One of the major changes introduced in Budget 2025, which was tabled in Parliament in October 2024, is the minimum wage increase from RM1,500 to RM1,700, which has been enforced since 1 February 2025.

On the eve of its implementation, the Ministry of Human Resources (KESUMA) lauded how the new minimum wage would benefit around 4.37 million workers in Malaysia and reminded that the minimum wage is not “starting pay”, hence, employers should offer a salary commensurate with the worker’s skills.

Prime minister datuk seri anwar ibrahim tabling budget 2025

With that in mind, there are still many things about the implementation of the new RM1,700 minimum wage that Malaysians don’t know about, such as the actions that can be taken against employers who don’t comply with it and the fact that the new minimum wage does not apply to all workers in our country.

Accordingly, we’ve gotten in touch with a legal professional to clarify the new RM1,700 minimum wage implementation, so read on to find out more.

The new RM1,700 minimum wage doesn’t apply to all workers

For illustration purposes

Speaking to WORLD OF BUZZ, Muhammad Danial, a Legal Associate at Kuala Lumpur-based law firm ADIL Legal, asserted that the implementation of the minimum wage policy is under the purview of the National Wages Consultative Council, which was formed under the National Wages Consultative Council Act 2011.

In order to implement the new policy, the Government has introduced six Minimum Wage Orders, the latest of which is named the Minimum Wage Order 2024.

Furthermore, Section 2 of the National Wages Consultative Council Act 2011 defines “minimum wages” as basic wages. In its FAQ, the council further elaborated that minimum wage doesn’t include allowances, incentives and other additional payments made to the employee.

For illustration purposes

The National Wages Consultative Council also clarified that the new minimum wage applies to:

- Employers who employ 5 workers or more

- Employers who carry out a professional activity classified under the Malaysia Standard Classification of Occupation (MASCO) as published officially by KESUMA, regardless of the number of employees employed

The aforementioned professional activities classified by MASCO are:

- Science and engineering professional

- Health professional

- Teaching professional

- Business and administration professional

- Information and communication technology professional

- Legal professional

- Hospitality and related professional

- Social and cultural professional

- Regulatory body professional

For illustration purposes

Danial further revealed that the new RM1,700 minimum wage will only be enforced to employers with less than 5 workers starting 1 August 2025. Moreover, it also applies to all workers, including non-citizens in the private sector.

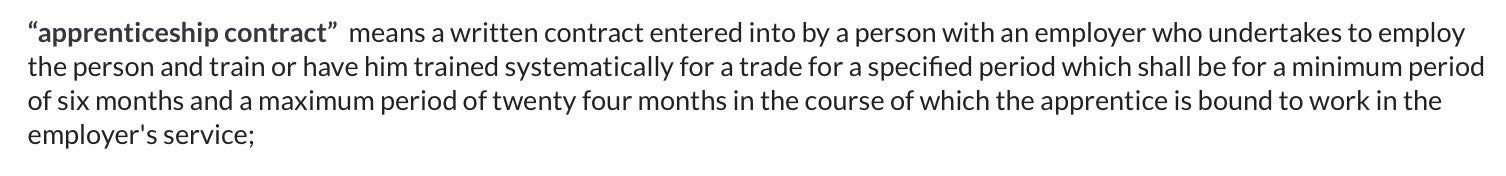

However, the new minimum wage won’t apply to domestic workers and those under apprenticeship contracts. Danial referenced a Section of the Employment Act 1955 below for what is meant by a “domestic employee” and an “apprenticeship contract”:

![]()

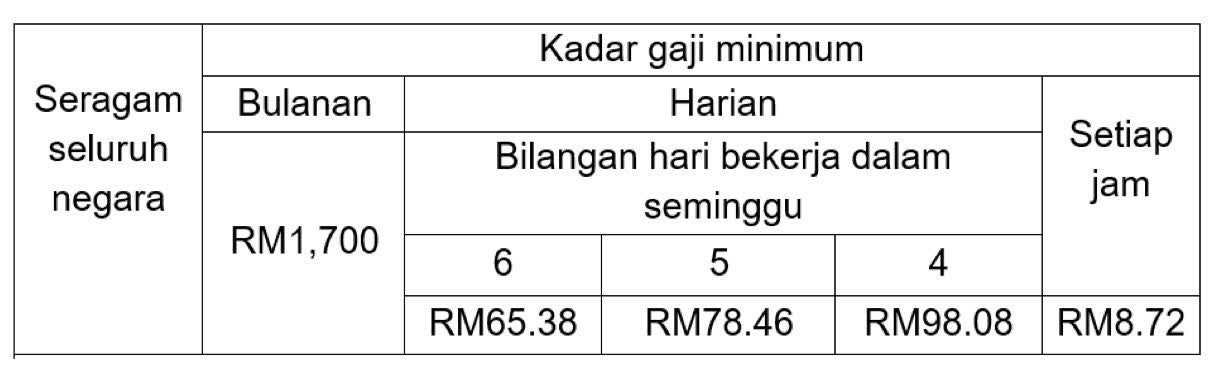

Besides that, the National Wages Consultative Council has also provided a breakdown of how the monthly, weekly, daily and hourly rates under the new minimum wage are like below:

As for workers who are not paid basic wages but wages based on piece rate, tonnage, task, trip or commission, the rate of monthly wages payable to that employee shall not be less than RM1,700.

