Getting your first car, whether it’s brand new or used, can be really exciting. But if you go for a used one, it can get tricky because you never really know if the sales advisor is being totally honest about its condition.

In a recent story shared by @meinmokhtar, it was revealed how an anonymous man (let’s call him Amir) voiced his concerns about his car-buying experience.

For illustration purposes only

The sales advisor assured him that he’d only have to pay RM600+

In the post, Amir revealed how he decided to buy a used car and dealt with a sales advisor (let’s call him Darren) who assured him that his monthly payment would only be around RM600+. Darren guaranteed that it was manageable.

Amir continued to share that the car’s condition didn’t look too bad, which didn’t bother him. Darren even offered to send the car directly to his house for a test drive.

He has to pay RM780 for 7 years!

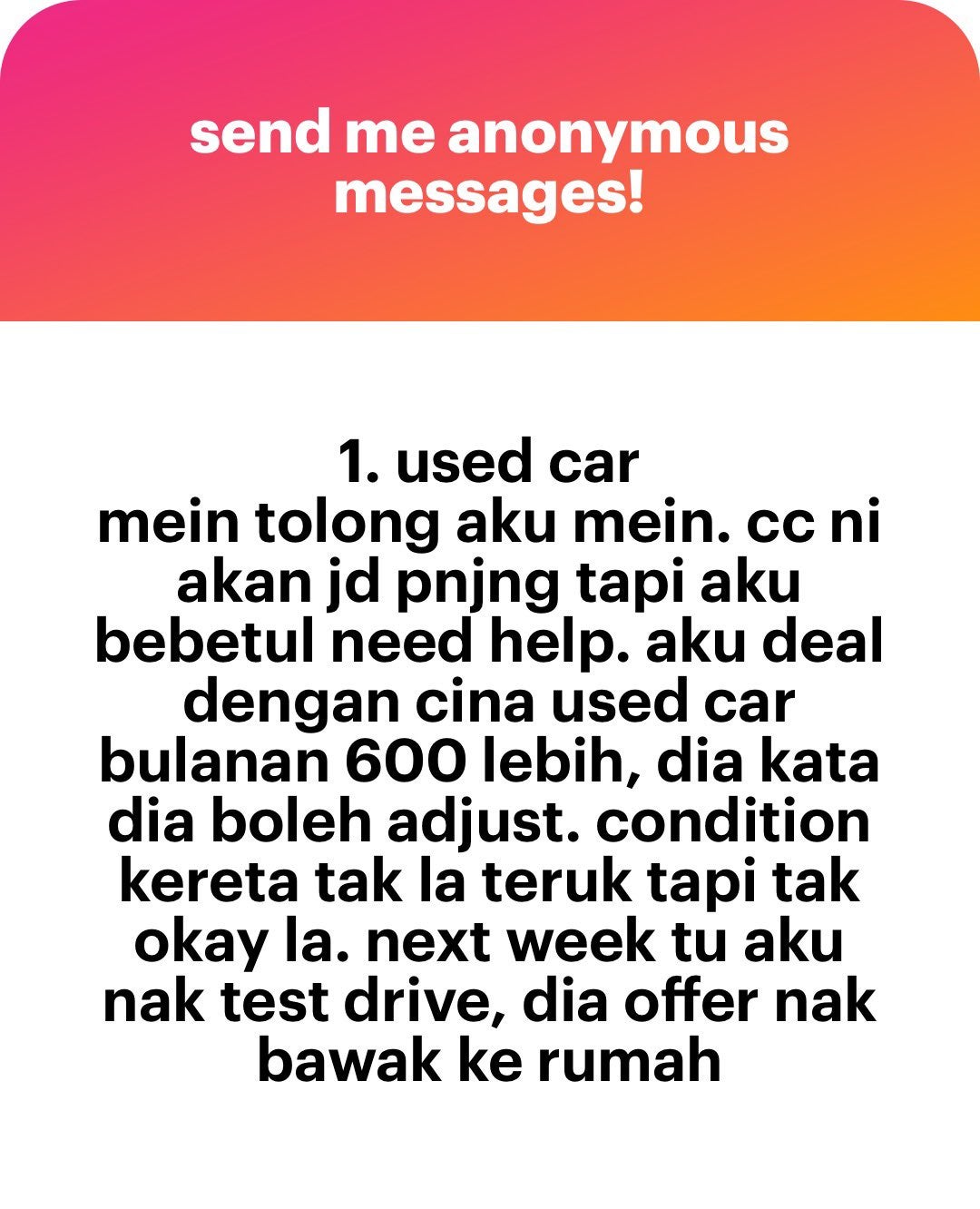

When Darren arrived at Amir’s house with the used car, he brought along the agreement and loan documents for Amir to sign.

“When he arrived at my house, he had the agreement and loan documents with him. Caught up in the excitement of getting a car, I signed the agreement but refrained from signing the loan document because it stipulated a payment of approximately RM780 over 7 years.”

Upon declining to sign the loan document, Darren assured him that he didn’t need to sign it immediately and promised to find a solution regarding the monthly payment.

Amir continued to explain that Darren left his home without taking the car, only bringing back the documents. This happened before Amir had a chance to test drive the car.

“After testing the car, I didn’t feel it was worth the money for me to proceed. So, I contacted the sales advisor to inform him that I had changed my mind and would not be going ahead with the purchase.”

