Congratulations! Now that you’ve gotten your SPM results, it’s time to think about the next step that you might take. Often times though that next step can cost quite a lot of money.

That’s why study loans are important. To make it convenient, we’ve gone ahead and put together a list of different study loans that you could potentially apply for.

1. Perbadanan Tabung Pendidikan Tinggi Nasional (PTPTN) Loan

What is it?

PTPTN was created specifically for the purpose of offering educational loans to students studying in Higher Education Institutions and it proves to be the favourite choice for a lot of students.

Source: ptptn.gov.my

Benefits

- Covers a lot of different courses.

- Can be converted into a scholarship if you achieve first-class honours.

- Different discount rates for settling your loan.

Terms

- Malaysian citizen.

- Under 45 years of age.

- Already got offered a place at an Institution of higher learning.

- Your course of choice is approved and accredited. You can check here.

- No other sponsors.

- The remaining study duration you have is not less than one year.

How to apply

- Open a SSPN-i account – Can be done at PTPTN offices or banks (Maybank, Bank Islam, BSN, CIMB Bank, Agrobank, Bank Rakyat)

- Open a savings account at a panel bank

- Purchase PTPTN number from Bank Simpanan Nasional (BSN) – valid for 6 months and priced at RM5.

- Apply online and carefully complete the application on PTPTN’s website here.

Pro Tip: If you apply for the SSPN-i account at Maybank or Bank Rakyat, you can apply for your PTPTN on the same day.

Terms to pay back

- Need to start making payments on the 7th month after you graduate.

- Time given to make the repayment depends on the amount that was borrowed.

- More info on repayment here

If you want to delve further, check the site.

2. Yayasan Bank Rakyat’s Pinajaman Pendidikan Boleh Ubah (PPBU) Loan

What is it?

A loan scheme set up by Yayasan Bank Rakyat (YBR) to aid the social and economic development of Malaysians by enabling bright but needy students to receive undergraduate education.

Source: Yayasan Bank Rakyat

Benefits

- Open to all fields of study but with priority given to certain fields.

- No additional interest or conditions for repayment.

Terms

- Malaysian citizen.

- Must have a savings account with Bank Rakyat with a minimum of RM100 account balance before applying.

- Those applying for Skills Certificate, Diploma, Vocational Diploma, Bachelor or Professional Degree must be over the age of 18 years old and not more than 30 years old upon graduation.

- Qualified to study full-time at local Public or Private Higher Education Institutions and Training Institute recognized by the Government of Malaysia.

- Only fields of studies which are recognised by the Public Services Department (JPA) / Malaysian Qualifications Agency (MQA) / Malaysian Vocational Training Council (NVTC) / Government Agencies (Malaysia) concerned and acknowledged by the Board of Trustees of YBR.

How to apply

- Register for an account on the site before applying for the PPBU loan.

- After completing the PPBU e-form, keep a printed copy for your reference.

- After the closing date, you will need to take a general knowledge quiz.

- Check the site to see if you’re successful and wait for the offer letter.

Terms to pay back

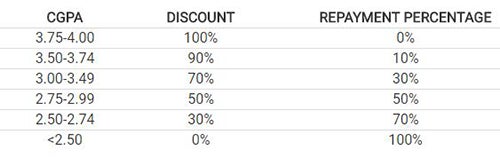

- Your repayment and incentive rate will depend on your result.

Source: Yayasan Bank Rakyat

For additional info on this loan, check here.

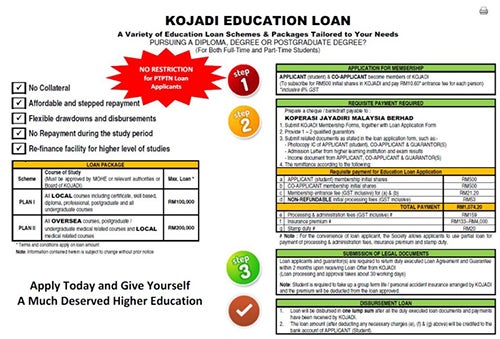

3. Koperasi Jayadiri (KOJADI) Education Loan

What is it?

Established in 1981, KOJADI’s main purpose is to provide an effective education loan to needy students. Currently, they offer 13 different options under their educational loan scheme which covers a wide range of fields.

Source: Kojadi.my

Benefits

- Covers both part-time and full-time students.

- Covers local and overseas courses.

- Amount of loan can go up to RM200,000 for overseas courses.

Terms

- Need to become a Kojadi member.

- Must provide 1-2 qualified guarantors.

- Must have all the necessary documents when submitting.

How to apply

- Apply for membership to become a KOJADI member.

- Pay the requisite payment required.

- Submit your legal documents.

Terms to pay back

- By equal monthly installment commencing from 4th month after graduation.

- Loan interest rate for new members will be 6.8% (on a monthly rest and reducing balance basis) for the first year and 7.8% (on a monthly rest and reducing balance basis) for the second year.

- You can find out more on paying back here

For more detailed info on the loan, click here.

4. AMMA Foundation Study Loan

What is it?

An education study loan started by the All Malaysia Malayalee Association (AMMA) in 1975 in an effort to give back to the community and help needy students.

Source: AMMA Foundation

Benefits

- Interest free.

- Up to RM4,500 per semester for Degree Courses and RM3,500 per semester for Diploma courses for a maximum of 6 semesters.

Terms

- Malaysian citizen.

- Full-time Diploma/Degree courses.

- Local & foreign universities and colleges only.

- To remain eligible for subsequent draw downs, candidates must ensure they pass all examinations and maintain a 3.5 CGPA and above each year.

How to apply

- The loan application forms can be downloaded here and must be furnished with copies of the relevant documents.

- Applications open from the 1st of April to 30th of June annually.

- Send your application over to this address:

The Education Committee Chairman

AMMA FOUNDATION

No. 40-B, 2nd Floor

Lorong Rahim Kajai 14,

Taman Tun Dr Ismail

60000 Kuala Lumpur

Terms to pay back

- Candidates shall commence repayments upon gaining full employment or 6 months after graduation, whichever comes earlier.

- Diploma & Degree graduates: RM300 per month (minimum).

Find out more on this particular loan here.

5. ECM Libra Foundation Study Loan

What is it?

A study loan given out by the ECM Libra Foundation, which is under the ECM Libra Financial Group Bhd. This particular loan is meant for the more underprivileged and needy students.

Source: ECM Libra Foundation

Benefits

- Interest and bond free.

- Covers the tuition fee that will be paid directly to the institution.

Terms

- Malaysian citizen.

- Prove eligibility for financial assistance – means testing will be strictly applied.

- Has a good academic record and preferably active in extracurricular activities.

- Has gained admission into an approved institution for an approved course.

- Able to provide evidence of strong self-discipline and drive.

How to apply

- Download these forms: Study Loan Application Form & Study Loan Appliction Checklist

- Submit completed forms and all necessary documents listed to this address:

Study Loan Application

ECM Libra Foundation

2nd Floor, Bangunan ECM Libra

8 Jalan Damansara Endah

Damansara Heights

50490 Kuala Lumpur

Terms to pay back

- Commences six months after the course has finished or when you start work, whichever comes first.

- Over a period of five years.

- Collected on a yearly basis.

- Details decided on by the foundation.

For more info, click here.

There are also certain banks as well as other institutions and organisations that offer study loans too. All you need to do is keep your eye out and do a little bit of digging. If you’re applying for one of these loans, do remember to check that you have all the documents needed. Good luck!

Also read: SPM Students Can Apply for These Two Highly-Anticipated Scholarships Starting 19 March