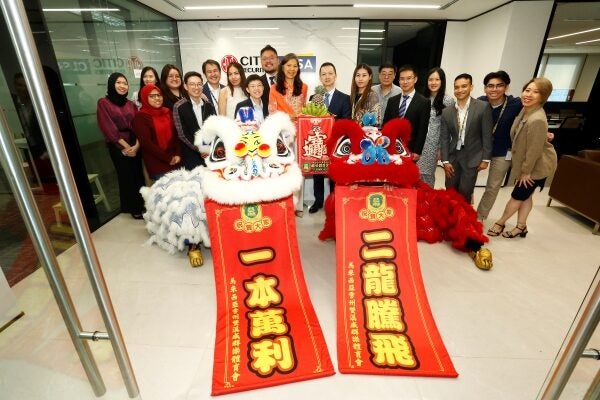

Calling all Malaysian traders! Get ready to trade up, because brokerage firm CLSA just rolled out its structured warrants offerings for everyone to trade with.

Backed by China’s heavyweight investment bank, CITIC Securities, CLSA is stepping into the ring as the second foreign issuer of structured warrants in Malaysia. And there’s no better time to launch them, considering how we’re experiencing FBM KLCI’s (Malaysia’s stock market index) best performance in 14 years!

CLSA is kicking things off with six structured warrants tied to Malaysia’s most actively traded names, like MYEG and GAMUDA — basically companies you would most likely know about! And this is just the beginning, they say, with more companies, more engagement, and more trading opportunities on the way.

More importantly, you don’t need to be an experienced investor to trade with structured warrants! Even though younger Malaysians (like you and I) tend to lean towards faster-paced, more leveraged products like crypto and FX trading, CLSA believes that structured warrants could be a smarter (and still fast-paced) way to get that financial adrenaline rush (and growth).

Plus, CLSA is planning a series of community events throughout the nation soon, hoping to meet new and seasoned investors and spread the power of knowledge, so this could be your chance to learn how to trade better!

Whether you’re a seasoned trader or someone who just learned what a warrant is five minutes ago (it’s ok, we Googled too), CLSA is eager to help you develop your trading skills.

Wanna trade smarter, not harder? Might be time to check them out at www.clsa.com.

Also read: US Tariffs on Imports: Need to Worry or Not? M’sians Could Experience These Effects