It’s common knowledge that Singapore used to be a part of Malaysia before officially seceding on 9 August 1965. After leaving Malaysia, the country introduced the Singapore Dollar (SGD), and now, it’s one of the strongest currencies in Asia and consistently outperforms the Malaysian Ringgit (RM).

In recent history, RM’s best performance against SGD was in 2013 when SGD1 was worth RM2.38. It went all downhill afterwards, with SGD notably tripling RM’s value in 2015 and remaining above RM3 since.

Malaysian ringgit and the singapore dollar | source: cna

However, did you know that both currencies used to have the exact same value? In fact, prior to 1973, Malaysia and Singapore used to have an agreement whereby:

- RM1 will always be the same amount as SGD1.

- You don’t need to exchange currency for RM to be used in Singapore and vice versa.

Furthermore, Singapore and Brunei are still using the same agreement to this day, hence why 1 Brunei Dollar (BND) is equivalent to SGD1 and Bruneians can use their Brunei Dollar to purchase items in Singapore without converting!

We are, of course, talking about the Currency Interchangeability Agreement (CIA) 1967, which would still be in place if Malaysia hadn’t pulled out in 1973.

Here’s everything you need to know:

1. Currency Interchangeability Agreement (CIA) 1967

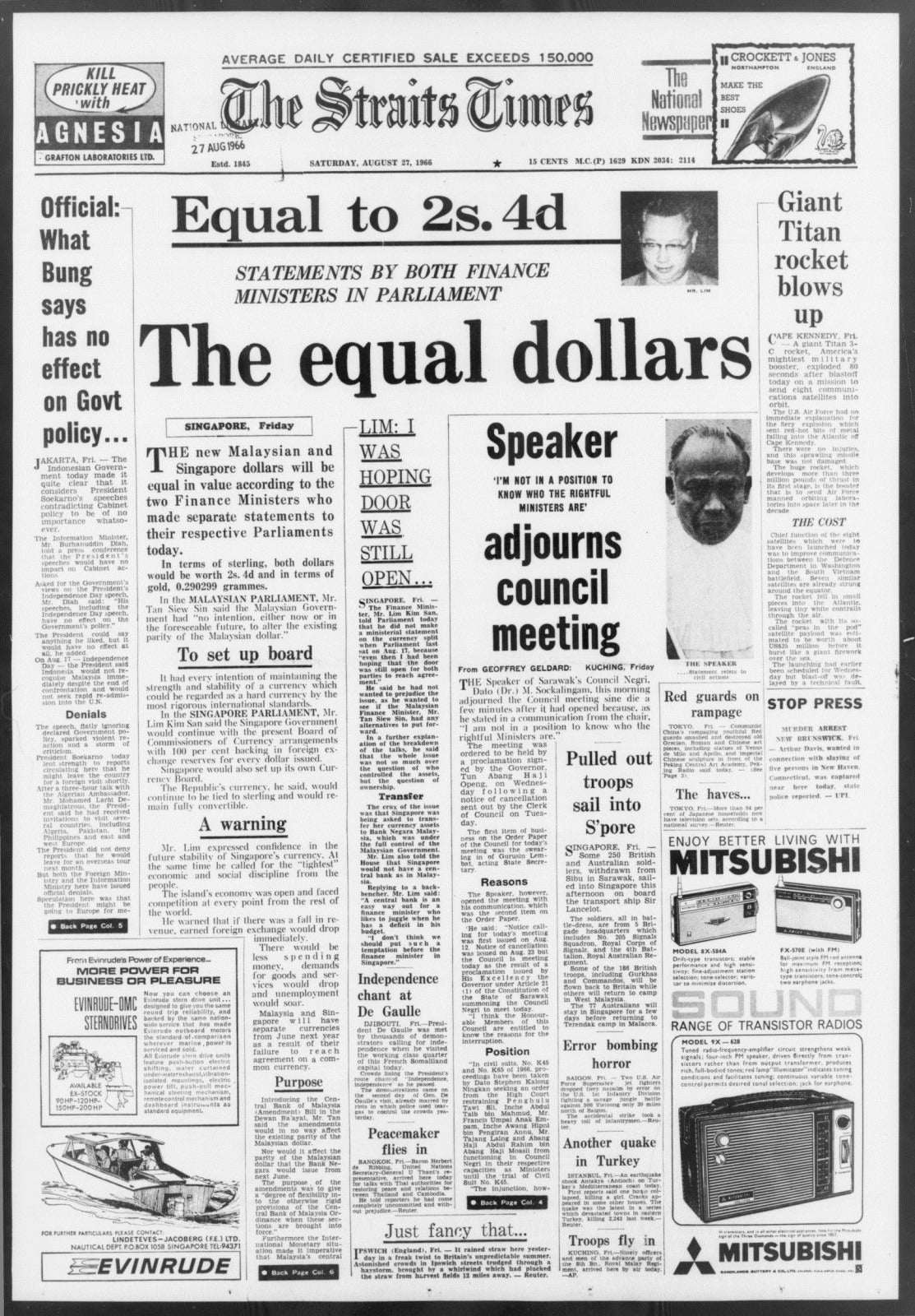

A 1966 straits times headline prior to the agreement | source: straits times

According to the Monetary Authority of Singapore (MAS), the agreement was made on 12 June 1967 between these three countries, which, after their respective independence, issued their own currencies:

- Malaysia with the Malaysian Dollar

- Singapore with the Singapore Dollar

- Brunei with the Brunei Dollar

Previously, Singapore and Malaysia used the same currency, which was the Malaya Dollar (as Singapore was still part of Malaysia), and Brunei used the British Borneo Dollar.

When the change happened, all three countries signed the Interchangeability Agreement, which would be in all three nations’ best interest. The CIA 1967 dictates that:

- All must accept each other’s currencies.

- All must exchange them at par, without charge, into their own currency.

In technical terms, the three currencies would not be legal tender when circulating in the other participating countries, but they would be “customary tender” and would be repatriated to the issuing country periodically.

Malayan and singaporean leaders in november 1963 | source: straits times