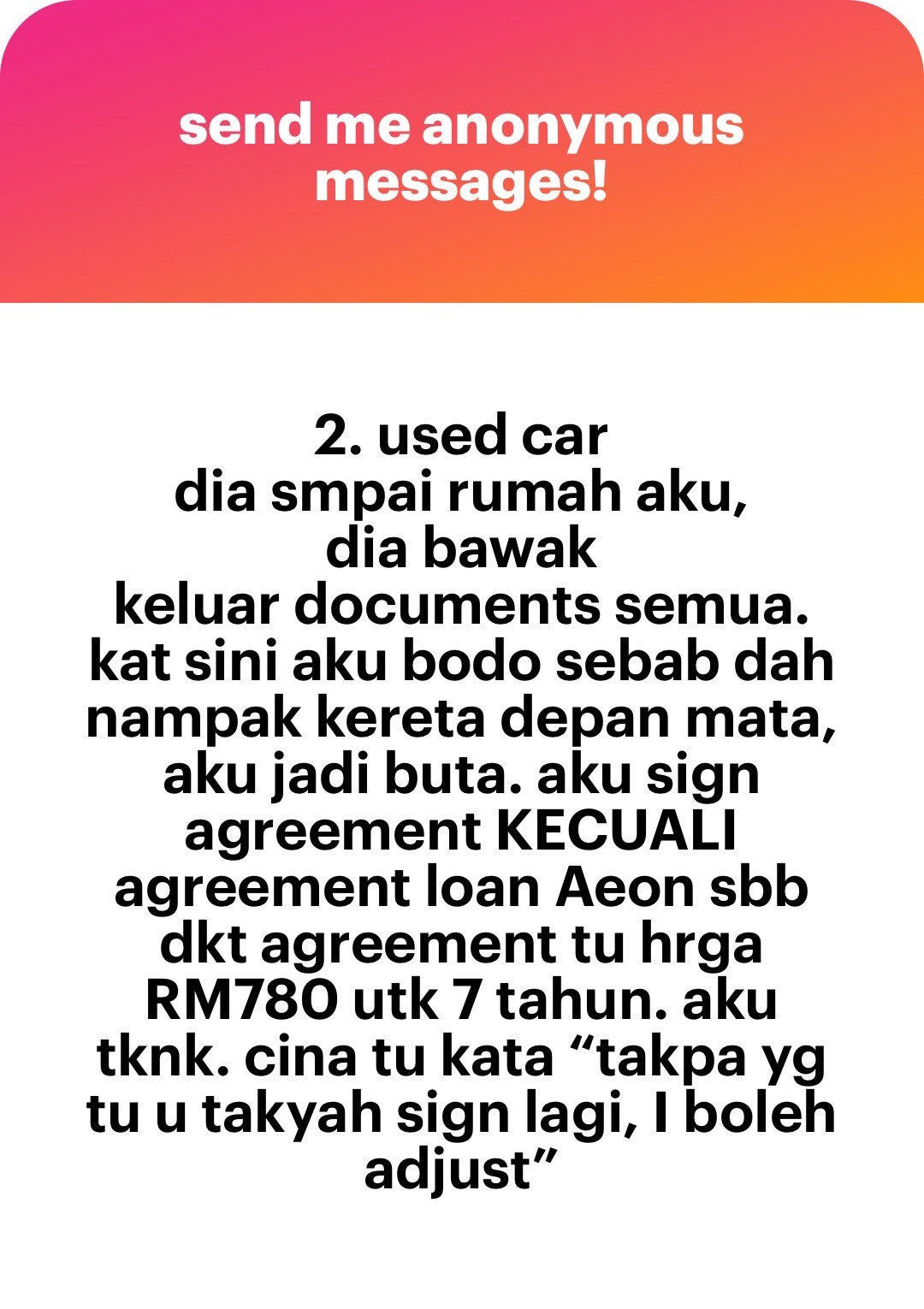

He was notified that a loan of RM800 was credited to him

Amir explained that he tried contacting Darren to return the car, but despite numerous attempts, Darren completely ignored him and didn’t respond.

He mentioned that when Darren did respond, it was only to say he was out of town and would get back to him later.

A week later, Amir discovered that a loan of RM800 per month for 7 years had been credited to him which is way out of his budget, despite never having signed the loan document.

“I couldn’t afford it. I was furious at the sales advisor, but he continued to ignore my calls and messages. When I visited his workplace, his staff told me he wasn’t there and refused to get involved.”

The sales advisor said that Amir had signed the loan document

After 2 to 3 days Amir decided to go to Darren’s workplace once again to which he was informed by Darren that he did indeed sign the loan document but Amir was sure of it that he didn’t do such thing.

He continued to share how Darren had lied to him to about the milage and how the car had never been into an accident, and even went so far as to lie about the age of car.

“On the same day I visited the sales advisor’s workplace, the car grant arrived and changed to my name. I tried my best to withdraw from the car loan from the loan company to which they told me that only the sales advisor who applied could take it back.”

Amir decided to file a police report, but he was advised to contact the Ministry of Domestic Trade and Costs of Living (MDTCL) instead. Unfortunately, MDTCL informed him that there was nothing they could do about it due to the fact that the document was signed.

What are your thoughts on this? Do you think Amir genuinely didn’t sign the document, or could his signature have been forged? Share your thoughts in the comments below!

Also read: M’sian Who Earns Only RM1.5k a Month Gets Pressured by Parents to Buy a Honda to be Like The Rest