerah certificate number to kitaok@prubsn.com.my

And that’s it! Not yet a PruBSN Anugerah customer? Wait for what some more? Hurry and sign up now! Not only will you be signing up for a great Takaful plan, you’ll also be well on your way to secure your status of being ‘financially secure’ AND stand a chance to win great prizes like:

- a trip for two to Perth Australia

- a 64GB iPhone X

- myDNA kits

We are definitely OK with winning those prizes! Hurry and submit your entries from now until the 30th of April. Visit the PruBSN Facebook page for more info.

![[Test] The Ultimate Checklist For Malaysians To Know If They’ve Escaped The Broke Life - World Of Buzz](https://worldofbuzz.com/wp-content/uploads/2018/01/test-the-ultimate-checklist-for-malaysians-to-know-if-theyve-escaped-the-broke-life-world-of-buzz-722x1024.jpg)