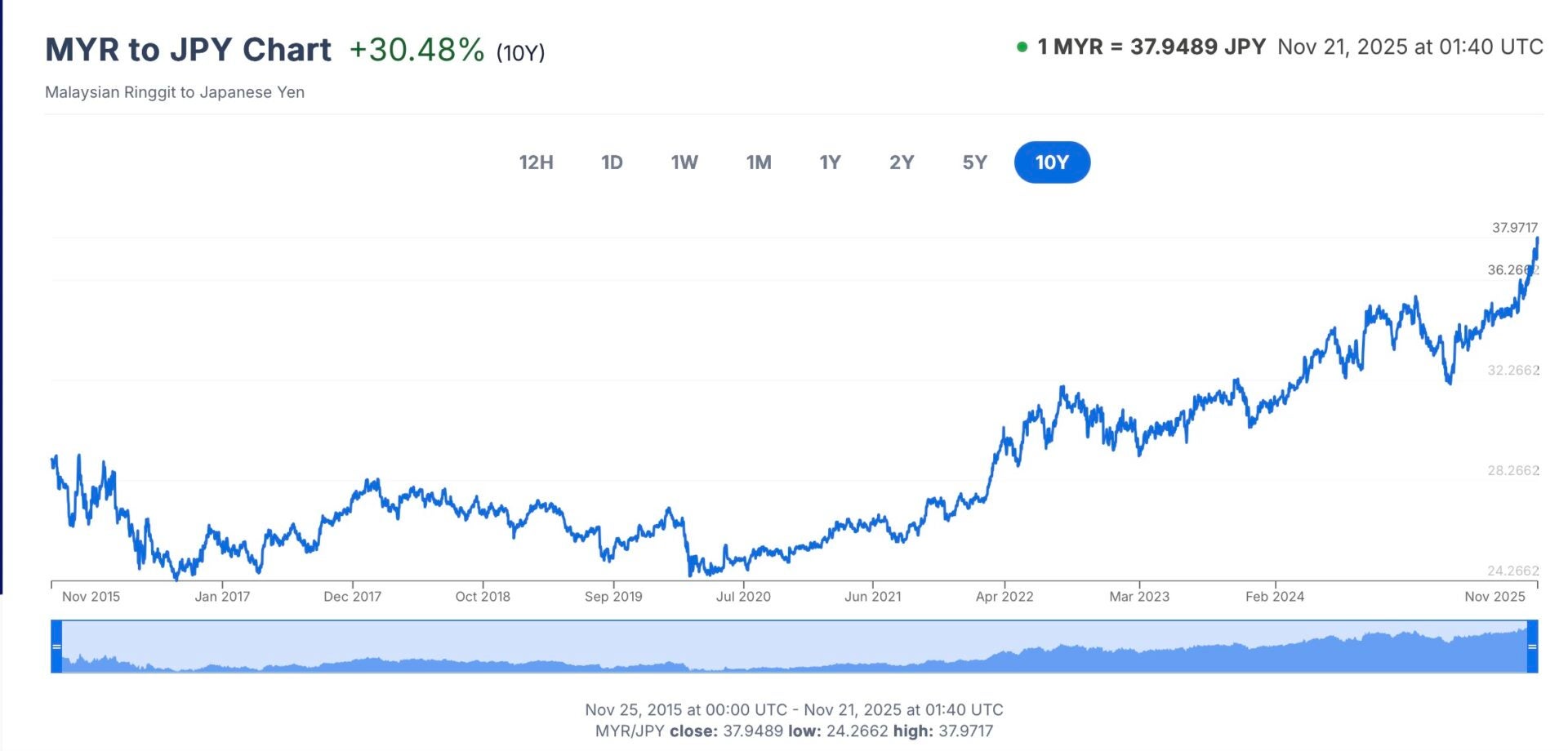

The Japanese Yen (JPY) has recorded its worst performance in recent history against the Malaysian Ringgit (RM), with RM1 equalling JPY37.94 as of today (21 November).

According to historical exchange rate data for the past 10 years obtained through XE.com today, JPY has plummeted against RM just a few months after 21 April 2025, when RM1 equalled JPY32.11.

JPY falls amid the new Japanese Government’s plan to introduce a stimulus package backed by low interest rates

JPY has also fallen to a 10-month low against the United States Dollar (USD), with Reuters reporting that the currency’s fall is associated with market expectations that the new Japanese Government under Prime Minister Sane Takichi will deliver a huge spending package backed by low interest rates.

The stimulus package is expected to exceed JPY20 trillion and be funded by an extra budget of around JPY17 trillion.

For illustration purposes

Furthermore, JPY further fell after the country’s Finance Minister Satsuki Katayama announced that the Japanese Government was closely monitoring markets “with a high sense of urgency” after ministers met Bank of Japan Governor Kazuo Ueda on Wednesday (19 November).

The perfect time for Malaysians to visit Japan?

In contrast, the RM has been on the rise recently, with Prime Minister Datuk Seri Anwar Ibrahim dubbing it “the best-performing currency in Asia”.

Anwar added that S&P Global Ratings and Moody’s have kept the country’s credit ratings at A- and A3, signalling a stable and strong outlook.

For illustration purposes

With RM hitting its best performance against JPY in 10 years, Japan is expected to see an increase in Malaysian tourists. More so, when you consider that last year, the Land of the Rising Sun welcomed the highest number of tourists from Malaysia at 506,800.

As per the latest data, Japan welcomed 406,973 Malaysian tourists as of September 2025; hence, the country is on track to break the record for most tourists from Malaysia this year.

However, do note that the JPY may strengthen soon as the Japanese Government is considering currency intervention to deal with excessively volatile and speculative moves in the currency market.

For illustration purposes

Bloomberg quoted Sastuki Katayama as saying that the Japanese Government is alarmed by “recent one-sided and sharp moves in the currency market” and that currency intervention is a possible response.

For those planning to travel to Japan in the near future, you may have to pay more in international tourist tax as the Japanese Government is mulling tripling the charge in fiscal 2026.

For illustration purposes

AND please, don’t behave like these Malaysian tourists while you’re in the East Asian country.