This agreement has its roots in the historical Straits Dollarisation to Malayan Currency Area from 1897 to 1967 and the establishment of the Board of Commissioners of Currency for the Straits Settlements (comprising Singapore, Penang and Malacca) in 1897.

The agreement still remains to this day between Singapore and Brunei despite significant changes in economic policies between the two.

Singapore and brunei celebrated the 50th anniversary of the agreement in 2017 | source: straits times

2. Why did Malaysia pull out of the agreement?

All was fine and dandy between the countries in regard to the agreement until the 1970s. As mentioned by MAS, several tumultuous events shook the global economy and the international monetary system during that decade.

In August 1971, US President Nixon closed the gold window and devalued the US dollar against gold. This had a significant effect on the Malaysian monetary system and others, whereby all currencies automatically revaluated against the US dollar.

The situation became more complex in 1973 and post-Vietnam War, when the Bretton Woods system of fixed exchange rates broke down. All the major currencies then decided to float against the US Dollar.

While these events were happening overseas, the Malaysian Government decided it was best to focus on domestic development, especially with the implementation of the New Economic Policy (NEP) in 1971. Hence, having two ‘inferior’ countries as Singapore and Brunei, as they arguably were at the time, pegging your currency’s value just doesn’t bode well with our nation’s leaders at the time.

Due to these external circumstances, and the focus of the Malaysian government back then was to focus on domestic development imperatives, Malaysia terminated its agreement with Singapore on 8 May 1973.

Two weeks later, the interchangeability agreement between Brunei and Malaysia was also cancelled. And the rest, as they say, is history.

Singapore leaders pushing for its own currency in 1967 | source: straits times

Some 51 years later, Malaysia, Singapore and Brunei have gone their own paths economically and also currency-wise.

Of course, we all know that Singapore has been doing a bit better than us, hence why Singaporeans have been cheekily pointing at the currency conversion chart whenever they find themselves in lighthearted feuds with Malaysians.

Well, as the old saying goes, “Sesal dahulu pendapatan, sesal kemudian Singapore Dollar lagi tinggi nilainya.”

Also read: The 1st Agong’s Image on Malaysian Ringgit Notes Carries Greater Significance Than Many May Know