For illustration purposes

Legal actions that can be taken against employers who don’t adhere to the new minimum wage

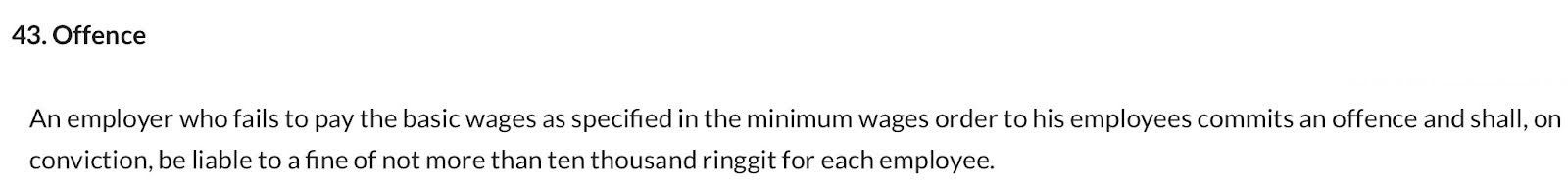

As for employers who fail to adhere to the new minimum wage, Danial elaborated that actions can be taken via Section 43 of the National Wages Consultative Council Act 2011 below.

As you can see, those who fail to pay the minimum wage to their workers can be fined up to RM10,000 for each employee if convicted.

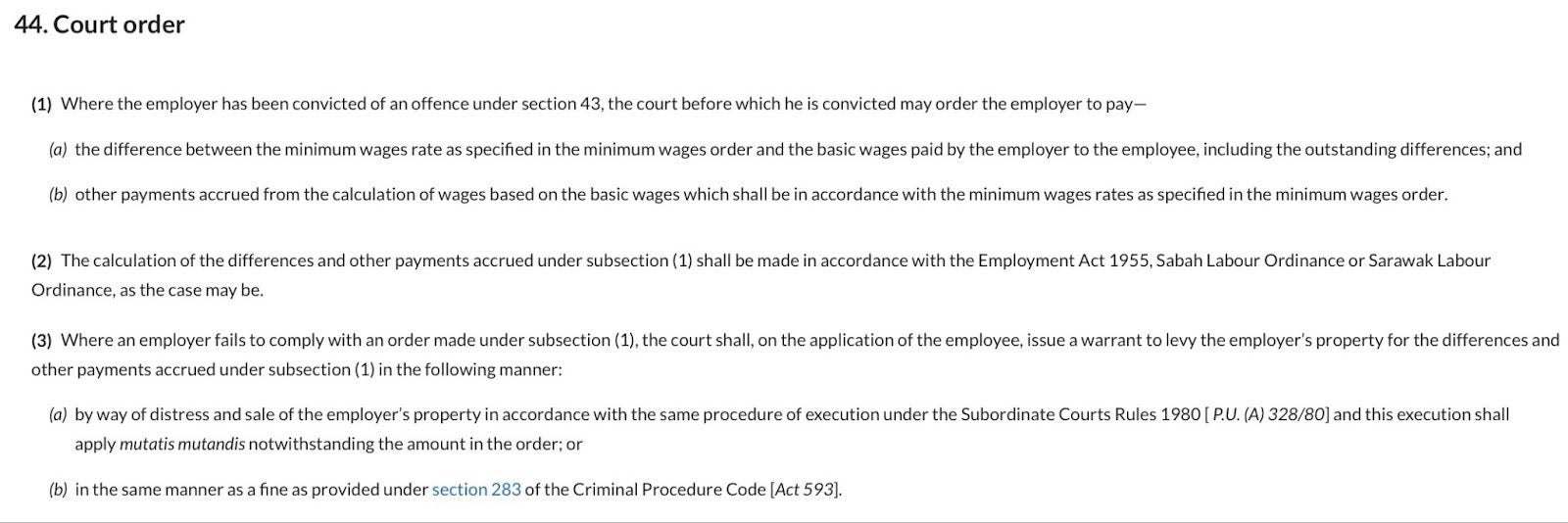

Meanwhile, Section 44 of the same Act established that when an employer has been convicted of an offence under Section 43, the Court may order the employer to pay the difference between the minimum wage rate and the basic wages paid by the employer to the employee. These include the outstanding differences, and other payments accrued from the calculation of wages based on the basic wages according to the minimum wage rates listed above.

If the employer fails to comply with an order under Section 44(1), the Court may issue a warrant to levy the employer’s property for the differences and other payments accrued.

Not only that, Section 46 of the same Act prescribed that a convicted employer may face a daily fine of up to RM1,000 for each day the offence continues after conviction.

Moreover, Section 47 prescribes that for repeat offences, an employer may face a fine of up to RM20,000 or up to 5 years of imprisonment.

For illustration purpose

So, what do you guys think of the implementation of the new minimum wage in Malaysia? Share your thoughts with us in the comments!